The Pension credit application is part of the service and government-funded help rendered to people who need it. Some of you who received the pension age and are not too high on income or savings while living in the United Kingdom can apply for it. People who apply for the Pension credit might still be working and yet apply for the funds. But working people must remember that their income cannot be very high.

To apply for the Pension credit, you do not require a National Insurance Record.

Each individual will receive the Pension credit in two parts- Guarantee credit and Savings credit.

- With Guarantee credit, you can get a minimum amount as a weekly income.

- Savings Credit will pay you some money for your retirements like a second pension or savings.

You will get£14.48 savings credit a week as an individual and £16.20 for two people. Guarantee credit will be £182.60 for single people and £278.70 for two people.

Page Contents

How to apply for a Pension Credit application?

To apply for the Pension credit application, you must take up the following points into consideration;

- To make an online application for Pension Credit, here is the link you should visit.

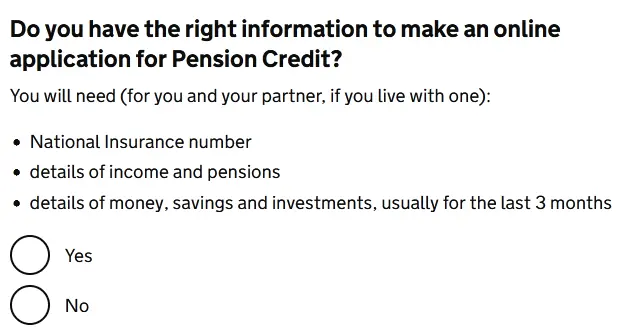

- Tell them if you have all your Pension Credit application requirements by checking the Yes or No box.

- Add the country where you live next.

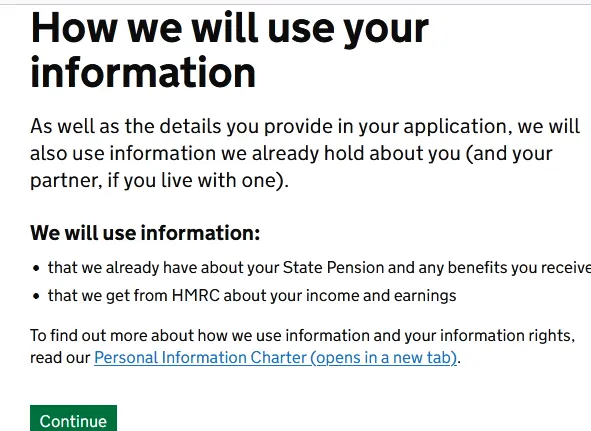

- In the next segment, you will understand how the site will be using your information.

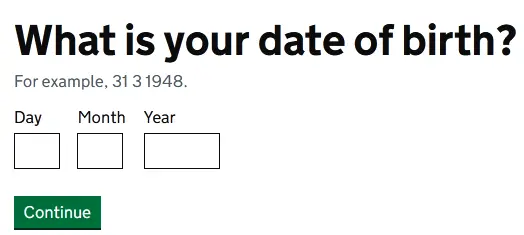

- Add your date of birth to the Pension credit application form.

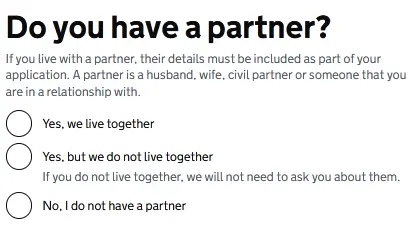

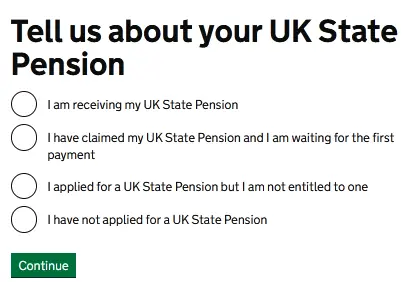

- Provide your nationality details, partner information, and your UK state pension details.

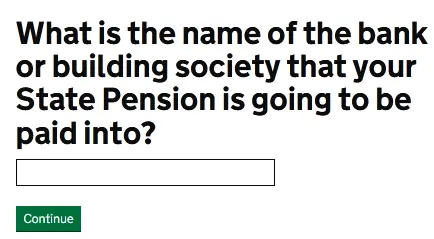

- Add your bank or housing details where you get your state pension.

