Students are always seeking loans if they could not get a grant or aid of any sort. Many parents cannot fund their student’s college and if they are working students fending for the family, a loan seems to be an easy option.

But many have in the process been defrauded by different colleges that often promise education but eventually don’t end up giving a valid degree. Some even close their courses or sometimes the entire college midway.

Page Contents

What is a Borrower Defense application?

Students often need financial help and they approach loan givers and assistance facilities. For those having federal student loans and were defrauded by the college, university or by career school can seek loan forgiveness. When Corinthian colleges began closing on the pretext of fraud in 2015 the Borrower Defense program was renewed by the then Barack Obama administration. Under the new law if any student felt defrauded under the state law they could straightaway ask for a discharge of student loan.

Who is Eligible?

Eligibility criteria must be met to apply for Borrowers Defense and they are;

- Only Federal Direct loans can be forgiven therefore, the first step in the process is to check the kind of loan you have taken up.

- You must have taken out a part or whole of the money to pay the organization for your fees and other monetary requirements.

- If your claims are for loans taken before 2011, you might not be eligible for loan forgiveness.

- If the school or college made false promises about your job or employment, you can seek loan forgiveness from them.

- Your school must not be closed for demanding the Borrowers Defense and if your school is closed you can simultaneously apply for a closed school loan discharge.

- Your school must have violated certain state laws or federal standards by all means for you to claim the borrower’s defence.

- If you have not made monthly payments from the time your application proved to be unsuccessful, you might find a higher loan amount in this scenario. Even though your loans will be under forbearance they will still be accruing interest.

What are Application Requirements?

The application process for filing the Borrower’s Defense application requires adding the following with the plea application.

- Student manual and course catalogue

- Study term transcripts

- Enrollment agreements and promotional material is given to you by your school

- Any type of communication with the school officials or employees could prove the breach.

- Legal documents, if any in favor

- Findings or determinations that have been made by any of the government bodies

- Any supporting document that you believe could prove your point.

Borrowers’ Defense application Online Process Guide

To apply for Borrower’s Defense application, this is how you need to proceed.

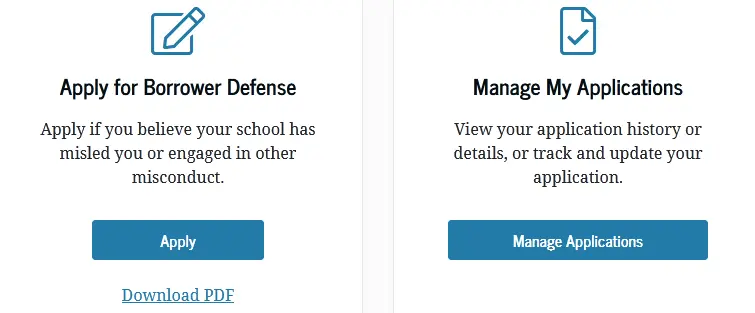

- Visit the online Borrower’s Defense portal at the link given below.

Click on the Apply tab to start the application process.

- You can either create an account or login (use your FSA ID as username alongwith your password) to your online account if you have one. You can, however, apply without logging in and to do that you will need to officially download an application form. After filling up the form, you will need to either submit the form online at StudentAid.gov/borrower-defence or mail it back to the given address: U.S. Department of Education, 4255 W HWY 90, Monticello, KY-42633.

Also read: TEACH Grant Application Online Guide – Requirements & Eligibility

You must include the following information in the given spaces:

- Borrower’s information in section 1.

- School related details in section 2

- Loan, remedies, refunds, tuition recovery and other related information are in section 3.

- School’s conduct makes the borrower eligible for a refund in section 4.

- The urgency to enrol the borrower must be explicitly mentioned. Though it does not serve as a reason enough, however, it will be considered given an enrollment urgency can often drive students to take wrong decisions.

- Specify if your school failed in keeping up with the educational opportunity failures or if it is the support services that it failed in.

- Did your school fail to fulfil the employment prospects they just promised you? Mention it to make your argument stand out.

- Mention the program cost and the nature of the loan you took up.

- Those who received a direct loan need to fill in a separate section.

- Mention the other details and then specify the financial harm that it caused you.

- Request forbearance by filling up this field to stop your collections.

- Finally, certify and sign and then submit the application form.

Borrowers Defense school list 2023

The school list is not limited to the ones given below but these few are mandatorily on board for 2023.

- American Career Institute

- Charlotte School of Law

- The Art Institute

- Colorado Technical University

- DeVry University

- ITT Technical Institute

- Le Cordon Bleu

- Kaplan College

- Ross University School of Medicine

- New England Institute of Art

- University of Phoenix

- Argosy University

Also read: How to Change Student Finance Application or Cancel it?

FAQs (Frequently Asked Questions)

How long does a Borrower Defense application take to process?

Individuals under the loan schemes will have to show the required attendance at an institution that is on the charts to clear off the loan. As per the agreement, the Education department will have to pass a judgement within 3 years (36 months precisely) post which the borrower’s loans will get discharged automatically.

How to check on Borrowers Defense application status?

To check the Borrower Defense application status call 1-855-279-6207. There is always a lag between the times a borrower gets intimated about their Borrower Defense application getting approved.

Conclusion

If you wish to know how to get out of the loans that you have taken mostly to complete your college or higher studies, this article will be the right place for you to be. In this, we have spoken in detail about the Borrower’s Defense eligibility requirements and other necessary information.

![Uniform Residential Loan Application - [Complete Details] uniform residential loan application](https://kingapplication.com/wp-content/uploads/2022/05/uniform-residential-loan-application-1-300x185.webp)