If you have a poor or zero credit score and think of having a credit card for yourself, try Tomo. Read the information about Tomo credit cards given below for more details.

The Tomo Credit card is put forth by a start-up company called Tomo Credit, based in San Francisco. People with FICO scores below 629 are considered to have poor credit scores. Even those with no credit scores can attempt to use this card. The card will allow for bettering credit scores, and the best part is, the card has no annual fee or APR, plus there are no security deposits to worry about.

Page Contents

Steps for Tomo credit card application

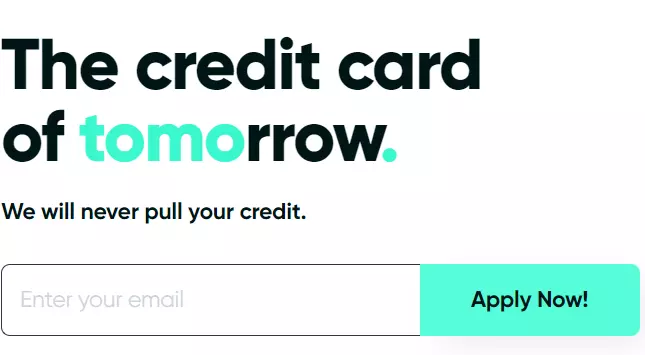

Visit the site tomocredit.com for more information.

- Add your email ID to start the application process.

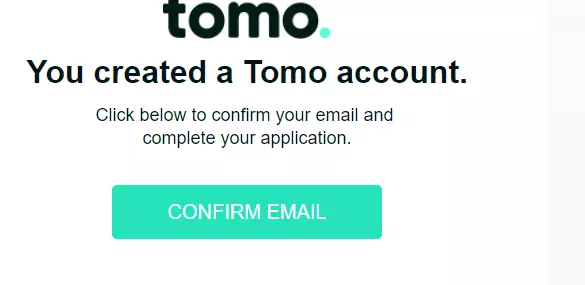

- You will be emailed a link that you need to click to start the application process.

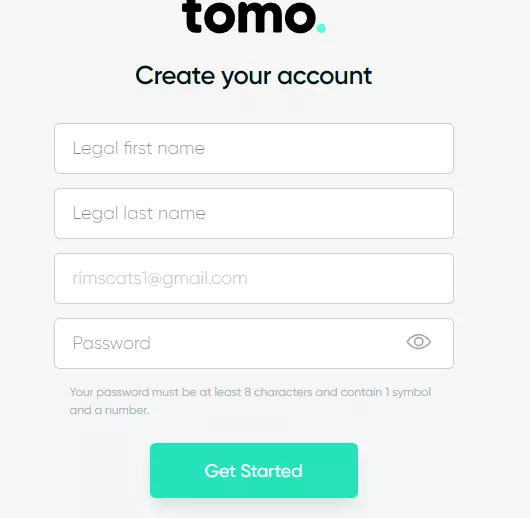

- Create your account if you don’t have one.

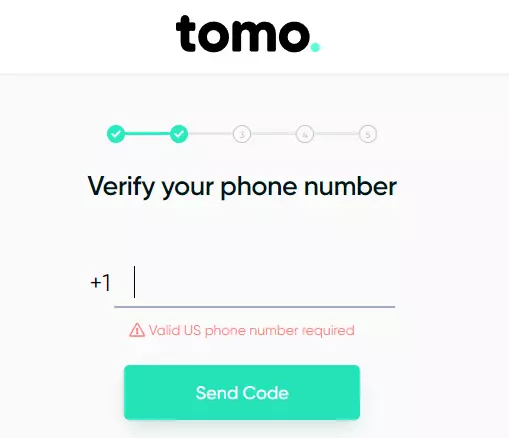

- Start the application immediately by adding a valid US phone number.

- Complete the next steps and then submit the application form.

What are the Requirements?

You need a valid mail ID and a telephone number.

A bank account number, a government-issued ID card, and a driver’s license are essential for filling up the application form. The company might ask for income proofs at some point in their verification, so keep them handy.

Eligibility

Eligibility is just two points you might need to consider.

- You must be a US citizen but, you can live in other nations.

- A social security number or ITIN is a must, no matter which country you stay in.

- To get a credit card, you must be 18 years and above.

- You must be working and should be able to prove it.

Annual Fees

There are no annual charges, and the best part of the card is that you do not need to be given an APR for it as well.

Also read: How Often can you Apply for a Credit Card [Latest Guide]

How to get pre-approval For Tomo Card?

The Tomo card has a pre-approval process, and you can always check if the company pre-approves you. Pre-approval means a Yes from the company that thinks you might be eligible for the credit card.

So go ahead, and add the following to the site;

- Your age

- Bank account balance

- Income level

A mail will come to your email ID to fill out the form, and it will be a welcome mail from them. The invitation will include the link to complete the application process.

Is Tomo credit legit?

The Tomo credit card is legitimate and issued keeping everything in order. They also have appropriate confirmations and orders to go ahead with the application process. There is nothing that you need to worry about when applying with them. The credit card issued by them works like a normal credit card, and it’s all a very simple process.

Conclusion

If you are searching for a credit card with zero annual fees and APR, and absolutely no fear about a credit score, you can then take up the Tomo credit card. While you want to apply for the Tomo credit card, you must read this blog that enlightens those who want to apply for the card.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)