The African Bank loans can help you do a lot of things. Their loan repayments can be done within 7 to 72 months and offer fixed-rate bank loans. The longer you take to pay back the loan, the more interest you accrue in the given period. Their loan rates are as low as 12% and have fixed monthly repayment options.

With them, your loan will get deposited straight into your bank account. Monthly repayments can be R436.34 when paying regularly for an R2000 loan amount. The loan amounts can vary from R2000 to R200000.

Here is a brief on how you can apply for their loans and what you will need to do so. Read ahead for more complete information on the loan process.

Page Contents

Steps for African Bank Loan application

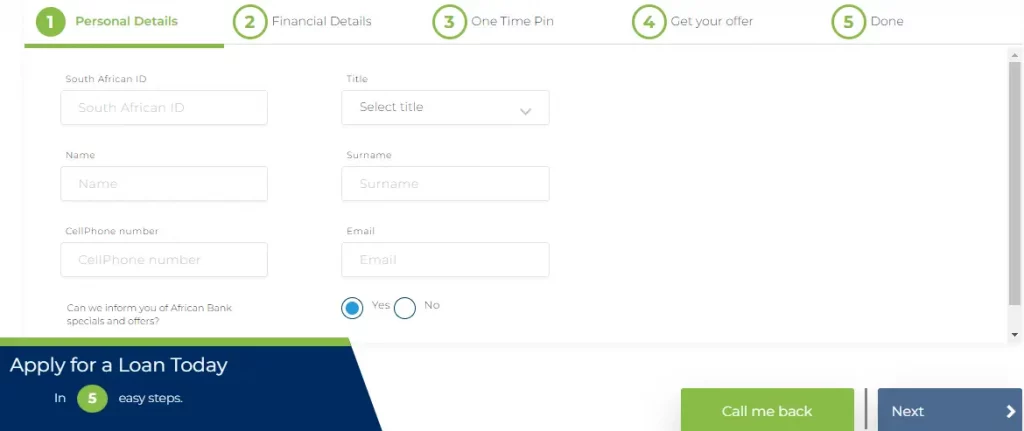

The application is an easy 5-step process for anyone interested in going online for filling it out. To start the application process visit their official website and then click on the “Apply Online” button.

- In the first step, you need to add the South African ID, name, cell phone number and email address.

- Include your financial details in the next step.

- Create and add a one-time PIN on your phone or mail.

- Obtain your offer and you are all set to complete your application.

What are the Application Requirements?

The African Bank loan application will require fulfillment of the following application requirements.

- For taking a loan, you cannot be below 18 years old.

- Proof of recent income must be provided by you in the form of salary deposits, residence proof, and a current bank statement that reflects three salary deposits.

- Submit your proof of residence with the past three-month details.

Who is eligible?

You will be eligible for an African Bank Loan if you meet the following eligibility criteria.

- If you do not hold a criminal record, you can go for an African bank loan.

- You need to hold a valid photo ID proof for it.

- If you are blacklisted, you can still avail of tailor-made customized loans from them.

- Your debt-to-income ratio must be good to apply for a loan.

Also read: SAL Loan Application Online Process Complete Details

How to check African Bank Loan Application Status?

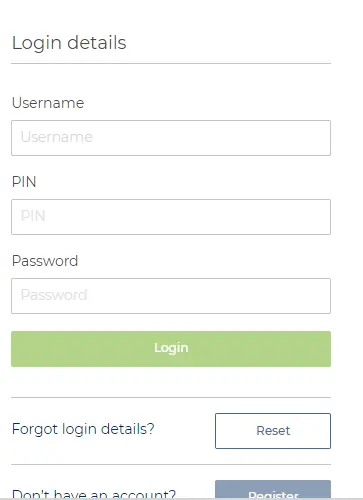

To check your African Bank loan application status, you need to create an online account with them.

- Enter your login details like username, password, and PIN to complete the login process.

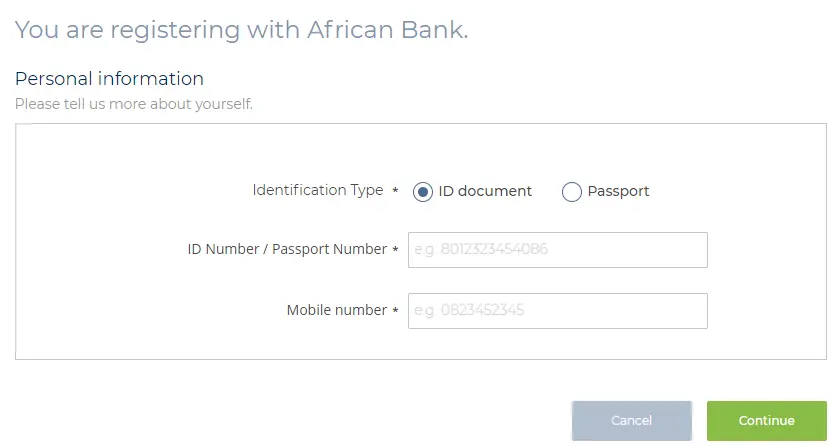

- If you do not have an online account, you must create one by registering yourself.

Use the identification document ID and mobile number to start the registration process.

- Fill in all necessary information to complete the registration process. Once done, every time you log in, you will get a PIN that helps in the login process.

- After you make an account, you will be able to move to the Application Status tab for those who did the online application process.

- Add your application number to check your application status.

African bank loan for blacklisted

Blacklisted people can receive loans but their criteria for loan sanctions will be far more than usual.

Your credit profile will be taken into consideration and they are based on;

- Late or non-payment situations

- Review of debts taken in the past

- Credit card remaining balances

If there is a lot of negative marking on all of these, you will get a bad credit score. To get a loan, you will have to get over these issues by making payments on time or by following a few other rules to get back your stand on your credit scores.

Also read: FHA Home Loan Application Online – Check Eligibility

FAQ (Frequently Asked Questions)

How long does African bank loan take to be approved?

It can take up to a day to approve a loan but it might also take more than this amount of time. It might take up to 30 days to approve a loan if certain information is not clear within the application.

How do I qualify for an African bank loan?

If you want to apply for an African bank loan, you must fulfill all their requirements and meet their eligibility criteria to complete the African bank loan process.

Conclusion

Here is all about the African Bank loan in South Africa and those who wish to go ahead with it, they can go through this information for a better understanding. Bank loans will give you the option to go ahead with your plans and as the loans come from banks to get them, you must fulfill the application requirements and required eligibility conditions.

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)

![Budgeting Loan Application Online [Complete Details] Budgeting loan application](https://kingapplication.com/wp-content/uploads/2022/05/Budgeting-loan-application-300x185.webp)