The Central Bank of Nigeria has brought out a stimulus scheme for all those small, medium, and micro working units which have got badly hit by the pandemic. A fund package of 50 billion Naira is being granted by the government to control the pandemic situation.

Page Contents

What is an NMFB household loan application?

Households who are not having a proper earning source, microenterprises, and SMEs of small businesses are being facilitated through this NMFB household scheme.

You have to grab an application form and submit it after completing it, it goes for approval from there and then disbursement of funds happens from the bank into your account.

How to get NMFB household loan application form?

For the loan application form, you need to enter the following details in the NMFB household loan portal for microenterprises and SMEs.

- Credit union account number,

- Check on the loan type from the options available- standard, motor, seasonal, secured, student, and household budget loan Naira land.

- Next, you have to fill in your details like name, PPS number, date of birth, etc.

- Amount of the loan required and also enter the purpose for which you’re going to use the loan amount.

- Members need to divulge how much of the amount they wish to pledge against their loan for security.

- Put in your signatures in the section.

- Repayment protection insurance is another additional insurance user might want to take up to cover their loans in events of accidents, sickness, redundancies. This comes with an additional charge for the member.

- Users need to confirm if they are taking a top-up on an existing repayment or is it a separate repayment.

- Further, they will have to state the loan term frequency and the frequency in which they wish to repay their loans.

- Additionally, tell the bank how you wish to repay the loans.

Step 1: To apply, after clicking on the link and ensuring you have all the information, you have to visit the site to press on the Apply tab.

Also read: Uniform Residential Loan Application – [Complete Details]

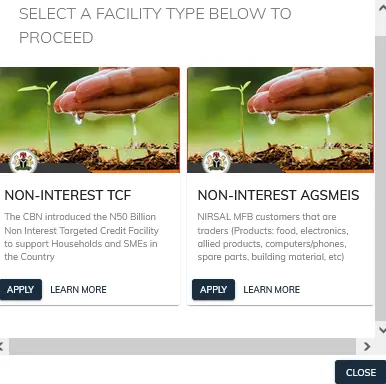

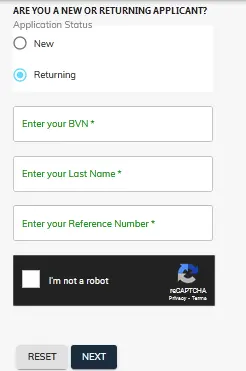

Step 2:From the two available options, choose one as per your requirement.

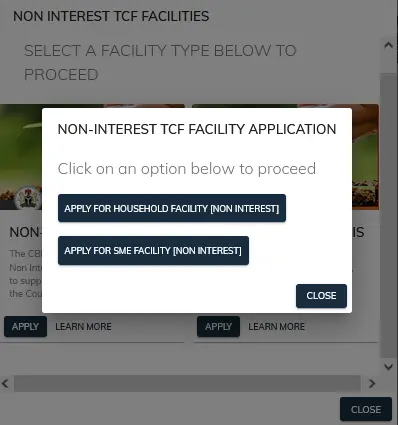

Step 3: In both the loan options, there will further be two options- one for household facility and another for SME.

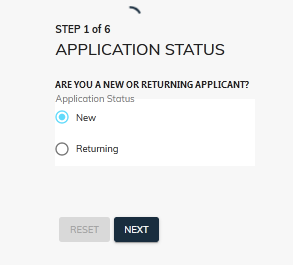

Step 4: Add information to all the six steps and start by answering if you are a new candidate or a returning one.

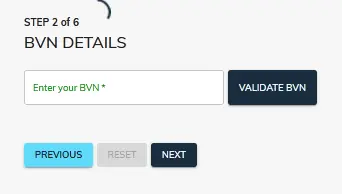

Step 5: If you choose new application option, you will need to begin the application process by adding your BVN.

Step 6: If you are a returning candidate, you will have to enter BVN, last name and reference number.

Complete the rest of the application and submit it.

How to NMFB household loan check?

To check whether your loan is under process or due for approval, here are a few links that can help you. People have already received 2.5 lakhs to 7 lakhs Naira as payments to date benefiting from the loan.

- NMFB household loan beneficiaries can click on the following link:

This is for household loan Covid 19.

2. For SMEs follow this link: Just a moment… (nmfb.com.ng)

3. Once you receive the loan confirmation message, visit on the link, https://covid19.nmfb.com.ng/.

How to get NMFB loan approval?

Once your loan application is approved, you will get a message from them stating it has been approved for you.

Further, you would be asked to fill in the below information.

- Choose from household or SME.

- Type in your BVN number

- Post this step, you can see the amount approved for you and then click on the confirm tab.

- On the next page, fill in your bank details.

Read the terms and conditions for payment and then wait for a few days till it is disbursed to your account.

Loan status

NMFB household Loan status:- Your household loan status can be checked from the above-mentioned link and once the loan status is obtained you can next work towards it as mentioned in your loan status.

Conclusion

If there is an NFMB housing loan requirement, you can try to use this article for more information about the loan application process and requirements.

![Uniform Residential Loan Application - [Complete Details] uniform residential loan application](https://kingapplication.com/wp-content/uploads/2022/05/uniform-residential-loan-application-1-300x185.webp)