Update: Those who are browsing to understand if the SBA restaurant revitalization application form is still available, then the current update is, it is not. However, the Restaurant Revitalization Fund Program (RRF) is planning to reallocate another $180 million to the already unspent funds. Therefore, if your fund intake is justified keep an eye out for the SBA news as you could be the next to get access to these funds.

There is no open application for the SBA restaurant revitalization currently. Instead, Congress has strictly requested SBA to retrieve allocated funds given to the wrong people. The Congress wants SBA to complete the fund retrieval no later than 14th November 2022. All those who did not deserve the funds but took them wrongly have to pay them back to SBA by the given due date.

Funding is being done to all small business owners to cover COVID-19 expenses and losses. The SBA restaurant revitalization fund application is open from noon on 3rd May.

After the first 21 days, all the eligible applicants would be issued funds on a first come first serve basis. Preferences would be given to women in business and veterans. Socially disadvantaged and professionally compensated people would be prioritized.

The money allocated will need to be spent by 11th March 2023.

Page Contents

SBA restaurant revitalization fund Requirements

These are the SBA restaurant revitalization fund requirements using which you could file when it was working. Also, know them well if they open again in future, you can send in your applications quickly then.

- Requirements include proving that 33% of the gross receipts come to the site from online public sales and those which opened in 2020 should have the plan to get 33% of the gross receipts from online public sales.

- 2020 Federal return is preferable.

- Completed and signed copy of SBA form 3172.

- Filled and signed copy of IRS form 4506-T.

- Any of the gross receipts show the expenses.

- IRS 1040 schedule C, or F.

- IRS Form 1065.

- Bank statements

- Profit or loss statements

- IRS form 1099-K.

- Further documentation is required for inns and bakeries or wineries.

How to apply for SBA restaurant revitalization fund?

To apply go to restaurants.sba.gov or you can call them at 844.279.8898.

You can refer to the below example to know what will be required to fill in the fields.

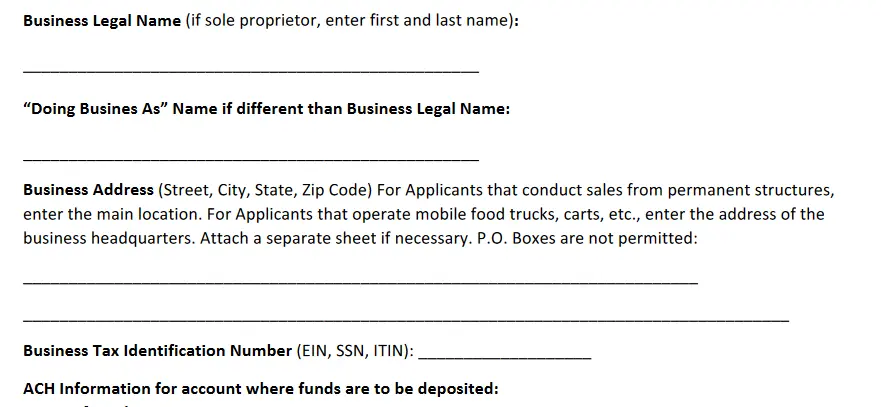

- Start by adding the business name, address, business tax identification number and also ACH details.

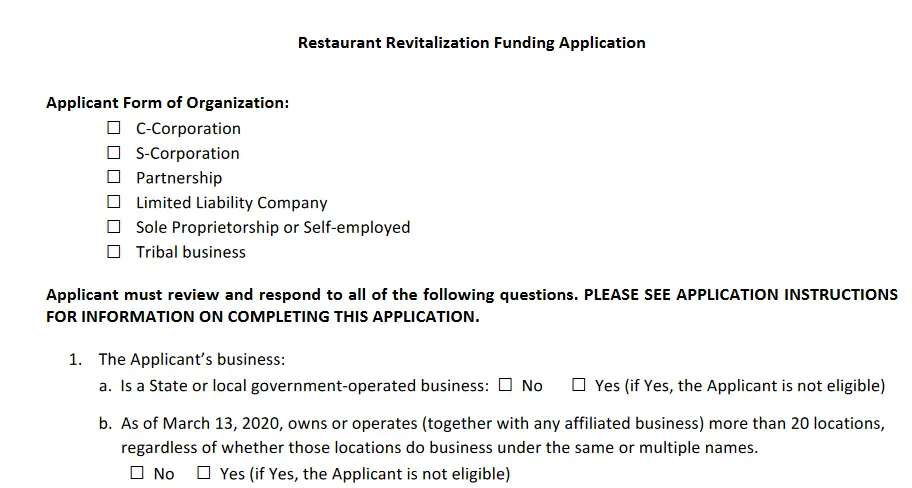

- List all owners who are a minimum of twenty percent shareholder in the company and then follow the details with information around the type of company, business details and also the type that best describes the business.

