Penfed credit cards are issued by the Pentagon Federal Credit Union and offer credit cards with a low annual fee, mostly $0. Even though the credit card is issued by the Pentagon Federal credit union, yet, it is not mandatory to be part of the military to be approved of the credit card.

But you will need impeccable credit scores to go ahead with the Penfed credit card. Apart from the military and their families, even the general public can go ahead with the application process.

Page Contents

Different Types of Penfed Credit Cards

In total, there are four different types of Penfed credit cards and each of these credit cards is popular with the crowd. Here’s a summated list of popularity reviews tagged for your reference.

| Penfed credit cards | Popularity of one credit card over other |

| Platinum Rewards Visa Signature credit card | 4.8/5 |

| Penfed Power Cash Rewards Visa Signature card | 4.5/5 |

| Pathfinder Rewards Visa Signature credit card | 4.2/5 |

| Gold Visa Credit card | 3.5/5 |

You can also apply for credit cards even if you do not hold a personal account with them. But before you apply, you must know more about the fees and the other requirements you must fulfill to be approved for the credit card.

| Notable Credit Card Features | Penfed credit card |

| Annual Fees | $0 for all credit cards except Pathfinder Rewards Visa Signature credit card ($95). |

| Purchase APR | Gold Visa Card: 7.49%- 17.99% Platinum Rewards Visa Signature card: 13.49%-17.99% PowerCash Rewards Visa Signature Card: 14.99%-17.99% Pathfinder Rewards Visa card: 14.99%-17.99% |

| Balance Transfer APR | Pathfinder Rewards Visa card: 0 for 12 months & 17.99% in the next months. |

| Minimum credit limit | Based on your creditworthiness |

| Foreign transaction fee | $0 |

Steps for Penfed credit card application

To apply for the Penfed credit card application, here is the online process you need to follow.

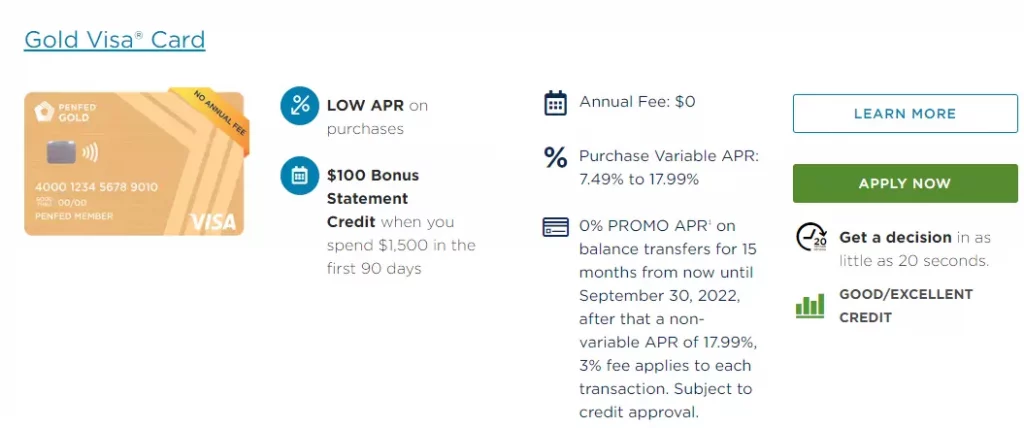

Step 1: After visiting this website i.e www.penfed.org/credit-cards, you must choose your credit card and press the Apply Now tab.

Step 2: In the above screenshot, you can see the green Apply Now tab for the Gold Visa credit card.

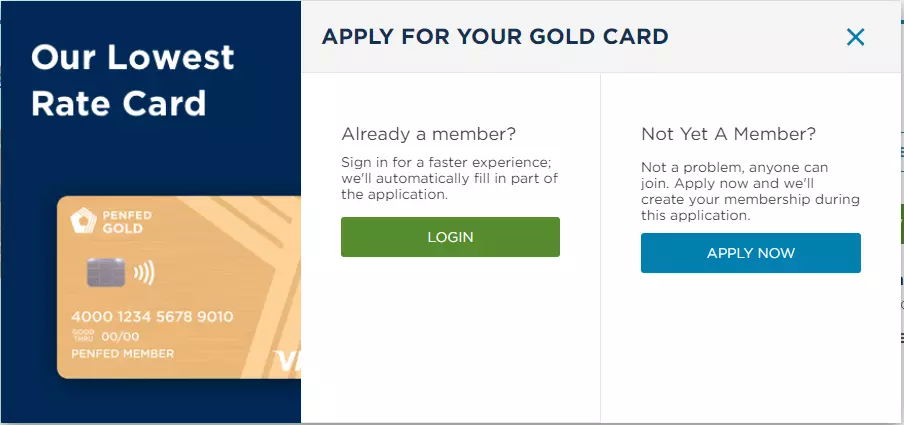

Once you click it, it will take you to the page where you will have to choose between the login tab and Apply Now tab.

