The First Savings credit card offers credit facilities but one can only apply for the credit card if one has received an invitation for it. After you received the invitation, you will need to go online to apply.

People with bad credit scores can apply for a credit card. Even though the credit card has an annual fee of $49 to $75, you can still build your credit scores if you plan to take it. Even with a bad credit score, you can easily apply for a credit card. Usually, a credit score of 300+ is enough to start the application process for the First Savings credit card.

Page Contents

What is First Savings Credit card?

With the First Savings credit card, you can shop anywhere freely utilizing its MasterCard features wherever a MasterCard is accepted. The credit card is a great way to build your credit score as it reports to all the three major bureaus like Experian, TransUnion, and Equifax.

You will have a few fees on the credit card that you must know prior to making the application process.

| Annual Fees | $49 to $75 |

| Minimum Credit Limit | $350 |

| Purchase APR | 29.99% |

| Cash Advance APR | 29.9% |

| Cash advance fee | 2% |

| Late payment fee | $25 |

| Grace Period | 25 days |

| Minimum Required Credit Score | 300+ |

| Security Deposit | Nil |

Steps for First Savings credit card Application

As you cannot apply for a credit card without being invited, you need to wait for their invitation. Once you are invited head straight to the online site link given here.

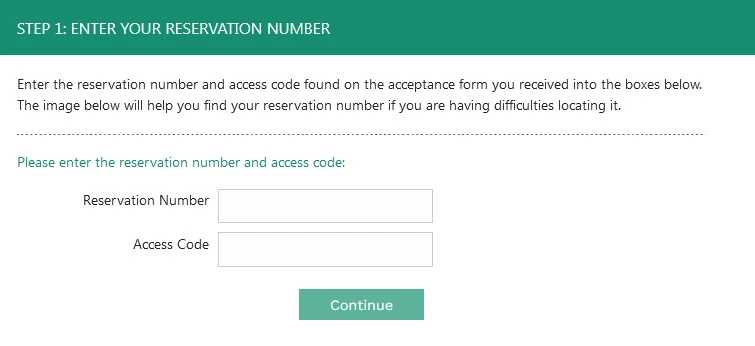

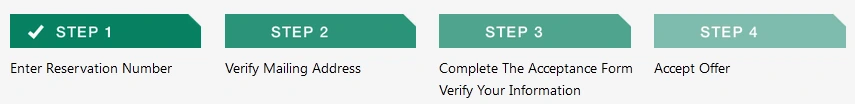

- Click on the Accept online tab to enter the relevant information like the Reservation number and the Access code.

- After entering them, you will have to verify your email address.

- Complete the acceptance form by entering your personal, professional and financial details in the provided spaces.

- Finally, click on the Accept Offer tab to complete the application offer.

- Once you have submitted the acceptance offer, you might have to wait a few days before you hear from them.

Also Read: How to Apply for Firestone Credit card Online?

What are the application Requirements?

The First Savings credit card customer service line is 888-469-0291, so to know the details of the application, you can call them.

- Keep your SSN or ITIN handy when making the application.

- Ensure you have a government-approved photo identity card on display wherever you need it.

- You must have a permanent address that is not just a PO Box number.

Also Check:- Best Credit Card in June 2022 with Cashback

Who is Eligible?

Eligibility criteria for the First Savings credit card include;

- You must be a US resident or citizen of the United States.

- For procuring a credit card, you must be a minimum 18-years-old.

- An annual income and a job are some of the prerequisites for making your credit card application.

Also Read: How to Apply for Coign Visa Conservative Credit card?

First Savings Credit Card Benefits

The several First Savings benefits include the following points;

- You are in complete control of your purchases when using the First Savings credit card.

- When using a credit card, you can get hold of secure online account access.

- Your credit card will have the facility to cover all kinds of frauds that happen when the credit card has an owner.

- The credit card does not provide a penalty APR and doesn’t incur any hidden costs.

FAQs (Frequently Asked Questions)

Is First Savings a good credit card?

If people are capable of drawing the benefits of the credit card the card’s usefulness is enhanced. The credit card provides a lot of benefits and thus is considered a good credit card by many.

It allows one to build their credit scores and is thus, essential to have. It is an unsecured credit card and apart from credit building, also allows people with no or low credit score histories to apply for the credit card. The First Savings credit card is an unsecured credit card and those who do not want a secured credit card can go for an unsecured credit card.

How to check First Savings credit card application status?

Checking your First Savings credit card status is possible in the following ways.

- You must dial (605) 782-3434 and follow the prompts to know the application status. You can also connect to a representative asking for the details.

- You can also go online into your newly created online account and then add your application number to find out your status.

You can also click on the Application Status tab to find out more about the status of your application.

What is the First Savings credit card credit limit?

The minimum starting credit limit for an applicant is $350 and could be more depending on your creditworthiness.

Conclusion

Through the First Savings credit card, you can not only build your credit score but you can also ensure you receive some of the best benefits an unsecured credit card can bring your way.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)