The Prosper credit card is issued by Coastal Community Bank and is licensed to Mastercard International. Founded in 2005, Prosper is for those who are attempting to find an affordable entry point for building on their credit scores.

To stay at par with financial goals, the affordability of the credit card is what drives customers towards it.

If you wish to obtain the Prosper credit card, you will need to start by filling out a simple application form. The online application process allows ease in filling it and can be done from the comforts of their own home.

With the credit card comes benefits that are exclusively designed for those who take the card, Before moving on to the credit card approval process, you must know a few essential features of the credit card.

| Notable Credit Card Features | Prosper credit card |

| Annual Fees | For those having an autopay option, it is $0 for the introductory period and $39 after the first-year completion |

| Purchase APR | 18.99% – 29.99% (variable) |

| Balance Transfer APR | N/A |

| Cash Advance APR | 29.99% |

| Minimum credit limit | $3000 |

| Foreign transaction fee | 1% of the amount being transacted |

| Security Deposit | None |

Page Contents

Prosper credit card pre-approval process

The Process credit card pre-approval process is automatic and the company will do a soft pull on your credit scores to understand your eligibility. A mail will be sent to you with your details if you are pre-approved.

To get prequalified, you need to have an account on the Prosper website first. You need to add all your details on their website to make sure they know about your annual income, debt status, and other related information.

Steps for Prosper credit card Application

To apply for a credit card, you need to add information around these points.

- Personal information about yourself

- Economic and financial information

- Identifying details

- Contact information

After adding information, agree to their terms and conditions and press the Submit tab to complete the application process.

What are the application requirements?

Different application requirements of the credit card include;

- Any US citizen living in any of the states of the US except Iowa and West Virginia can apply for a credit card.

- You must be a citizen of the United States to apply for the Prosper credit card.

- The residential address you have to enter must not be a P.O box address but instead, must be a complete address in itself.

- You must be able to supply an SSN (social security number).

- Any government-sponsored ID card confirming your photo identity must also be submitted.

Who is eligible

Eligibility of the credit card includes the following;

- You must be 18 or more when applying for a credit card.

- Your average credit score must be 640 which is 20 less than all other unsecured credit cards.

- The debt to income ratio should not exceed more than 50%.

- You mustn’t have been declared bankrupt in the last 12 months.

Also read: Blaze credit card application Online [Blazecc.com accept]

Card Pros & Cons

There are different credit card pros and cons that come with it and here are a few of them.

| Prosper credit card pros | Prosper credit card Cons |

| You can get your credit card for building your credit score | You have an annual fee to pay |

| You will not need to make any security deposit | |

| It has a high initial credit limit extending to $3000. |

Prosper credit card reviews

If you have to talk about the credit card then its reviews will revolve around the following points.

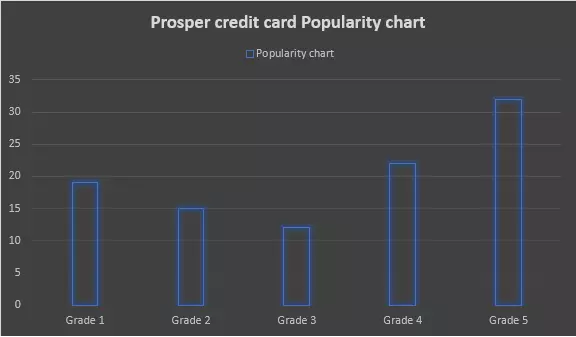

On average, credit card reviews show a distinct popularity chart in the population using it.

FAQ (Frequently Asked Questions)

What credit score does Prosper require?

Prosper credit card requires a Prosper score of a minimum of 640.

Does Prosper credit card report to credit bureaus?

Yes, Prosper credit card reports to all three major credit bureaus- Equifax, Experian, and TransUnion. It is thus a good way to build your credit scores.

How often does Prosper report to credit bureaus?

Every month your credit scores will get reported to the credit bureaus.

Conclusion

If you have a credit card with you, there is a lot less you need to think about now around building your credit scores. You must read more about the information given about the credit card in this article to get a complete picture of it before you apply.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![First Savings Credit Card Application [Simple & Quick Guide] First Savings credit card](https://kingapplication.com/wp-content/uploads/2022/05/First-Savings-credit-card-1-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)