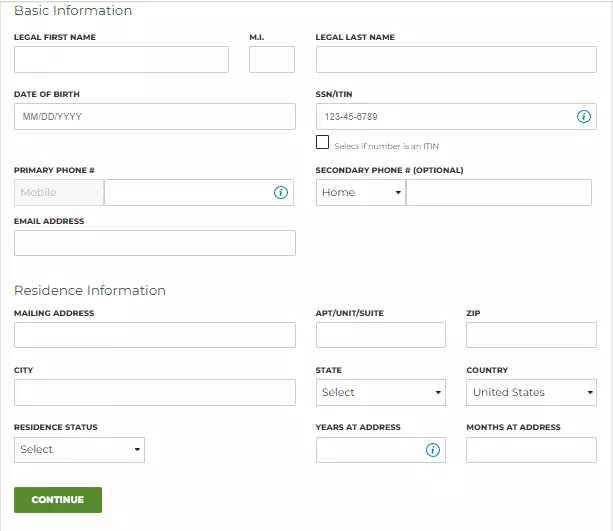

Step 3: Start by filling in the basic information like name, mailing address, phone number, and email address.

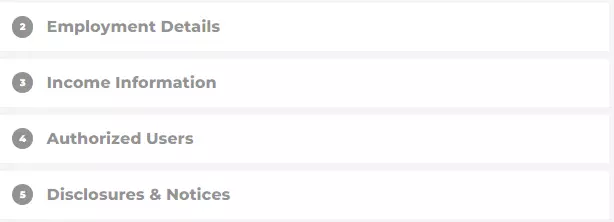

Step 4: The next segments you need to fill include employment, income-related, authorized user details, and disclosures and notices.

After you have filled in the information in the entire application, you can now click on the Submit tab to complete the application process.

You can also apply if you have a pre-approved code with you. Add the offer code and your last four SSN digits.

Penfed Credit card application Requirements

The application requirements include the following:

- You must have a steady source of income to acquire the Penfed credit card.

- Your credit score will be 750+ to obtain the credit card.

- The address must be a permanent one that you will have to enter for proper communication.

- You should have an SSN (social security number) for getting this credit card.

Who is eligible?

Eligibility criteria include the following;

- As an applicant, you must be 18 years old for receiving the Penfed credit card.

- If you want to get a credit card, you should have a government-issued ID like a driver’s license.

- You must have valid US citizen proof or if you are applying from a military family, you should have your appropriate IDs and other requirements.

- You must be able to fund at least $5 into your savings account.

Card Pros

The credit card has several advantages including;

- You get a $100 air ancillary travel credit card

- Reimbursements for Global entry or TSA precheck application fees and priority pass air lounges of $32 per visit is made available.

- Your credit card will earn rich rewards for travel purchases.

- The cashback is a redemption option with them.

- The Platinum Rewards Visa Signature card is quoted as the best for gas.

Card Cons

Credit cards have several disadvantages:

- You will need some extra steps to get your annual fee waived.

- The value of their points is a bit less than their original cost.

Also read: How to increase your credit score quickly with or without credit card

FAQ (Frequently Asked Questions)

Is Penfed credit card hard to get?

Penfed credit score requirements are on the higher end and thus, you might find it a bit hard to have a credit card.

How many credit cards can you have with Penfed?

There is no limit on the number of credit cards you can have from them but you must remember to have a $50K minimum CL (credit limit) for all of your credit cards together.

What credit score do you need for Penfed credit card?

You must have a 750+ credit score to get the Penfed.

How long does it take Penfed to approve a credit card?

It takes a standard 7-10 days to approve.

Which Penfed credit card is easiest to get?

The easiest Penfed card to get is the Platinum Rewards Visa Signature credit card.

Conclusion

Some of the best credit cards are made by military personnel, and if you want to go ahead with them, you must know more about credit cards here.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![First Savings Credit Card Application [Simple & Quick Guide] First Savings credit card](https://kingapplication.com/wp-content/uploads/2022/05/First-Savings-credit-card-1-300x185.webp)