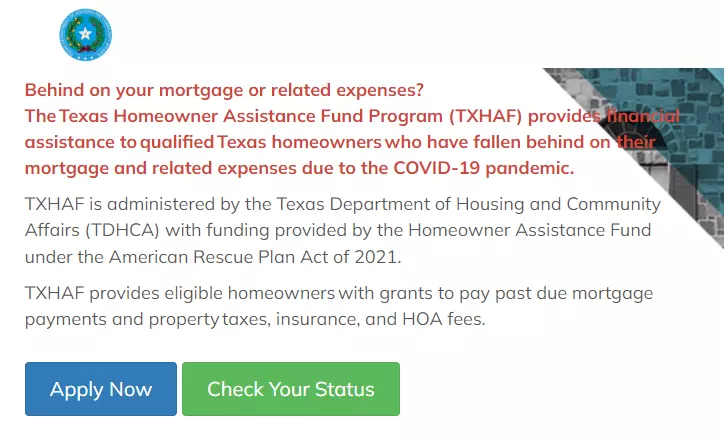

The Texas homeowner assistance fund program is one of those few programs that are trying to help pay mortgages of people who are way behind at it. All thanks to COVID-19, the assistance program is built to help those who could not try paying off their mortgage loans during this span.

You can use the amount not just for paying your Texas homeowner assistance fund program but to clear off property taxes, insurance, and HOA payments. You can also use it to pay for the condo association fees and the housing department and community affairs of Texas are handling the program.

The program is offering $840 million and those having mortgages due up to $40,000 can clear it by applying with them. If it’s not mortgages but other kinds of taxes then you can ask for $25000.

Page Contents

Texas Homeowner Assistance Fund 2023 Application

Step 1- To apply, you must go to the TXHAF website.

Step 2- Next you need to click on Apply Now Button Given there.

Step 3- Once you click on the application tab, you will need to fill in all the details in the form.

Step 4- Your personal, professional, income, and job-related details must be filled in wherever prompted.

Step 5- For more information, you can also contact them at 1-833-651-3874. They are available from Monday to Friday 8 am-6 pm CST.

Who is eligible?

If you meet any of the following said criteria, you can apply for the Texas Homeowner assistance fund.

- If you have not successfully given off your loan amounts and mortgages.

- For applying to this program, you need to live in Texas.

- You must be earning less than the US median income of $79,000 or as per your Area’s median income, whichever stands greater.

What are the application requirements?

Apart from fulfilling the above eligibility criteria, you must also fulfill the different application requirements. It includes;

- Your family or as an individual, you underwent financial hardships after the 21st of January, 2020 during COVID-19.

- You must have your bills and income details with you.

Benefits

The monetary benefits from the THAF help people take care of their loans, mortgages, taxes, or even insurance. Payment assistance is also provided for delinquent properties and this is a way to make the most of the amount you can receive from them

Conclusion

If there is some mortgage or other amounts unpaid due to COVID-19, try to take the help of THAF to pay off your loans and mortgages.