The Kohls credit card allows you to access various offers and if you want more convenience, you can create an online account for yourself. Their online account will allow you to easily manage your credit card.

Paying bills, reviewing paperless bill statements, asking for credit limit increases, and checking your balance are some of the daily tasks made easy for you with the online account.

But if you have a credit card, you might also have bills to pay. What kind of fees you might need to pay, you can decide from the below table.

| Essential Features | Kohls Credit Card |

| Late Payment Fee | $40 |

| Returned Payment Fee | Up to $40 |

| Interest & Purchase APR | 25.99% p.a. |

| Cash Advance Fee | 3% (min $10) |

| Grace Period | No grace period |

| Balance Transfer APR | Not allowed |

Page Contents

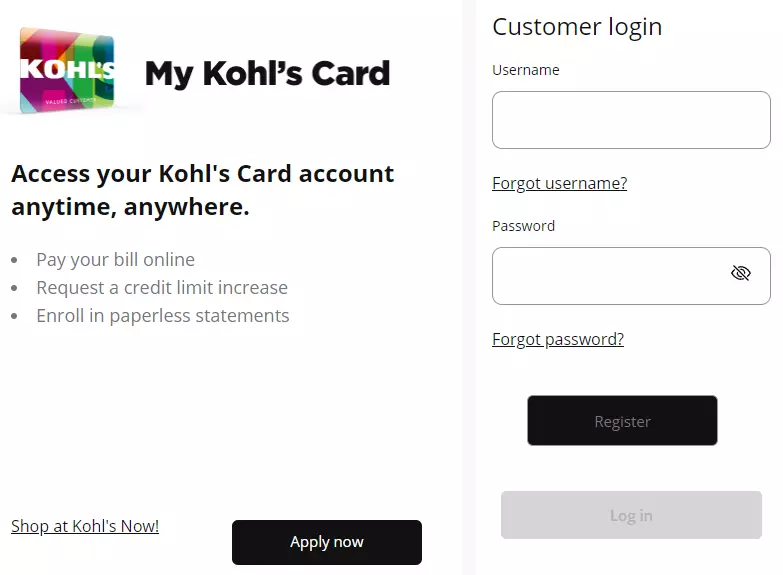

How to do Kohls Credit card account login?

Step 1- Kohls credit card account login involves adding your username and password before clicking the login tab.

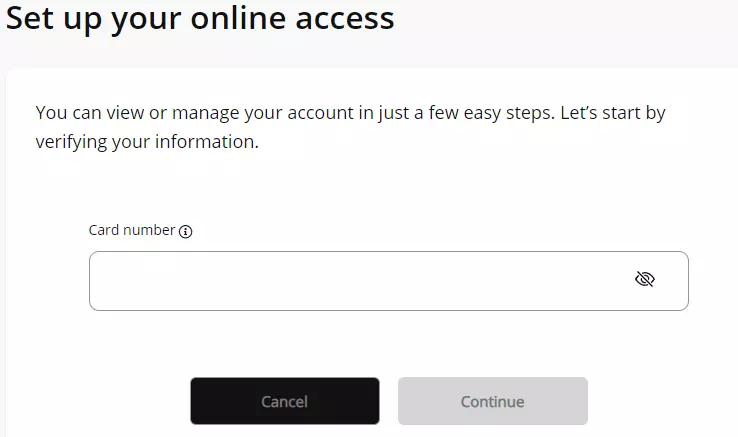

Step 2- If you do not have your username and password, click on the Register tab and start by filling in the account number.

Step 3- Yes, you need your card number before you start the online registration of the application.

Step 4- Complete the application by adding your personal and income details as well as your contact details.

Step 5- Once you press the Register tab, you will be sent an activation link in your mail.

Step 6- Press the activation link and start using your online account.

How to Pay Kohls credit card Bill Payment?

To pay for Kohls credit card bills, you have several payment options.

- Pay at the local store

- Use the mail prospect

- Through phone

- Online payment

- To pay online you must hit your sign-in tab.

- Once you are in your account, move to the payment option.

- Choose the Pay Bill tab, and then add your current account details. Additionally, add your bill details before pressing the Pay tab

- Wait till the payment crosses the secure gateway and you get an acknowledgment for your payments.

- You can also pay at their stores easily.

Payment Mailing Address & Phone Number

The payment mailing address is Kohl’s, P.O. Box 60043, City of Industry, CA 91716 & Kohl’s, P.O. Box 1456 Charlotte, NC 28201. You can send in your check to either of these addresses.

The phone number you must dial to pay your bills is, 855-564-5748 and to pay, you will need a bank routing and account number.

How to increase credit card limit?

You can increase the credit limit by going to your online account.

- Go online to Kohl’s account and then visit the Menu tab.

- From the Manage card tab, click on the credit limit increase.

- Add your complete annual income and then press the request increase tab.

- In a few minutes, a decision will flash up on the board about your credit increase.

- The credit increase is purely based on your annual income, history of bankruptcy, no increase in credit limit in the last months, and past debts for the credit increase verdict by clicking the accept tab.

How to check Kohl’s credit card balance?

To check your balance, you need to log into your account. Go to the menu option and then to the check your balance option.

Once you click that option you will need to choose your credit card account finally to see your account details

Customer Service Number

Kohls credit card customer service number is 1-800-564-5740 for queries and problems.

FAQs

Can you pay Kohls credit card in-store?

Yes, you can pay Kohls credit card in-store.

Do Kohls credit cards expire?

The card has no expiry date and you can use it as long as you want it.

How to cancel Kohls Credit card?

To cancel Kohls card, you can call the customer service number 1-800-564-5740 or go online to raise a cancellation request through live chat.

Will closing the Kohls card hurt your credit?

Closing your card will not exactly hurt your credit.

Can you have 2 Kohls credit cards?

No, you cannot have two cards together.

Conclusion

Kohls credit card is one of the best ones for those who shop from there. They can get 12 annual discounts and introductory discounts with a credit card.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)