Tangerine credit cards are available to Canadian citizens upon application.

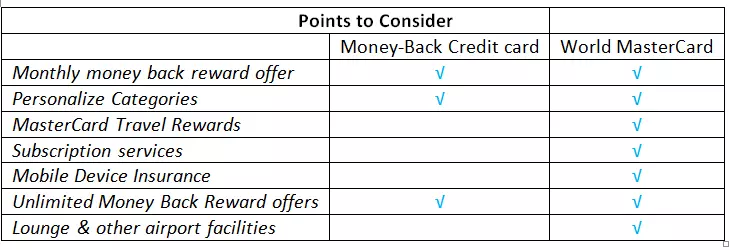

Tangerine is a bank with its headquarters in Canada. Any Canadian planning to have a credit card in their pocket that not only makes spending easy but also makes saving easier can apply for one of the two Tangerine credit cards- a World MasterCard and a money-back credit card. Each of these credit cards offers a separate repertoire of benefits. Each of these benefits makes life easier and fills pockets easily.

In the next few segments, you will know more about the credit card application process as well as other essentials related to your application.

Page Contents

How to apply for Tangerine credit card Application?

Applying for the Tangerine World MasterCard and the money-back credit card is possible by visiting their official website i.e. https://www.tangerine.ca/en/products/spending/creditcard

The process of application involves filling in the same set of information, thus, we would elaborate the further steps through the Tangerine MasterCard.

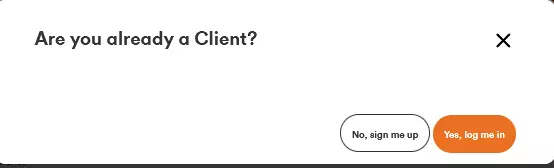

Step 1: The first pop-up that you need to address when you click on the Apply Now tab below the requirements segment of the World MasterCard in the given link, you will have to confirm if you are already a member of the Bank or if you want to become a member of the Bank.

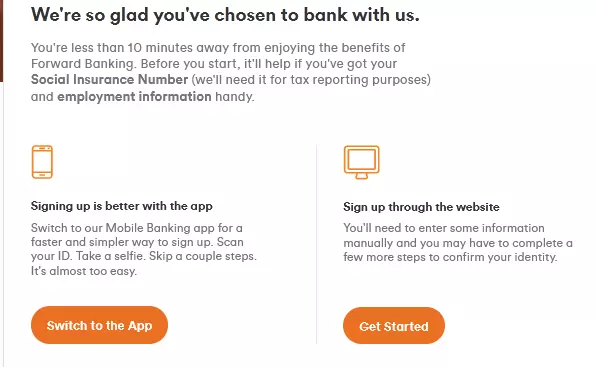

Step 2: If you are not, you will have to sign up for the site. Fill out a disclosure to choose between a mobile banking site, and their website.

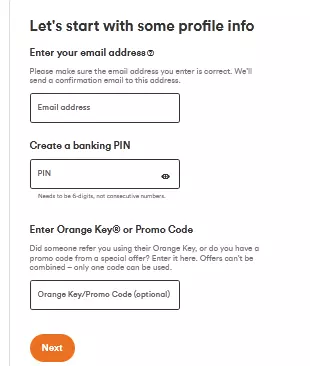

Step 3: Start the registration process by filling in the first set of information.

Add your email address, create a banking PIN and enter your Tangerine key or add the promo code, if you were sent one by someone close to you.

Step 4: Once you have filled in all the information in the short form that follows, you must submit it. A registration activation link will be sent to you and you must click on it to activate it.

Step 5: Now add all the essential details to your application form including your personal, professional, economic, and other related fields on the application form.

Tangerine credit card Requirements

On a general level, one must have the following requirements fulfilled.

- Social security details must be added

- Employment details need to be specified.

- Financial information must be declared including the debts and assets.

For a Tangerine MasterCard, you must fulfill one of the below requirements.

- Your gross household income must be one lakh or more.

- If your gross annual income is more than $60,000, you can apply for a credit card.

- You can also avail of the credit card if your Tangerine account balance is $250,000 or more at the time of application.

For a Tangerine money-back credit card, you should be able to show a gross annual income of $12000 or even more as your account balance.

Who is eligible?

Eligibility for the Tangerine credit card application includes the three below-mentioned criteria.

- Anyone applying for a Tangerine card must be a major in their territory or province.

- There should be no reported issues of bankruptcies in the last 7 years of their livelihood.

- One must be a permanent resident of Canada if one wants to apply for a credit card.

- For both credit cards, applying for them means earning a gross of $12000 towards one’s income.

- One must have a credit score of 600.

Also read: ExxonMobil credit card Application – Who is Eligible for it?

PROS

- There is no annual fee associated with your Tangerine credit cards.

- You get the cashback amounts monthly instead of yearly payouts.

- The credit card offers a special welcome offer occasionally and provides you with extra cashback.

- Balance transfers only require 1.95% as an interest rate with a 1% applied transfer fee.

- Cashback amount is not a restricted amount and credit cards also do not have any maximum spending limits.

- From the spending options available, you must choose anyone in which you want to win cashback.

CONS

- They are not a good fit for wholesale groceries and warehouse clubs.

- You will have to manage everything online as there are no physical Tangerine bank branches.

- Beyond cash back and promotion of balance transfers, you do not have a supply of unlimited perks.

- Regular cash-back rates are lower compared to credit cards with an annual fee.

Tangerine credit card FAQs

Does Tangerine credit card have travel insurance?

Yes, the Tangerine credit card is eligible for travel medical insurance benefits. If you require medical attention while traveling, you can opt for it by using this credit card. Healthcare outside Canada is costly and hence, Tangerine’s credit card can be a timely intervention.

Is Tangerine credit card hard to get?

The MasterCard requirements might make it slightly difficult to obtain but the money-back credit card is easier in comparison as it has lesser requirements to fulfill.

Conclusion

Here are a few details about the Tangerine credit card for those who want to apply for it. If you plan to go for it, read all about the credit cards from here, and since with Tangerine, you cannot visit a brick-and-mortar bank, you need to do everything online. Hence, knowing the process well is essential and thus reading the blog will help you immensely.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![First Savings Credit Card Application [Simple & Quick Guide] First Savings credit card](https://kingapplication.com/wp-content/uploads/2022/05/First-Savings-credit-card-1-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)