- In the next segments keep adding the details as per the prompts. Once you have filled out the entire application form, click on the Submit tab to send your application to the next step.

What are the application requirements?

Application requirements for your Pension Credit application will include the following conditions.

- Your National Insurance Number is essential for filling up your Pension Credit form.

- Savings, investments, and income-related information must go in the given segments.

- If you want to backdate your information, you must enter all previous savings and income details.

- You also need to add your bank account details if you plan to send your application by phone or post.

If you are from EU, EE, or Switzerland, you can also claim it if you fulfill the following conditions;

- You must be having a settled status or a certain right to claim the Pension credit. At least one needs to be a habitual resident to go ahead with the application.

- Basically, the UK, Ireland, Isle of Man, or the Channel Islands will serve as your primary home.

- You can also apply if you have a pre-settled identity from the EU Settlement Scheme. Additionally, you must have another right to reside there.

- You have taken an indefinite leave to remain or be within the EU Settlement Scheme.

Also Read: How to Apply for Harris County Gold Card?

Who is eligible?

Eligibility for the Pension Credit application will need you to be a pensioner or at least a retired professional. Apart from being a pensioner, your eligibility will include;

- Add a permanent contact address for further correspondence is a must.

- Include your day’s phone number and email address that you will primarily use for all your future communications.

- You must also add all the benefit schemes in which you are enrolled currently within your county.

- Pensioners need to give details about the pensioners’ hospital details.

- Do you have any child support responsibility upon you and do your social security benefits and allowances come up.

- Financial retirement planning and your occupational and personal pension schemes.

Pension Credit Application: Benefits

There are several benefits of the Pension Credit Fund;

- Your state pension age is 66 years old currently.

- Pension credit provides you with an extra sum for your living if you are ahead of the State Pension plan and have a lower income range.

- You can use the money to support your housing needs such as service charges and ground rent.

- For putting up with extra help, you can use this money if you are disabled or have the responsibility of a child or a young person on your head.

- It can also support your mortgage interests if you have a property you own.

- You can have a free TV license if you are above 75 years old.

- With it, you can try getting help with your NHS dental treatments and glasses including transport costs and hospital appointments.

- Even if you need help with your heating costs, you can use the pension credit.

Also Read: How to Apply for YourTexasBenefits Online?

FAQs (Frequently Asked Questions)

How long does a pension credit application take?

Your pension claim can take up to 6 to 8 weeks before your application is assessed and paid to you. Ideally, your first pension will be within the first five weeks from the date you reach the State Pension age. Post the first payment, you can expect all payments to come to you every four weeks.

Where to send pension credit application form?

If you are not applying by phone or not going online for submitting it, you can send your pension credit application form to the below-given address;

The Pension Service 8

Post Handling Site B

Wolverhampton

WV99 1AN

You can also apply by phone for the pension credit and the numbers to reach out to will include the following;

For the pension credit claim line, you can call 0800 99 1234 or text 0800 169 0133 and if you are unable to hear or speak over the phone, try calling 18001 followed by 0800 99 1234.

Do you have to apply for pension credit every year?

Only if you are turned down a particular year will you need to make a claim each year. But if your claim is already accepted there will be no requirement to make the claim, again and again, each year.

Is pension credit a state benefit?

Yes, it is a state benefit that people can get even if they get other benefits and sanctions.

- The rule is that if you are single, you can get pension credit, and even if you have a partner, you can get state benefits.

- For your partner, pension credit will come if you and your partner both have reached the pensioner’s age.

Where can I get a pension credit application form?

For mailing them a pension credit form, you will need to download the claim form from this given link.

Do you get pension credit automatically?

Yes, you can get the cold automatic transfers to your account every month and a monthly pay slip is also generated for the same.

Conclusion

Here is what you have to know about pension credits if you are a pensioner. The application form and requirements are here for the pensioners to learn before applying for it. As pension credit application takes 6-8 weeks to get approval, you can always benefit by starting your application a bit early and completing them carefully.