JC Penney is a departmental store that provides its customers with a wide variety of shopping experiences. In JC Penney, something is available for everyone, and starting from clothes to shoes and accessories, you have a lot to choose from. With JC Penney, you can qualify for three types of credit cards, one being the ordinary one and the other two being the gold and the platinum.

With $500 or more on merchandise, you can earn a Gold card and a Platinum, if you shop for products above $1000. They offer you a MasterCard which means you can get the benefits from any of the stores and places other than JC Penney.

Each of their credit card whether in-store or MasterCard comes with a lot of benefits and these include points, rewards, and discounts. There is a pre-qualification process for members and you can find out if you prequalify by filling in your information.

However, pre-qualification does not mean you will get their cards but it means your chances of getting their credit card is high. Your credit scores will not get influenced by running your check. A few facts about the credit card you must know to go ahead with it will include the points covered in the table.

| Notable Credit Card Features | JCPenney credit card |

| Annual Fees | $0 |

| Purchase APR | 25.99% |

| Balance Transfer APR | NA |

| Minimum credit limit | $300 |

| Maximum credit limit | $1,000 |

| Foreign transaction fee | 3% of each transaction |

Page Contents

Steps for JCPenney Credit Card Application

You can check if you pre-qualify before you fill out the application form as that will save you from sending them your application.

Prequalification takes just five seconds and you got to do it this way.

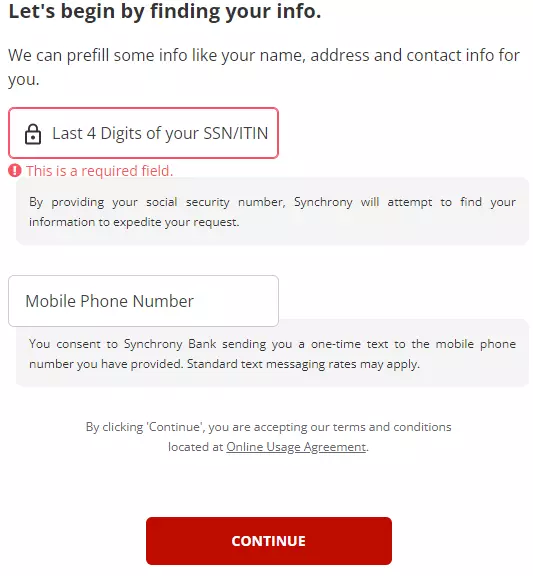

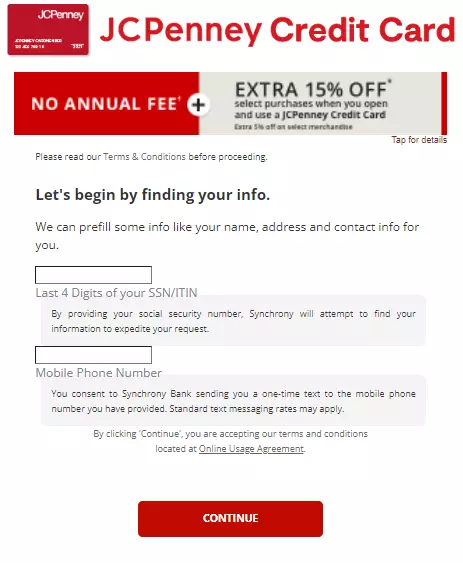

Step 1- Add your SSN and mobile phone number to start the process.

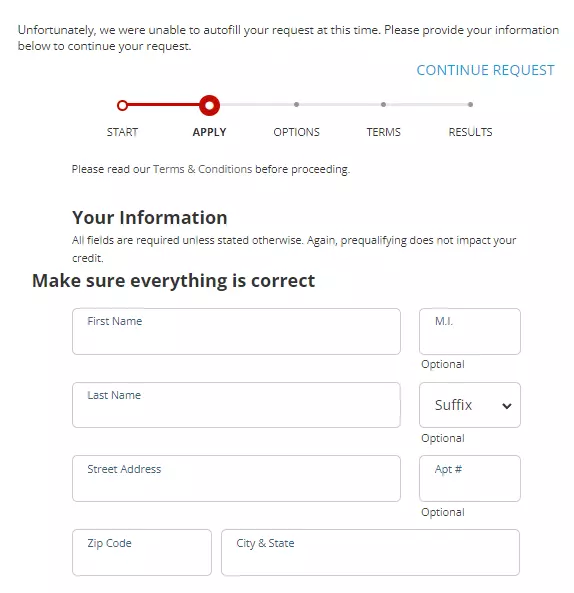

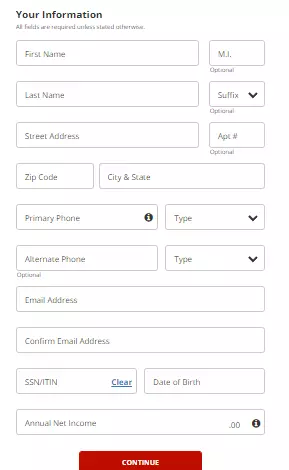

Step 2- Next, add your name and complete your address quickly.

