Parent PLUS loans are taken by parents to assist their offspring in their studies. The loan cannot be taken by a legal guardian or grandparents unless they have lawfully adopted the child. The loan is for all those candidates who want to pursue theirs under graduation. The Parent PLUS loan is a federal loan. There are innumerable documents needed to register for this loan. The amount that a parent can get as a loan is the number of lectures that the applicant has attended and all the financial aid that the candidate has received is deducted from that.

There are four types of repayment plans for the Parent PLUS loan that a candidate can choose from. Remember that the parent has the complete responsibility to pay off the loan in any case. If the student agrees and says that he/she will return the amount of the loan still in case of any uncertainty or delay, the parent will be answerable. The Parent PLUS loan is quite beneficial for families who have a shortage of funds and want money. However, ensure that you are capable to return back the money as taking debt is easier but paying back is difficult.

Page Contents

Are Parent Plus loans federal or Private?

Parent PLUS loans are federal direct loans. The ROI for the current year which is 2022 was around 7.45%. There are a few conditions that are compulsory to get this Parent PLUS loan as not everybody can get it. The loan is given to parents who do not have sufficient funds to bear the cost of their undergraduate child. A legal guardian or a parent takes this Parent PLUS loan in the place of the student.

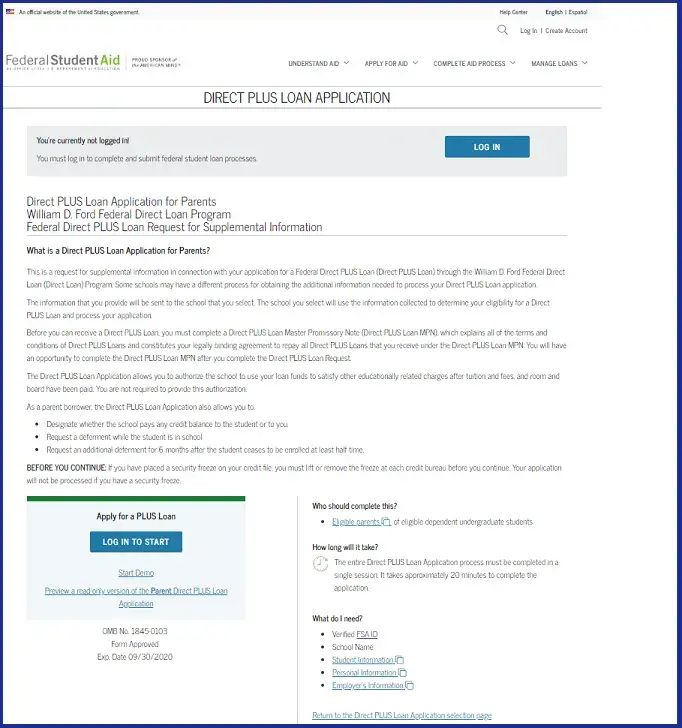

There are a few steps that a borrower has to follow to apply for this Parent PLUS loan and these are quite simple. Firstly an application form for Federal Student Aid(FAFSA) is to be filled out. Then, the candidate has to check all the available options for student aid. Moreover, the Parent PLUS loans eligibility list is scrutinized carefully. Moving ahead, check whether you are entitled to the loan or not. In addition to this, all the obligatory details in the form are added. At last, the application form for the Parent PLUS loan is reviewed and finally, the loan is sanctioned. Now, the borrower can use the money.

How do I know if my parent plus loans are federal?

The Parent PLUS loans are one of the components(part) of the Federal Direct Loans. These are the loans that are quite easy to get if you have met the aspects that are needed to qualify. The interest on Parent PLUS loans starts at the same time when the person sanctions the amount in your name.

Parent PLUS loan may also be forgiven under PSLF if the applicant for whom the loan is taking died due to some mishappening. Ensure that the applicant has all the income proof and other obligatory documents at the time of loan application.

FAQs

Will federal Parent PLUS loans be forgiven?

The answer is yes, the Federal Parent PLUS loans can be forgiven but only after 25 years. The borrower has to choose many other ways to waive off the Parent PLUS loan.

What are federal direct parent plus loans?

The loans are initiated by William D. Ford and are a special type of federal student loan that comes under the federal direct parent plus.

Are navient parent plus loans federal?

Yes, the Navient parent loans are federal.

![African Bank Loan Application & Status [Complete Details] African bank loan](https://kingapplication.com/wp-content/uploads/2022/04/African-bank-loan--300x185.webp)

![Uniform Residential Loan Application - [Complete Details] uniform residential loan application](https://kingapplication.com/wp-content/uploads/2022/05/uniform-residential-loan-application-1-300x185.webp)

![Budgeting Loan Application Online [Complete Details] Budgeting loan application](https://kingapplication.com/wp-content/uploads/2022/05/Budgeting-loan-application-300x185.webp)