The www.sss.gov.ph loan online application is meant to mitigate the monetary shortages of members.

There are different occasions during which one can apply for a loan from SSS as a member.

- SSS calamity loan: A loan facility for members who are facing some sort of calamity in their area

- SSS pension loan: Retired people in need of a pension loan can apply for the same with SSS.

- SSS online educational loan: If you have an online education ongoing for your child or yourself, you can go for this loan.

- SSS online emergency loan: Any ill-defined emergency can be tackled by the loan provisions they have towards the emergency loan.

- SSS salary loan: The salary loan is where a full-time worker or a business owner can apply for a loan as salary for one or two-month span.

The members can either take a one-month or a two-month loan from the SSS which is given in the form of a salary loan to the individual members.

For the one-month loan, the member will have to have 36 posted contributions out of which 6 must be done within the last 12 months.

For a two-month loan, the member must have done 72 posted contributions and six should be within the last 12 months. The loans are given at an interest rate of 10% per annum.

Page Contents

Steps for SSS Online Loan Application

To apply for the SSS online loan application, here’s what you must do.

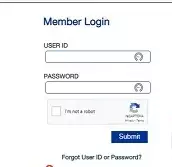

Step 1: Do a SSS online loan application member login by adding your username and password after clicking on the member tab.

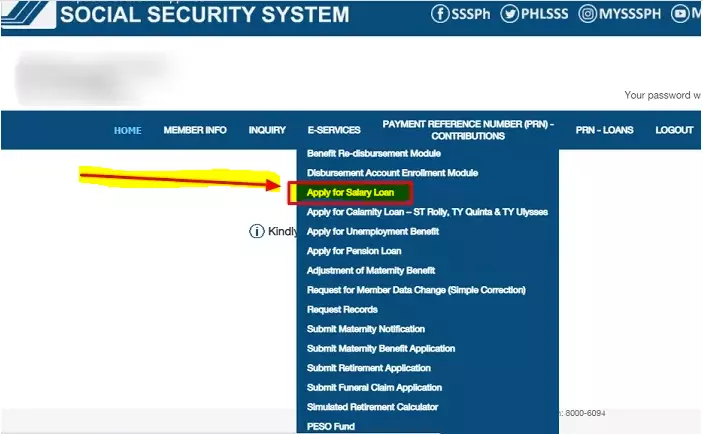

Step 2: Once you are inside, you must click on the e-services tab, and from the drop-down, press the Apply for Salary Loan option.

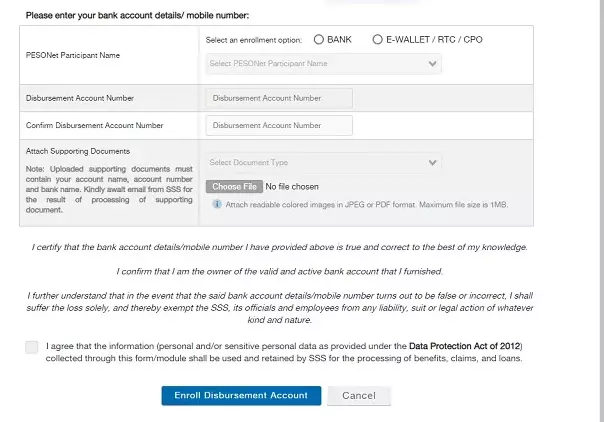

Step 3: Choose your preferred electronic loan disbursement method.

- Use PESONet-participating bank

- Press e-wallet/RTC/CPO

- UBP quick card that is issued by SSS.

Step 4: In the next step, you will be directed to the disbursement account enrolment module (DAEM) before proceeding through the application form.

Step 5: Enrol your bank account or your mobile number using the Disbursement account enrolment module.

Step 6: Once the disbursement enrolment is approved, you will be intimated about the same. You must wait for it until you receive the confirmation.

What are application requirements?

You can read the loan requirements in detail from this specific link.

However, you will need a few essential things without which you cannot file a loan application.

- Passport details and postal ID.

- Identity card of the professional regulation committee.

- Active driver’s license

- Tax identification number

- Senior citizen card/ voter ID card/ ATM card

- Seaman’s book

In all these online cards, one must have the cardholder’s name in it.

How to qualify for SSS loan?

To qualify for the SSS loan, you must check if you qualify and you only do so, if you can confirm the following points.

- Applicants need to be eligible members of their registered worker’s organization.

- They must also be valid members of the SSS.

- As a premium contribution, you must have made 36 premium contributions with 24 continuous contributions within the period that is before the application term.

- Members should not be more than 60 years old.

- They should have previously not been granted the SSS loan and must not have settled the SSS benefits.

How to check if SSS loan is approved online?

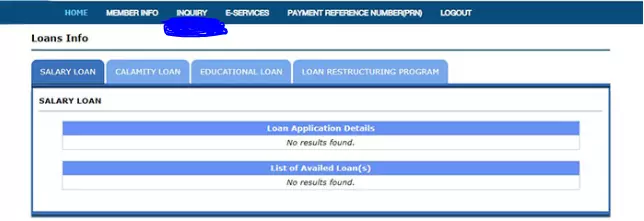

Step 1: Visit the www.sss.gov.ph site and then login to your profile.

Step 2: Move to the Inquiry tab, and from there choose the Loan information tab.

Step 3: In here, you can view your loan application details.

If you have a loan application detail, the application status will be visible in this segment.

How to check SSS loan balance online?

If you look at the last screenshot of the previous list, you will see that there is a list of available loans below the loan application details. If you have filed for a www.sss.gov.ph loan online application, you can check the balance from the available loan segment.

Also read: Finchoice Loan Application Online requirement, Eligibility

Conclusion

If you are a SSS member, and you want to apply for a loan with them, learn more about them from this article. If you have got stuck in any of the steps and need help with the application or the registration process, you can find the essential information from this segment.

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)

![African Bank Loan Application & Status [Complete Details] African bank loan](https://kingapplication.com/wp-content/uploads/2022/04/African-bank-loan--300x185.webp)

![Budgeting Loan Application Online [Complete Details] Budgeting loan application](https://kingapplication.com/wp-content/uploads/2022/05/Budgeting-loan-application-300x185.webp)

![Union Bank Quick Loan Application [Invite Code] Union bank quick loan](https://kingapplication.com/wp-content/uploads/2022/05/2-300x185.webp)