Update: Canada Recovery Benefit is now closed for any retroactive application as received on 23rd December 2021. Based on your type of CRB application, you would have either received a grant of $600 ($540 after tax deductions) or $900 (out of $1000 after deduction of taxes) for a 14 day span. CRB applications were active for the CRB benefits between 27th September 2020 and 23 October 2021.

Canada Recovery Benefit is created to support self-employed and those employed individuals who are directly hit by COVID-19 in the world. It is mainly aiming citizens who do not avail the Employment Insurance benefits and CRB is being given out by the Canada Revenue Agency.

For 2-week period eligible candidates can receive $1000 ($900 in hand after deducting taxes) for 2-weeks. A total of 19 eligible periods are being given to those who are hit by the pandemic brutally which sums upto a total span of 38 weeks as each eligible period is a 14-day period.

Page Contents

How to apply for CRB application in Canada online?

Note:- The CRB has closed this application on December 23, 2021. Users can no longer apply for this benefit.

To apply, begin by answering the below-mentioned questions.

- Confirm your registration with CRA.

- Set up a direct deposit fund: A direct deposit takes just 3-5 days and a cheque takes 10-12 business days to get delivered at the address.

- Counter-check if the amount being received by you would impact your social assistance benefits.

- Apply on the Monday of the two-week period, once the 2-week span has ended

- Apply online or through the phone.

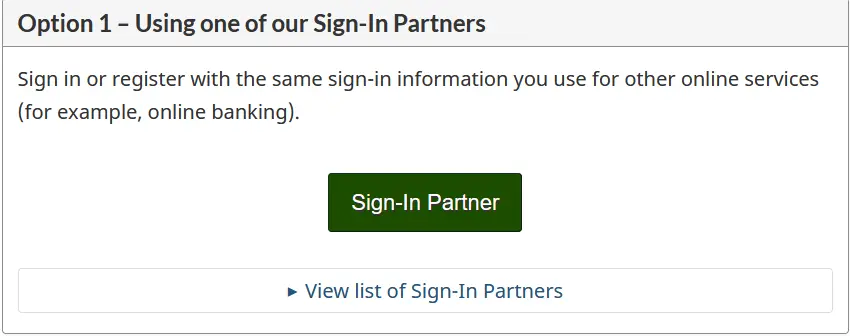

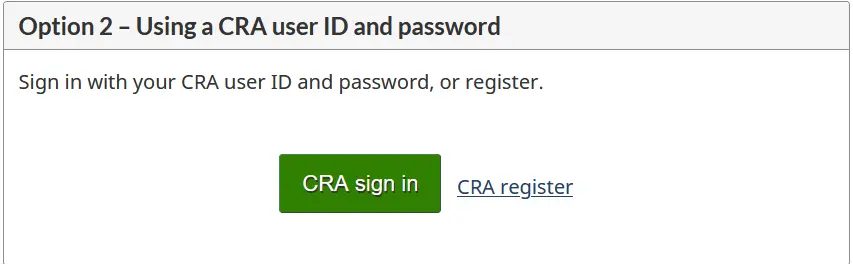

- There are two options to apply- using one of the sign-in partners or using a CRA user ID and password. You can even apply using a BC service card facility.

Requirements

To be eligible you must follow and check your qualifications as per the below checklist:

- Were you unemployed for the period you applied for a loan or were you partially employed?

- Did you receive any other grant or fund?

- Were you eligible for EI (Employment Insurance) benefits?

- Do you reside in Canada or you were present in Canada or you are at least 15 years old

- Do you have a valid SSN?

- You earned a minimum of $5000 in 2019 or 2020?

- You have not voluntarily given up your job?

- Were you seeking work during that period of time?

- You have not declined reasonable job offers during that period of time?

- Were you in self-isolation or quarantine during that period of time?

Once you know the eligibility criteria, next you can go ahead and apply for the benefits scheme.

CRB Application dates

The deadlines are restricted to a total of 19 eligibility periods (38 weeks) between the time span of 27-Sep-2020 to 25-Sep-2021.

How to Login CRB Application?

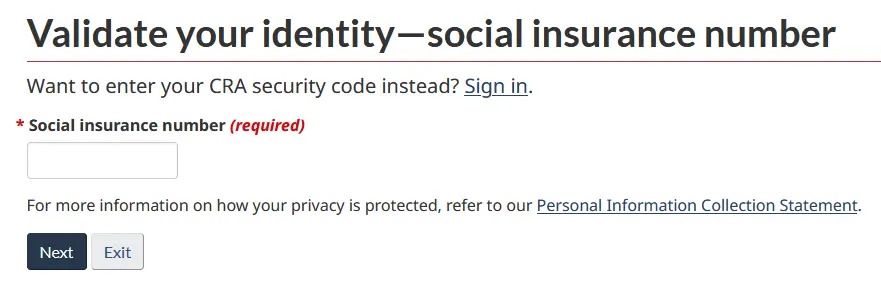

To sign in, you will have to register with CRB. You will need to start by starting registration with your SSN (social security number).

You can sign in using either of the following ways-

- Use the Sign-in partner tab

2. Include the CRA ID and password to register and sign-in. CRA registration will begin by adding your SIN (Social Insurance Number).

3. Sign-in using MyAlberta Digital ID or BC Services Card.

How to Check CRB Online Application Status?

CRB application form status can be checked directly from the portal to check if you are granted the amount or your status is pending with them. If it is pending find out why and resolve it by answering the additional questions.

CRB application service Canada

Recovery benefits is an essential step to aid the Canadians who lost work completely or partially during this period of time.

- If the job they previously did is not available now for them.

- Individuals in self-isolation or quarantine.

- Caring for children or adults hose normal care suffered due to COVID-19.

As long as people are residing and are available in Canada during that certain period for which the claim is being made can definitely apply for it. It is a retroactive recovery scheme where you can receive an amount only for a period that has already ended. A flat 10% deduction towards taxes would be made from the amount and instead of $1000 a person would start receiving $900. People can apply from anywhere in Canada whether Toronto, Ontario or Ottawa for a 14-day period.

FAQs (Frequently Asked Questions)

What is the percentage tax deduction from the amounts you received?

You will receive 10% deductions on the amount you receive. Anyone who receives $1000 will receive a total of $900, and anyone receiving $600 will receive $540 in hand.

If you wanted to receive CRB funds, what all other funds should you have not received?

Benefits like these should not be received by an individual if they want to receive the CRB benefits;

- Canada Sickness Recovery

- Canada Recovery Caregiving dues

- Short term disability related funds

- Québec Parental Insurance Plan (QPIP) amount

- Employment Insurance (EI) money

Conclusion

Those who received a notice for validation of applications must call their toll-free number. You might have to submit the following;

- If you were an employee you must submit your recent pay stubs, salary letter and employment confirmation proof, bank statements with the name of the bank, address, and payroll deposits.

- Self-employed individuals must submit invoices, payment receipts, and income proofs for documents.

- Any document that proves you earned $5000 from your self-employment initiative.

You can submit the proofs either online or via facsimile (1-833-325-0555). Find other essential details if you ever filed your application and did not get your payment.

![Assurance Wireless Application Online form [Easy Steps] Assurance Wireless Application Online form [Easy Steps]](https://kingapplication.com/wp-content/uploads/2022/09/assurance-wireless-apply.webp)

![UCLA application deadline: spring 2024- [Complete Details] UCLA application](https://kingapplication.com/wp-content/uploads/2022/12/UCLA-application-300x157.webp)