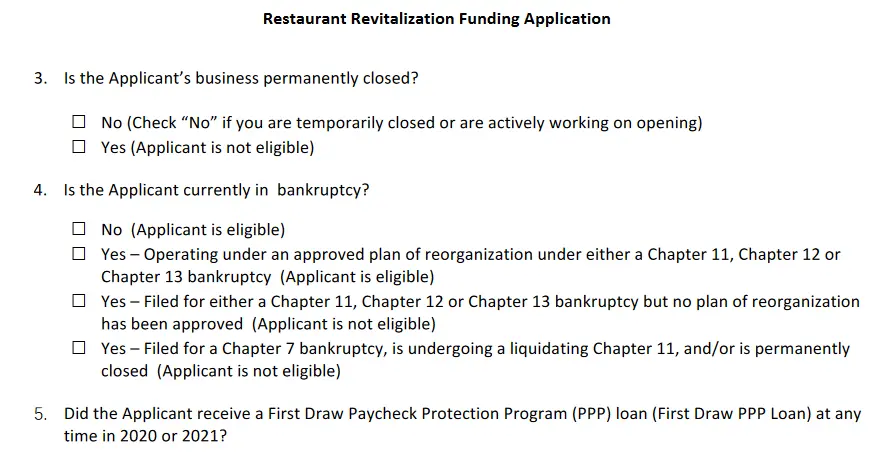

- Next state if the business is currently closed and if the business holders declared themselves bankrupt. State if there are any active applicant affiliates also.

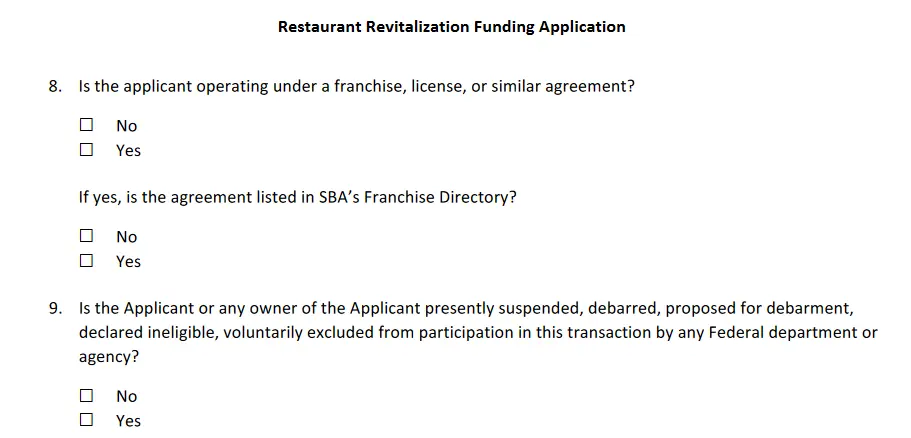

- Do they have operations with franchises, or do they hold a license or have any form of other agreements?

Once you fill in the form, submit the completed form or download and submit it physically.

SBA restaurant revitalization fund grant application?

The grant is being given to all those small businesses that have suffered losses during the times of COVID-19 and those businesses which were opened in the year 2020 or were planned during this period.

SBA Grant Application portal

The portal timeline is open from 3rd May 2021 and restaurants, bakeries, bars, breweries, wineries, inns, caterers, food trucks and stands are eligible to apply to receive the grant.

The funding applies to 5 million dollars per location and would have to be less than 10 million dollars. The minimum amount decided is $1000.

Also read: SBA Disaster Loan Application Online & Check status

How to log SBA restaurant revitalization fund?

For the SBA restaurant revitalization fund, you will have to register with the website.

- Fill in the restaurants.sba.gov.

- It will take you to the registration page where you can either register to start the application or you can log in if you have already registered with it.

- You must put a username, email address, password and add the captcha.

- Verify your email address by clicking on the activation link sent to your email address whereby asks you to confirm the email address.

- Next, you must confirm & verify your phone number.

- Fill in the application form completely and add all the required documents to it.

FAQs (Frequently Asked Questions)

How many hotels benefited from the SBA funding?

Almost one lakh hotels, bars and restaurants benefited from the SBA funding last year.

Do the businesses need to report their total expenditure of the funds?

Businesses need to report their total expenditure every year. As of 1st December 2021, businesses spending the complete amount need to report the details of their expenditure. If they did not spend the entire amount, individuals will need to report annually their expenditure for the year 2022 and finally again by 11 March 2023.

Do they need to pay back any amount to the Treasury?

If they have spent all the amount by 11 March 2023 they will not need to payback any amount but if they have not been able to utilize all the funds and there is a balance left, that balance amount must be returned by them to the treasury after the closure of the term.

Are the SBA grants taxable by nature?

No, the SBA grant gross amount is non-taxable and deductible.

Conclusion

Here’s all about the SBA restaurant grant given by RRA the last year. The distribution of the SBA restaurant revitalization fund was primarily done to support individual business owners suffering from low income and less turn-out of people during COVID. The restaurants had to be closed during COVID which led to heavy losses for these units.

![CPP Disability Application Medical form [2024] How to Apply for CPP Disability Application?](https://kingapplication.com/wp-content/uploads/2023/04/CPP-Disability-Application-300x185.png)