Branch Banking & Trust (BB&T) is a company that offers credit cards that can help you build your credit. There are various credit cards offered by BB&T and these cards charge a nil annual fee. They have 0% introductory APR and have very simple reward programs.

You can choose from many BB&T credit cards-

- BB&T Spectrum cash rewards

- BB&T Bright credit card

- Travel Rewards for Business card

- Vantage VISA Signature credit card

To get a credit card, you must first apply for it. To apply, read the blog here to know the process beforehand.

| Essential Features | BB&T credit card |

| Late Payment Fee | Upto $38 |

| Returned Payment Fee | Nil |

| Interest & Purchase APR | 11.24% or 20.24% variable |

| Cardholder Fee | NA |

| Cash Advance Fee | 3% or $10 whichever is greater |

| Cash Advance APR | 22.4% |

| Grace Period | 7 to 15 days |

| Balance Transfer APR | 0% for the first 15 months followed by 11.24% to 20.24% |

| Annual Fee | Varies from one to another credit card |

Page Contents

Steps for BB&T credit card Application

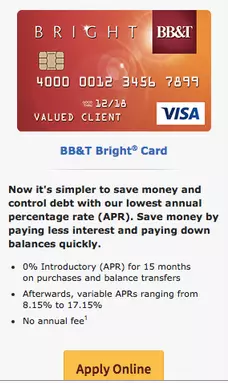

The BB&T credit card application can be made online and to apply there is a process you must follow. There are several BB&T cards and to demonstrate, we will choose the BB&T Bright credit card.

Step 1: First, visit this link www.truist.com/credit-cards to start the application process.

Step 2: In the next step, press the Apply online tab to enter different information.

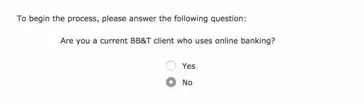

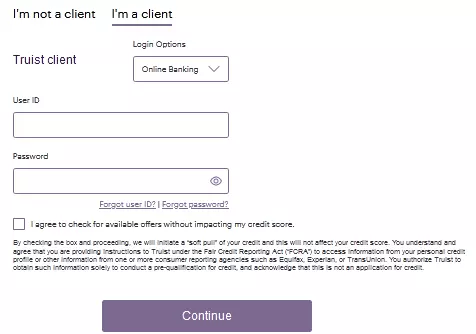

Step 3: Answer if you are currently a BB&T customer who uses the online banking process.

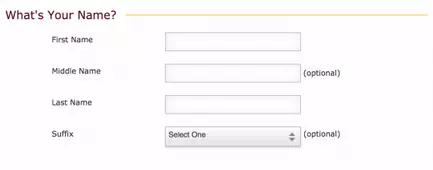

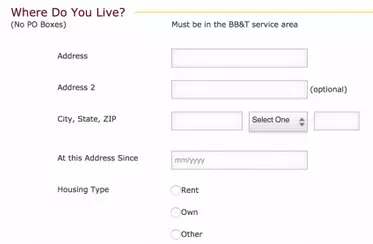

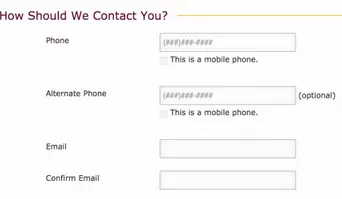

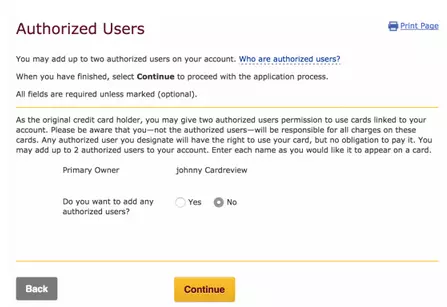

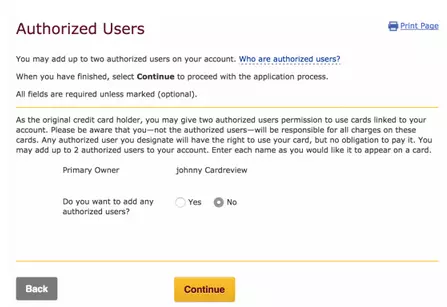

Step 4: Add your personal details in consequent pages like name, address, contact details, current employment status, annual income, and different identifying information.

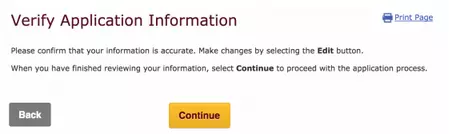

Step 5: Verify the application process and also the terms and conditions.

What are the application requirements?

There are a few requirements one needs to fulfill to apply for a credit card.

- The minimum credit score for the BB&T credit card is 750.

- Applicants must be more than 18 years.

- Residents of the United States need to have their SSN (social security number) and a government-sponsored ID card.

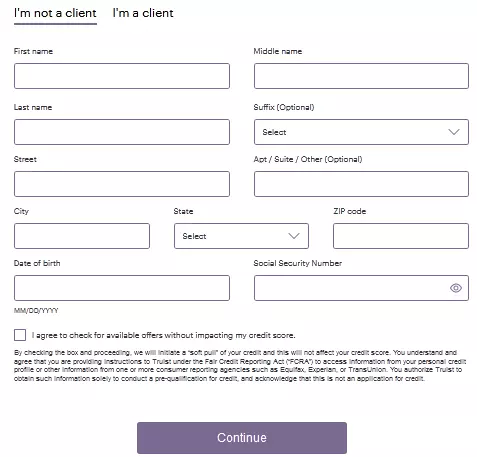

How to get BB&T credit card pre-approval?

To get a BB&T credit card pre-approval, you must go to their site link creditcard.digitalcommerce.truist.com/product/dcfo.

Choose if you are a client or if you are not.

Once done, you can press the Continue tab to move to the next screen where you complete the pre-approval application process.

Who is Eligible?

You are eligible if you fulfill the below criteria.

- You need to reveal your total annual income to them.

- Applicants must provide a complete address for their credit cards.

Also read: Wawa credit card login and Pay Bill Payment [2023]

Card Pros & Cons

Pros:

- Your liability for unauthorized purchases will be zero.

- They have several services for travel and emergency assistance and even collision for auto rental services that are advantageous for customers.

- You can earn cashback when shopping with a credit card.

Cons:

- Some of the credit cards have very limited offers.

- There are no sign-up bonuses or credit card fees

Conclusion

Here’s what you need to know about the BB&T credit card if you want one of them. Though this is a generalized description, however, it is quite an accurate process if you are trying to understand the online application process. The article also covers the pros and cons including the requirements for getting a credit card.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)