The National housing trust contribution refund application form is targeted for providing help in housing construction to those who contribute regularly. If and when you have contributed to the NHT Fund, you can seek a refund for the contributions made from your end.

In case, you already have received a mortgage amount from them, do not apply for a refund as the refund in such a scenario will automatically be done to your mortgage account on the 1st January of the eighth year. Like the NHT refund application form for 2013 can be claimed in 2021 and similarly the year calculations continue.

However, people who fall under the below two categories will not receive their refund amounts and will have to claim them separately.

- People enrolled under the Combined Mortgage Program or the Joint Finance Mortgage Program need to apply separately.

- NHT mortgagers working in public sector companies who meet certain specific conditions that need them to file for a refund separately.

Page Contents

Steps for NHT contribution refund Application online

It is an easy process and the NHT contribution refund online can be pursued in the following way.

STEP 1- Visit the website link for applying to the NHT contribution refund online account.

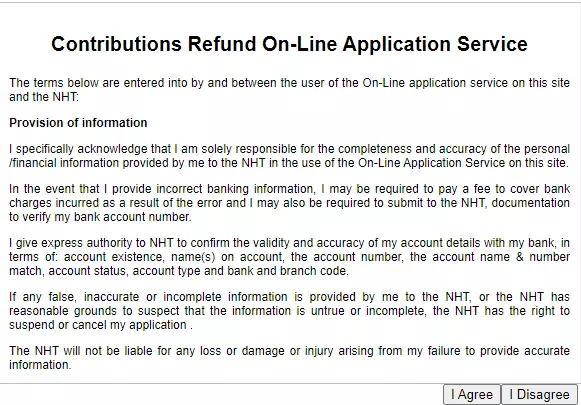

STEP 2- The first thing you need to do is, read the terms and conditions and click the Agree tab.

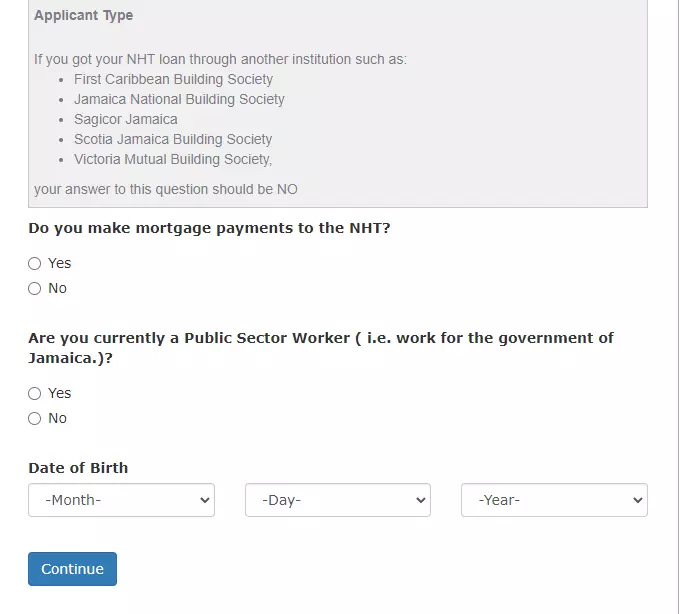

STEP 3- Fill in the basic information, once you are on the first page of your application.