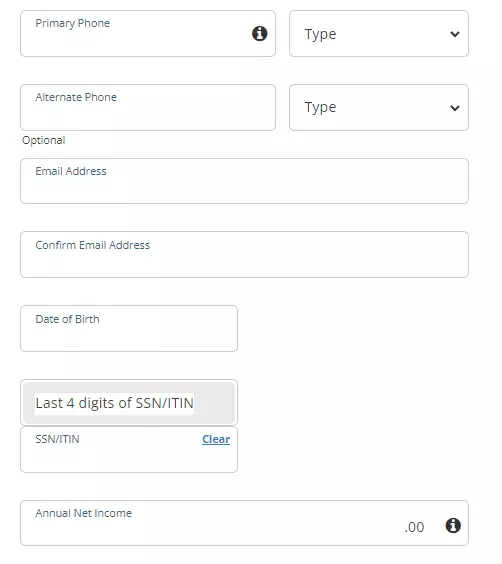

Step 3- Include your primary phone number, email address, date of birth, and last digits of your ITIN/SSN along with your annual net income.

Step 4- Read and check if you pre-qualify by pressing the pre-qualify tab.

Step 5- If you pre-qualify, press the apply tab to complete the application process.

Step 6- Similar to the login process, start by adding the end digits of your SSN and your complete mobile number.

Step 7- Add all the essential details like your name, address, SSN, phone, and email address.

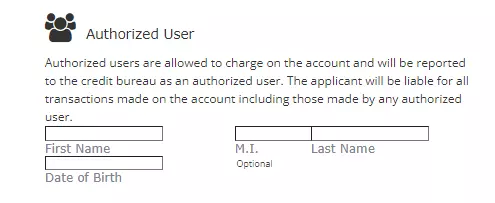

Step 8- Add your authorized buyer, if any.

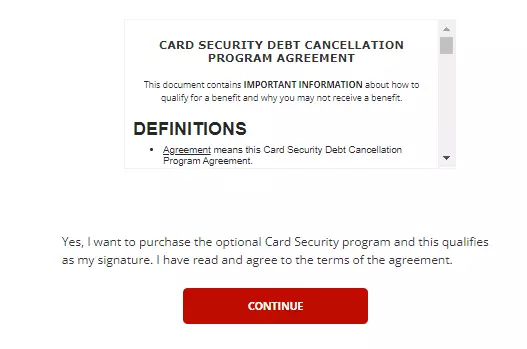

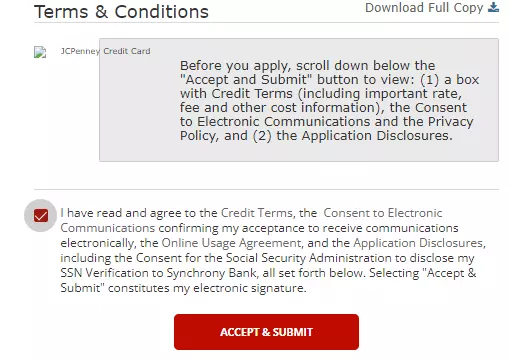

Step 9- Agree to all the terms and conditions before hitting the Continue tab.

Step 10- Read their terms and conditions and then submit the application form.

JCPenney credit card Application Requirements

Requirements do not vary much from other credit cards and here’s basically what you will need to apply.

- Your SSN (social security number) or ITIN (Tax identification number) as that will help them identify you.

- You must have a valid US address for them to send the application.

- Your annual income should be a fair one and apt for the JCPenney credit card range.

- A decent credit score of 640 and above should serve your application process well.

Who is Eligible?

For being eligible for the offers and rewards on JC Penney credit card, you need to be

- A US resident

- Your birth date must be on their file with you being a mature individual at 18 or above.

- Points are earned by you in the last 12 months or at least, a single purchase made in that direction during the year to be eligible for their birthday offers.

Card PROS

Credit cards from them come with several advantages and have some very good reasons as to why you must have their credit card.

- Bonus events can raise your earnings through points.

- You get to avail yourself of different financial offers.

- Cardholders get 150+ saving days exclusively for themselves.

- No annual fee is one reason that the credit card immediately strikes off with credit cardholders.

Also read: How to Pay HSBC credit card Bill Payment or Login to Account?

Card Cons

If you want to decide against taking a credit card, you could look at the cons of it as given below.

- Reward expiration depends on your credit card use and at least once a year, you need to use the credit card to prevent the expiration of points.

- However, your reward certificates will expire within a certain time which is always some months.

- The store card can only be used in selected JCPenney stores and bears a high APR.

FAQ (Frequently Asked Questions)

What bank owns JCPenney credit card?

Synchrony Bank owns the credit card for the applications.

Can JCPenney credit card be used anywhere?

The store card can be used in certain selected stores approved by JCPenney for shopping and the MasterCard can be used anywhere a MasterCard is accepted.

Does JCPenney credit card report to credit bureaus?

Yes, JCPenney reports to all three credit card bureaus and thus, you can use this credit card to build your credit score.

Is it hard to get approved for a JCPenney credit card?

You just need a credit score of 640+ and above to get approval for the credit card. If you do not have credit scores or are close to the credit scores, you might get approved based on your annual income and other considerable details.

How long does it take to get a JCPenney credit card?

After approval like any other credit card, it just takes 7-10 days to get the credit card mailed to your address.

Conclusion

Applying for the JC Penney credit card works for the ones who regularly use their outlets as a shopping hub. If you are an individual shopping from them, do look into this article for more information about the application process.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)