A tax-processing number issued by IRS to individuals and businesses alike is known as the ITIN. ITINs issued after 1s January 2013 will expire five years after being issued to the taxpayer regardless of whether the tax payer uses it or not.

Page Contents

How to apply for ITIN application?

You can apply by directly mailing the required documents to the

Internal Revenue Service

Austin Service Center

ITIN Operation

PO Box 149342

Austin

TX 78714-9342

You can also apply through a certified acceptance agent or a designated taxpayer assistance center of the IRS.

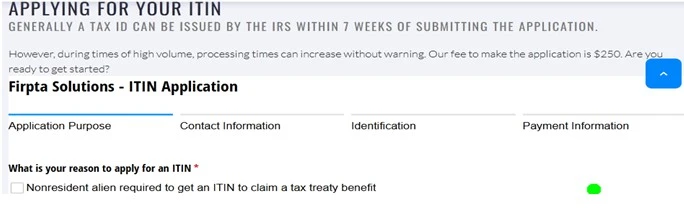

- You must first know the reason for sending in your ITIN application.

- Your business or you must provide identification proof by submitting one of the numerous IDs accepted by them.

- Confirm your identity with them.

- Apply by adding the following information in the given fields- application purpose, contact information, identification, and payment details.

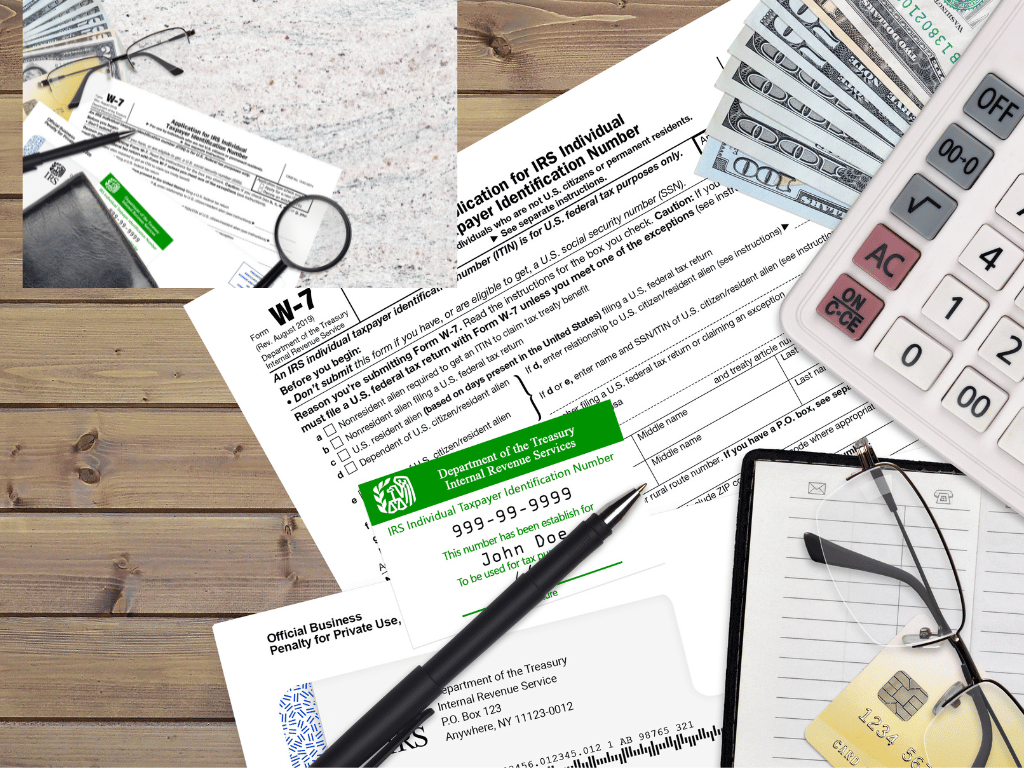

What are the requirements for filling up an ITIN application?

The requirements for filling up an ITIN application will include the following:

- W-7 form

- Tax returns

- Identity proofs and address proofs

- Suitable documents declaring foreign status

- Associate documents if any are required

Identity proof documents

| U.S. driver’s license |

| Any national ID card |

| Foreign voter registration card |

| Visa |

| US military identification card |

| U.S. Citizenship and Immigration Services (USCIS) |

| Dependents can submit school records |

| Medical records for dependents |

What are the benefits of getting an ITIN for you?

There are several benefits of getting an ITIN and they are;

- Using it for filing taxes

- To secure an identification purpose

- Those who are working to build credit can apply

- For buying health insurance

- Claiming a tax credit needs you to submit an ITIN

- You can open a bank account with the details

Also read: www.sars.gov.za tax number registration online application

FAQ (Frequently Asked Questions)

What is the application fee for filling up the ITIN application?

Through an acceptance agent, you must provide $295 and for a full family desiring ITIN, you will get a discount whereby you will only have to pay $150.

Where do you enter the ITIN for paying your taxes?

You must enter your ITIN in the SSN space provided in the tax form.

Can you file an ITIN without an SSN?

If you have an SSN, you will not be given an ITIN. If you previously used your ITIN, switch to your SSN as soon as you receive it.

Conclusion

If you want to get your ITIN, you must know that you have to submit all the required documents. When filing with an approved individual, ensure you find the right guy for your work. An ITIN can be taken even by a non-resident alien even if they are not eligible for SSN and need to file an annual tax. Those immigrants who do not have a lawful status in the country can also obtain an ITIN. Read the entire detail carefully from here to understand better the process before going for it.