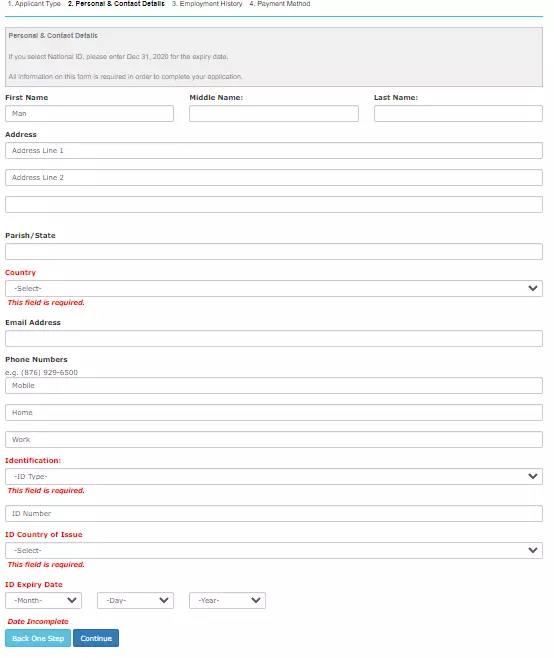

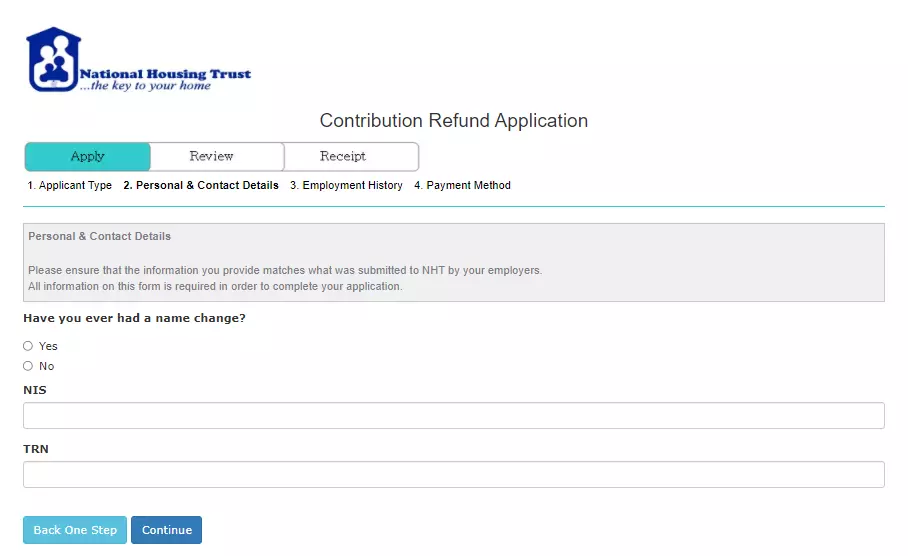

STEP 4- On the next page, fill in your contact details, and also your name and address completely.

