The Parent Plus loan application is an initiative by the US Department of Education. You can use it to fund your child’s undergraduate education programs. There are several other options other than the Parent Plus loan in the market if you are a parent trying to finance your child.

However, the Parent Plus loan comes with several benefits like lesser return expectations compared to other loans, and also as it is financed by the Federal government.

It is worthwhile for your child if the program is uncovered by any other loans. When as a parent, you have exhausted all your resources, try going for this loan.

If you did not already go for Federal grants, scholarships through your child’s school or college and also private scholarship schemes, choose this loan process as an option.

Page Contents

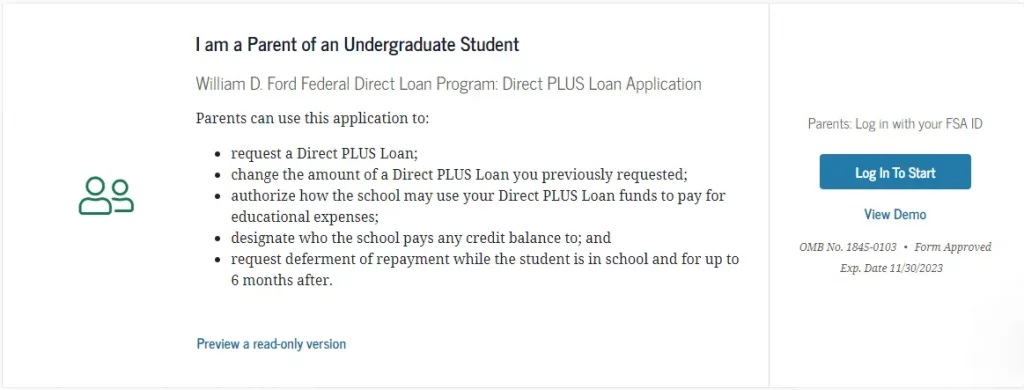

FAFSA Parent Plus Loan Application

The several steps in the process of the application include the following;

- After checking your eligibility, ensure your child fills out the FAFSA form.

- Add up and summate to find out the amount you need to borrow to help your child.

- Visit the Department of Education website to apply for the loan.

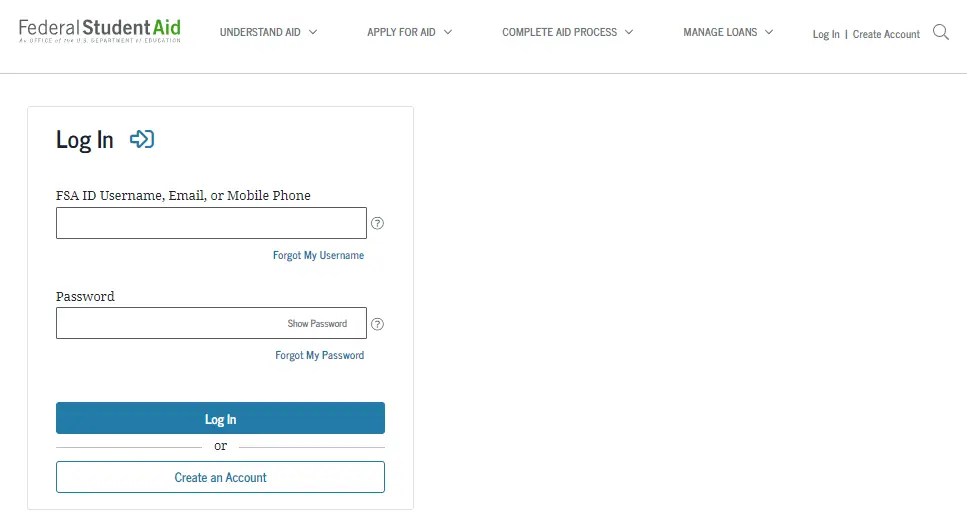

- You will need to log in to the site using your Parent’s login ID which is none other than the FSA ID & password.

- Add your email ID or mobile phone number other than FSA ID Username (as per your registration process).

- If you don’t have an account, you will have to create one for yourself.

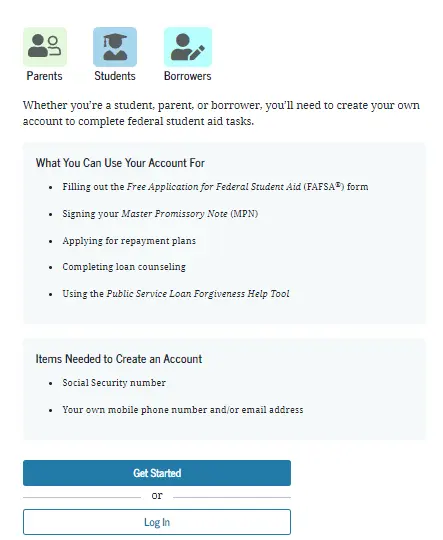

- Use the Parents option other than the Students or Borrowers option.

Add your details to complete the account creation.

- Post the account creation process, you must fill in personal, professional, and educational details.

- Submit the application process post adding all essential documents.

Parent Plus Loan Application Requirements

The application requirements for FAFSA include the following documents.

- The social security number of the parent or the guardian.

- Driver’s license number for a government-approved photo identification card

- If not a US citizen, you need to provide the Alien registration number.

- Tax information like IRS 1040, IRS 1040NR, and or Tax Return for

- Guam,

- Puerto Rico,

- the U.S. Virgin Islands,

- American Samoa,

- the Federated States of Micronesia, or

- the Marshall Islands,

- Palau.

- Untaxed income records- child support received, interest income, and veterans noneducation benefits.

- Cash information and bank account details

Also read: Does Student Loan Forgiveness include Parent PLUS Loans?

FAFSA Parent Plus Loan Eligibility

For the FAFSA Parent Plus Loan eligibility, these eligibilities must be satisfied.

- You need to be a biological or adoptive parent or guardian of a student who at least is enrolled for half the time at a qualifying school.

- If you want to be eligible, you must either be a US citizen or a non-citizen fulfilling certain eligibility criteria.

- Adverse credit history can badly impact your eligibility scores.

Benefits

The loan allows the following benefits apart from the monetary advantages.

- The loan provides its borrowers with a pre-payment and overpayment option.

- Federal repayment is an option for the parents.

- The loan discharge provision exists if the student or the parent dies or becomes disabled.

- You can avail of the loan cancellation, either the entire or a partial amount.

FAQs (Frequently Asked Questions)

When does Parent plus loan application open?

The application begins on 1st May 2022 and students can verify on BU BRAIN following mid-May 2022.

How long does Parent plus loan approval take?

The Parent Plus loan approval can take an approx. 3-5 days and the funds are posted often on the same day after approval.

When should a Parent apply for a plus loan?

The FAFSA is available on the 1st of October each year and for a parent loan, you can apply a few months later either in spring or early summer.

Does Parent plus loan check credit score?

There is no minimum credit score for applying for the Parent loan but you should not have a credit history.

Does Parent plus loan affect credit score?

There can be some negative impact on your credit score but it will never be drastic.

Conclusion

The Parent Plus loan is one of the most wonderful scopes for parents who want to help their children and their studies. It is a form of federal student aid and if the students have already exhausted all the options, a parent can apply for an unsubsidized federal direct loan.

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)