Sunoco credit card application is essential for those who want to apply for their credit card. If you are an applicant too, you can read this article to know more about credit card-related information.

Credit card is favored by those who are eager to save more on their fuel purchase. As Sunoco provides 25 cents off per gallon for the first 60 days from the time of your account opening, many flocks to their site to get this credit card.

Not only that, but people can also avail themselves of a lot of other benefits with this credit card apart from the one mentioned above. If you want to have the Sunoco Rewards credit card, you must be well-informed about the application process and requirements.

They not only offer the Rewards credit card, but also commercial credit cards.

Apart from it, you must also know more about a few essential features as mentioned in the table below.

| Annual Fees | $0 |

| Credit Limit | Based on your creditworthiness |

| Purchase APR | 26.49% variable |

| Balance Transfer APR | Not allowed |

| Cash advance APR | 29.95% |

| Minimum Required Credit Score | 640 or higher |

| Security Deposit | None |

Page Contents

Steps for Sunoco credit card application

There are three primary ways to apply for a Sunoco credit card.

- Online application

- Speaking to a call center executive

- Printed application form for Sunoco must be sent to a certain address

- For the online application process, you must use the process as given here.

Step 1: You can select one of the four options-

- Consumer: One must use it for personal purposes

- APlus Rewards: You can save while purchasing at APlus convenience stores

- Commercial: If you are applying for a corporation, you can go for this one.

- Grocery Rewards: To go for the rewards at a gas station, and if you already have a Shop n Save, Redner’s Warehouse, or Price Chopper card.

Visit the given website i.e www.sunoco.com/consumer-credit-cards to complete the application form.

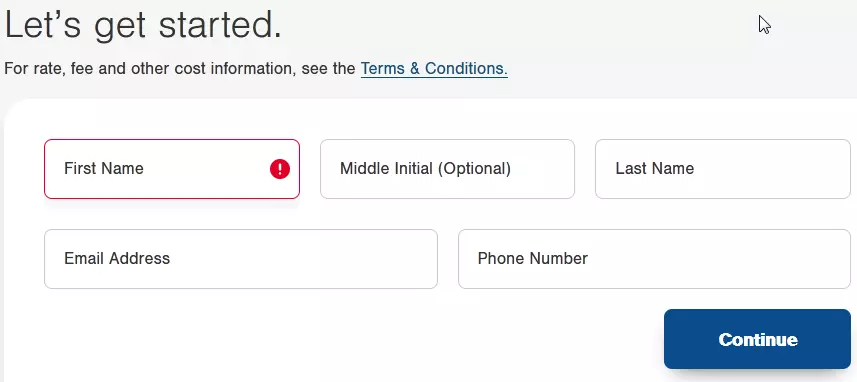

Step 2: In the first screen, fill in your name, email address, and phone number.

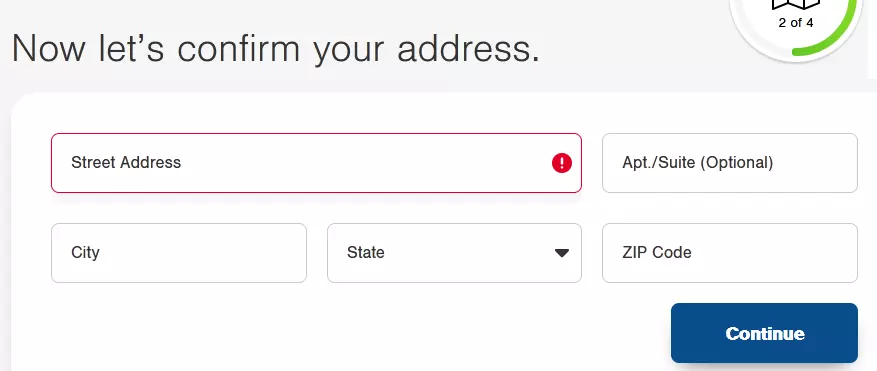

Step 2: For this step, add your entire address. It must be a whole address and not just a PO Box address.