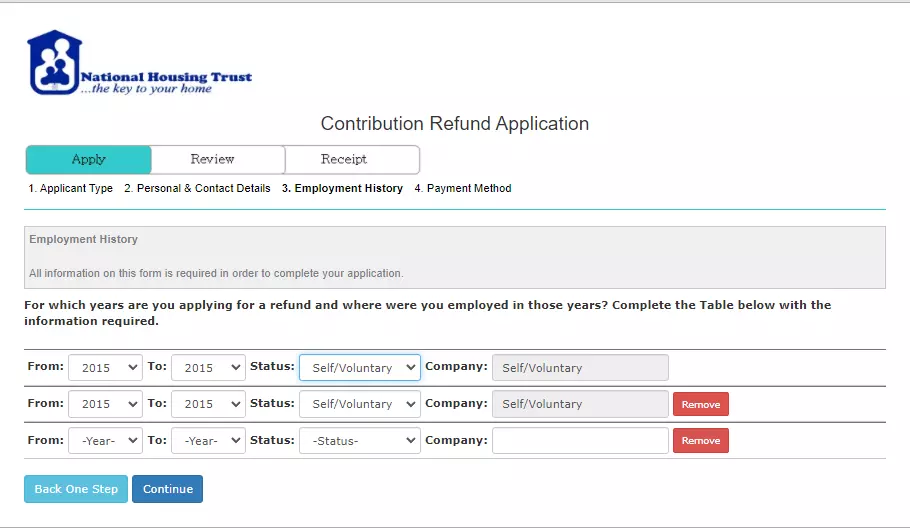

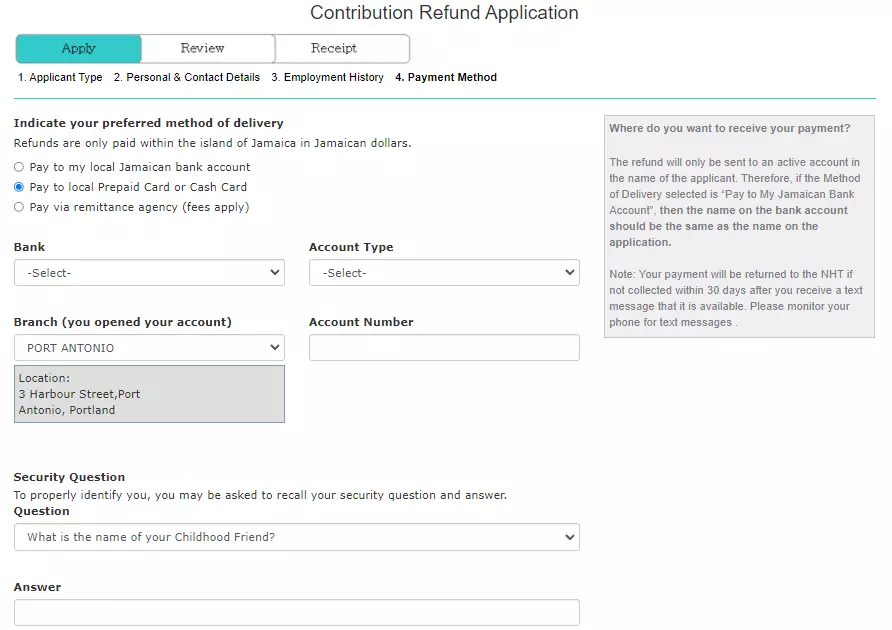

STEP 5- Next, add your employment history and then review the application, post which you must add your payment method, and then submit the application form.

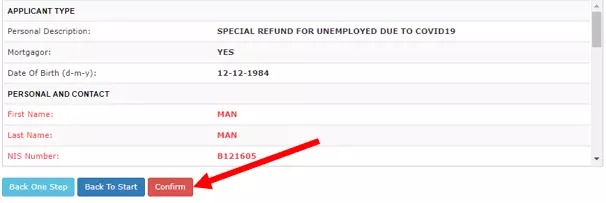

STEP 6- After reviewing your application form, click on the Confirm tab to complete the application.

Who is Eligible?

Eligibility for NHT differs from person to person and includes the following points.

- Individuals between 18 years and 65 years old.

- People who have contributed towards the fund for 52 weeks.

- You must not be holding a public sector job.

Also read: Which year is NHT refunding & How much is NHT refund?

Application Requirements

The application requirements for the NHT contribution refund application form include the following documents;

- Driver’s License

- Government-approved ID card

- Social security number (SSN)

- They need to show their NIS (National Insurance Number), and TRN (Taxpayer Registration Number).

- People also need to have their banking number with them for claiming the refund.

How to claim an NHT refund?

To claim the NHT refund, your funds should have been submitted to your account. The NHT refund is possible to obtain by applying online to their organization. Once applied, your application status will be checked and then you will be told about their decision. It takes 10 days for the organization to send you a confirmation of your application.

www.nht.gov.jm refund application form online?

The application form online for NHT is available with due payments made and individuals can claim the money after 7 years of refilling, on the first January of the eighth year.

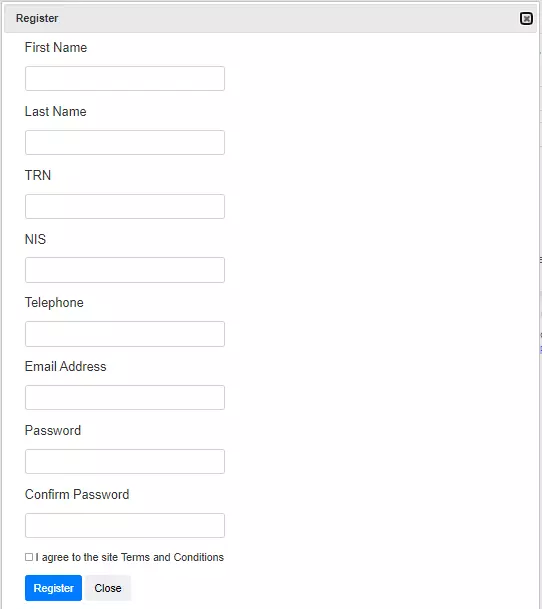

If you don’t have an account, you can create one for yourself. To create an account, you must register with them. Fill in some basic details and create an account with them for the same.

Query contact number

- The Jamaican office contact number is (876)-929-6500-9.

- For the US and Canada, callers can use 1-800-858-3219.

- For the UK callers can use, +44 203 514 8816

- Local callers can use (888)-225-5648

Conclusion

Here are the details of the NHT housing trust Jamaica refund and if you are planning to claim yours, read more about it here.

![Assurance Wireless Application Online form [Easy Steps] Assurance Wireless Application Online form [Easy Steps]](https://kingapplication.com/wp-content/uploads/2022/09/assurance-wireless-apply.webp)