If you have a property you wish to retain because you call it home, you might be aware of all the taxes and exemptions by now. Have you heard of the Homestead exemptions? If you are being forced out of your house, you can refer to this article for more information.

Page Contents

What is Homestead Exemption?

If you wish to minimize property taxes, you can go for the Homestead Exemption. Most states encourage it as it is a legal way to manage the safety of one’s home from different sorts of creditors soon after the owner of the property dies or declares bankruptcy.

The surviving spouse is eligible for the Homestead Exemption, which provides tax relief. The homes that have the lowest value will benefit the most from it. It is a way to protect vested interests in the property, thereby guaranteeing you financial relief and protection along with the provision of a suitable shelter.

But, even though it blocks certain kinds of creditors, it does not block banks from mortgage foreclosures. If the owner did not make the payments at the right time for a mortgage amount, the bank might take possession of the home. Here, we will learn more about the details of the Homestead Exemption application process.

| Prime Takeaways |

| If you want to reduce property taxes |

| Protection of families from creditors |

| Property tax relief for surviving spouses |

| Only your primary residence is considered |

| Rules and restrictions vary from one state to another |

How to Apply for Florida Homestead Exemption application?

To apply for the Florida Homestead Exemption, you need to take one of the routes.

- E-filing is available for Florida Homestead Exemption.

- Download the application, print it, and send your filled application to the Palm Beach County Property Appraiser’s Office, Exemption Services, 1st Floor, 301 N. Olive Ave., West Palm Beach, FL 33401.

- If you want to file it in person, you need to visit one of the five available centers. You can check the list by visiting the website https://www.pbcgov.org/papa/contact-us.htm

To do an e-filing use the following steps;

- After you gather your documents, go to the website, and click on the link that says PIN request.

- The PIN will come to your email once you meet the eligibility requirements.

Answer if you are a permanent Florida resident, note that it is your primary residence and also that you are a permanent resident.

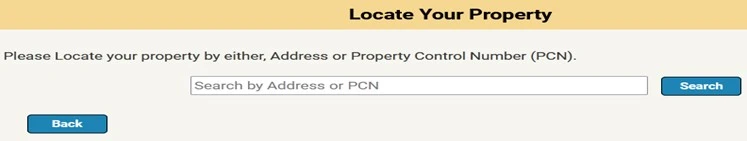

- After that, respond to the question about where you found your address or property control number (PCN).

- If your name is not enlisted in the owner information, you must file in the first and last name. Answer the questions in yes or no as mentioned after your name and then press the Accept tab.

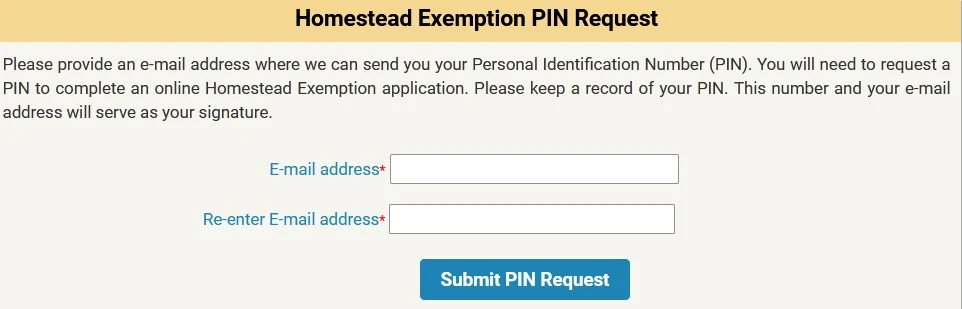

- After you click on the Accept tab, you will next need to enter your email address and then to confirm, re-enter your email address again.

Submit the PIN request, and once you get the PIN, create an account to login online. After you login, fill out your personal details, deceased death details, and also your mortgage details, if any. Once you have completed these segments, you will need to further add details about your home and the property you possess.

After completely filling out the details, go ahead and submit your application for review by the Homestead Exemption group.

What documents are required?

Homestead Exemption documents include the following essential documents;

- Florida’s Driver License

- Florida ID

- Car registration details for Florida

- Voter ID

- If you are not a US citizen, you will need to submit your immigration documents.

- You need to attach ownership proof for your property

- If you have any other property, you must confirm you are not submitting a Homestead application for two properties at a time.

- Your deed is essential

- Documents need to reflect your address, the one you use as your permanent residence.

Check the documents you will need for each county. Here is a reference for Duval, St. Johns, and Nassau counties; you can file the following documents;

| Duval | St. John’s | Nassau |

| Deed | Deed | Home deed or tax bill |

| Driver’s License (DL) | DL | DL |

| Vehicle registration number | Voter card registration number | Vehicle registration number |

| Social security number (SSN)/ birthdate | SSN | Voter card registration number |

| Vehicle registration number | SSN | |

| Previously recorded permanent residency | Active military personnel must provide proof of their legal residence state address. | |

| Employment location | ||

| Address recorded in the Federal Income tax return |

Who qualifies for Homestead Exemption?

You will qualify for the Homestead Exemption if you fulfill the following objectives;

- You are the owner of your primary legal residence.

- As your primary legal residence, it could be your life estate in either case.

- Even though you are a trust beneficiary, you hold the title to your permanent primary legal residence.

- If you have resided in your Florida home for a complete calendar year as of 31st December.

- You are at least 65 years old.

- If you are declared completely disabled or partially disabled by any particular state or federal agency.

- A licensed ophthalmologist must declare you completely blind.

- Any rent collected for the property must not be more than 30 days in a particular calendar year.

How does Florida Homestead Exemption work?

The Florida Homestead application works in a tiered system and is based on your home’s value.

- For the first $50,000, you are entitled to an exemption of $25,000.

- The exemption is applicable to different property taxes.

- You must pay full tax on any assessed value between $50000 and $75000; a tax exemption of $25,000 is available.

- Those with properties worth more than $75,000 are exempt from paying property taxes.

For the $48,000 home, the first $25,000 will be exempted from the property taxes.

For those with a net worth of $70000, the first $25,000 may be exempt.

- People who get $90000 in home value will have a $25000 exemption.

- The next $25000 exemption will be given on all fronts except for school district taxes.

- The last $15000 will get a complete tax exemption.

FAQs (Frequently Asked Questions)

Both spouses will mandatorily need to sign the application. In the case of a deceased partner, if the surviving spouse does not sign the exemption, their exemption will be lost unless they file it.

It means you have to pay fewer taxes for your home’s value. The process will work towards reducing your tax amount.

Only a homeowner who owns the property can file a Homestead Exemption and not a renter or a tenant staying on it. Before going through the exemption process, you should also check to see how long a tenant can stay in your property if you have one.

Conclusion

Here are all the details you need to know about the homeowner’s exemption. Read carefully about who can apply and who can’t, and also your principal requirements to apply for a Homestead Exemption application online.