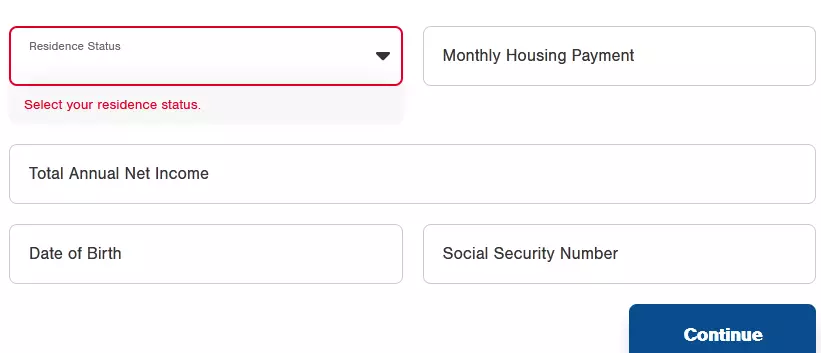

Step 3: Once you have filled in your address, you must now add up your housing details.

Include your resident status, monthly housing payment, net annual income, birth date, and social security number.

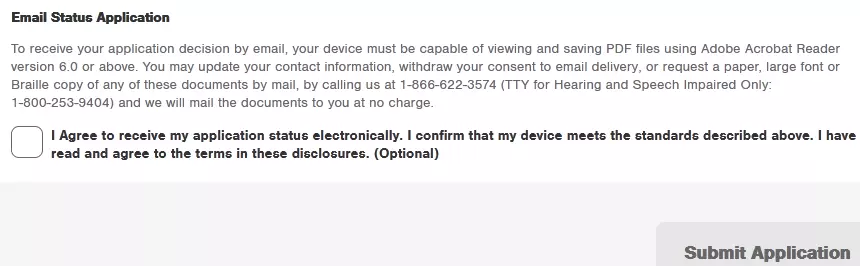

Step 4: Next review your information followed by the terms and conditions. Once you have reviewed it and agreed to the terms, press on the Submit tab to complete the application process.

- You can speak to a call center representative by calling 1-800-4SUNOCO or dial 1-800-478-6626. Tell them that you want to apply for their credit card application and complete the procedure.

- If you are not tech-savvy enough, you can get your printed-form version by visiting this link. Send it to the following address: 8111 Westchester Drive, Dallas, TX 75225.

What are the application requirements?

To apply, you need to fulfill these basic requirements.

- Add your SSN (social security number) which is a must for you.

- Include your address that should not be a PO Box address but instead a complete address.

- Incorporate your income details that ideally should be your annual income.

- You need to specify if you have the house on rent or if you own it by choosing the right option from your dropdown.

- Your credit score must be above 640.

Who is eligible for Sunoco Credit Card?

You will be eligible if you fulfill the below criteria.

- Be 18 years of age and above, ideally must be a major in your city.

- You must have US citizenship or you must be a permanent resident of one of the states in the US.

- Your date of birth, email address, and phone number should match the one present in your bank account.

Also read: Menards Credit Card Application:

Card Pros & Cons

Pros: The credit card has several pros that are following;

- No annual fee for owning a credit card.

- You will fetch discounts at the gas office and it can go up to 5 cents per gallon of gas.

- Along with your credit card, you can have cards even for your family.

- Within the first 60 days, you will get a discount of 4% per gallon, which is almost 10 cents and above every gallon.

Cons:

- Earning potential with a gas credit card is quite weak.

- APR is high and it can go as high as 26.49% variable rates.

FAQs

Where can you use your Sunoco credit card?

It is used in gas pumps and also inside their stores when using a credit card. You can use their app, website, or physical credit card. This is an in-store credit card and can be used only in their mentioned stores.

Does Sunoco take credit cards?

Yes, They take credit cards along with debit cards and also operate current and savings account transactions.

Conclusion

Applying for any of the Sunoco credit cards is easy and all you need to do is fill up their application form. Above all, meet the several requirements of the credit card and their eligibility before hitting the Apply button.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![First Savings Credit Card Application [Simple & Quick Guide] First Savings credit card](https://kingapplication.com/wp-content/uploads/2022/05/First-Savings-credit-card-1-300x185.webp)