A part of the Home Choice group, Finchoice loan application is the best online loan service provider in South Africa. Located in Cape Town, they provide their services through various online options. It caters to those who need loans or even need a funeral policy. The loan amount goes upto R30, 000 and the repayment span is from 12 to 36 months.

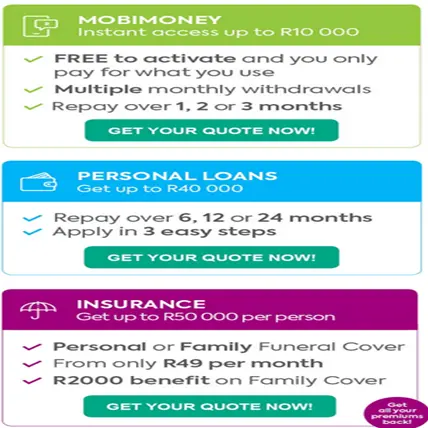

They have five types of loans under them.

| Type of loan | Amount you can get |

| Finchoice Mobi Money | R10000 |

| Funeral Cover | R100,000 |

| Personal Loans | R40,000 |

| Payday loans | R2500 |

| Flexi loans | R8000 |

Page Contents

How to apply for a Finchoice Loan application online?

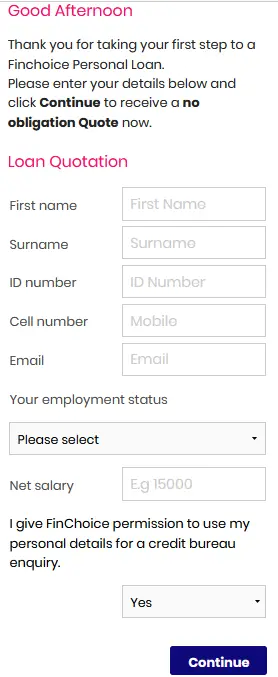

To apply for the Finchoice Loan application, you must fill in the application form with the following information.

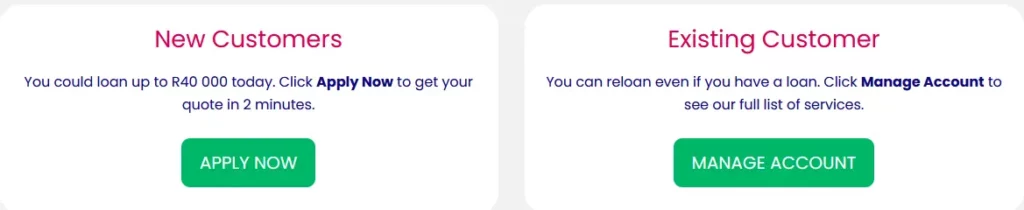

- You need to visit the finchoice website and then click on the Apply Now tab. If you are a new customer and for existing customers, you can click on the Manage account tab.

- Choose any of the schemes and click on the Get your quote now tab to understand if you can get a loan from them.

- Add your first and last name, ID number, cell number, email details, employment status, and also your net salary. Click if you have the right financial details entered and then click on the continue tab.

- Next, based on their eligibility they will give you a call back and you can tell them your needs to get a proper quote.

- Create an account with them and fill in the essential information as required in the given spaces. Wait for their approval.

Also read: How to check NPC application status? (Complete Guide 2023)

What are the requirements of a Finchoice loan application?

The Finchoice loan application requirements must include the following:

- Your banking information must be added to the application.

- Bank statements must be included

- Your current work experience and other work related details must be added

- A South African ID card or book must be incorporated.

- Your South African cell phone number must be added

Benefits

There are several benefits of taking Finchoice loans which include;

- The online application loan process is very easy and does not require much expertise

- Your loan repayment is possible in a 6, 12, or 24 month span.

- Whenever you experience financial difficulties, you can miss out on the payments and can do so through the Mobi application.

- If you are not happy with the loan, you can return it to the bank within fourteen days with no penalties or additional costs.

- If you pay back their loan within 14 days, you will need to not pay any interest.

Also read: Nirsal Covid 19 loan (Here are the Complete Details)

FAQs (Frequently Asked Questions)

Does Finchoice have a mobile app? What can you do with it?

Yes, there is a Mobi application that benefits you in many ways.

- Use it to view your loan account balance

- application is possible for another loan or a Kwik advance loan

- If you wish to raise a request or skip a loan repayment

- Updation of your personal details is possible through the app.

- Viewing mini statement is possible

- Personal documentation upload, raising settlement quote request, and keeping a personal, family, or funeral policy is also possible using this app.

How much will be the interest rate for Finchoice loans?

Almost 21-24% of loan percentage is charged as interest for almost all loan types. The borrower will need to keep the interest rates in mind when paying back the loan amounts.

Finchoice contact details

You can contact Finchoice for any of your queries and grievances. Telephonic contact is possible through the number 0861 346 246.

Conclusion

Here is what you need to understand if you plan to apply for Finchoice loans. Finchoice offers loans for almost every occasion that calls for some extra money If you think you need a Finchoice loan and you are in South Africa, do not forget to knock on their doors. Finchoice is a digital, fast, safe, and an absolutely reliable way of taking loans when in need.

Check the details of the different loan types and essential information before putting forth an application. Most of the time, loan approvals are also instantaneous.

![African Bank Loan Application & Status [Complete Details] African bank loan](https://kingapplication.com/wp-content/uploads/2022/04/African-bank-loan--300x185.webp)

![Budgeting Loan Application Online [Complete Details] Budgeting loan application](https://kingapplication.com/wp-content/uploads/2022/05/Budgeting-loan-application-300x185.webp)

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)