Essential Information: The Tribal applications, Eastern Time, and technical assistance seekers can apply now until 01st September 2022.

The State Small Business Credit Initiative (SSBCI) application gives monetary access to small businesses and entrepreneurs. This provision helps one to expand and support their businesses in times of COVID crisis.

The US Treasury Department is planning a $10 billion second monetary installment as part of the American Jobs Plan. SSBCI 1.0 was passed in 2010 and in both the issued fundings; the target is small business financing and technical assistance to support different business structures and ventures.

In the Discover phase of the Planning process, different kinds of stakeholders are made to complete a public survey. Those who participate include small and diverse businesses, lenders and funders for the small businesses, and entrepreneur support organizations (ESO).

Different types of capital that will get included would involve the ones given below;

- Venture Capital funding for people

- Debt partnership facilities

- Loan Guarantee schemes

- Collateral Assistance

- Capital Access Funding

Page Contents

SSBCI application

To apply you must know more about the different funding categories.

| Different categories of Funding | Basis of allocation calculations |

| State Allocation | Data is based on their unemployment figures |

| Technical help | This help could come before or after loan or equity infusions |

| SEDI Business allocations & Incentives | Socially and Economically Disadvantaged Businesses |

| Tribal governments | Based on their population and government schemes |

- Apply to start the SSBCI application process.

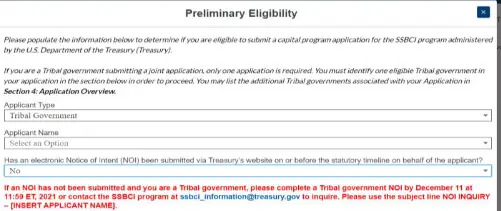

- Enter the type of applicant, name of the applicant, and intent notice in the eligibility portion of the application.

- To continue, you need to sign using your name and email address.

- The next thing that follows is an email in your mentioned email address stating that you have completed your signing process.

- Post this step, you will need to complete ten sections out of which you have to read through three segments and fill another seven segments.

Reading segments are the user instructions, application documents, and different terms along with their definitions.

Segments that you need to fill in the application form include the following:

- Application overview segment

- Identity and entity-related information

- Award amount

- Program overview and details

- Application compliance and oversight

- Certification of application

Fill in the information required in the different sub-sections of each segment. After completing all segments, you will need to submit the application. Online submissions are only open for three categories whereas the general application timeline is already over.

Also Read: How to Apply for Google Illinois Settlement?

What are the Application Requirements?

For applying to SSBCI Application, you will need all these business-related documents.

- Business-related documents must be submitted with the start date and other information details.

- To add financial details of your business like the amount you earn if you already have a set business. If you have not yet set up the business, you can provide an average estimate of your finances to get the money for investing in the startup program.

- Add the number of employees you plan to have in your office along with the other business-related details.

Who is Eligible for SSBCI application?

Eligibility for your funds involves the fulfillment of the following conditions.

- Your social security number and a government-issued tax ID.

- Incorporate your address must be a complete mailing address and just not a PO Box address.

- Include a valid email address and phone number for the SSBCI application process.

SSBCI Florida Benefits

Once loans are approved within Florida for your small business initiatives, you can spend the amount in the following ways.

- As a working capital or to bear startup costs

- Receivables

- Inventory & equipments

- Credit line and term loan financings

- Trade cycle financings

- Renovation of the construction site as well as the purchase of active or non-passive real estate.

- It will further help in building and strengthening the delivery system of capital across and within the state.

- Cyclical innovations can be facilitated with the help of this program.

- Scaling and focusing on underserved entrepreneurs is another advantage of the program.

FAQs

What is the SSBCI Application Portal

The SSBCI portal link is given here in this section. If you wish to find out more about the application process, you can refer to all the instructions and information provided in the given segments

Conclusion

If you are not applying under any of the three criteria mentioned above, you will not be able to make the application. However, if you are applying under any of the three categories, you can refer to the information provided here as help and guide.

![UCLA application deadline: spring 2024- [Complete Details] UCLA application](https://kingapplication.com/wp-content/uploads/2022/12/UCLA-application-300x157.webp)