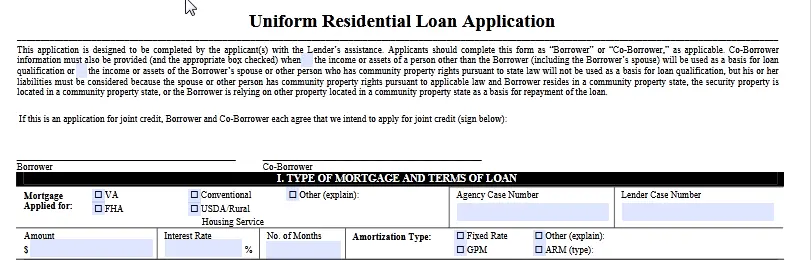

The Uniform Residential loan application or Form 1003, alternately known as the Fannie Mae form is a mortgage form primarily. Anyone interested in taking up a mortgage loan has to fill out this form. This form is the beginning of a mortgage process between a lender and a borrower. There are many lenders who, however, use a different set of forms but mostly all of them use this form for the commencement of a mortgage loan process.

It is a form that individuals need to fill out twice- once at the beginning of the mortgage loan and another time at the end of the mortgage loan. Individuals interested in taking the loan must fill it out twice to avoid any kind of discrepancy from appearing in the information that is provided by them for the mortgage process.

Page Contents

Steps for uniform residential Loan Application

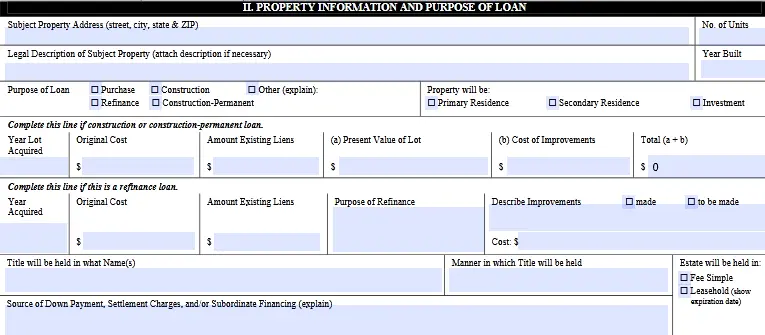

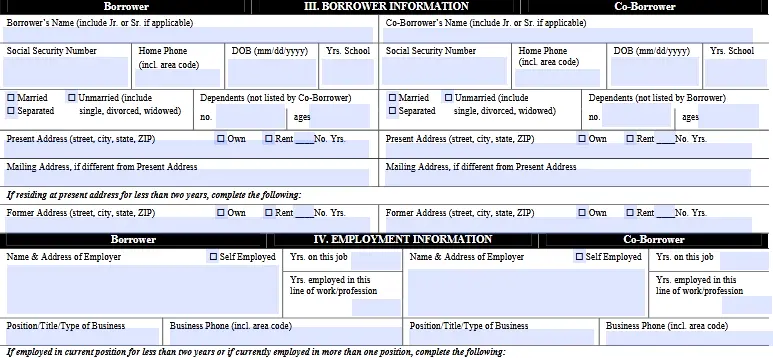

The Uniform Residential loan application is supposed to take down all essential information about the borrower concerning the mortgage loan.

The information about the borrower needs to go into the application.

- Employment-related information

- Household income, assets (anything that can recover loan payments like life insurance policies, savings & checking accounts, stocks, mutual funds, bonds, IRA, 401 (k)), and also liabilities.

- Any other debt on the borrower like card, credit card, student debt, and anything similar to it.

- If you have any other home or flat, that too needs to be declared to the lender.

There are a total of 9 sections and each of these sections needs to be filled. These sections will pertain to the following parts;

- Information about the borrower

- Assets & liabilities related financial details

- Real estate related financial information

- Property & loan relation details

- Declarations

- Acknowledgments and agreements

- Details about military service if any

- Demographic details

- Information about the loan originator.

If you want to find out more about the application form columns, here is the link to the form.

Fact Check

- On 01st March 2021, the need to use the new redesigned form was authorized.

- From 01st March 2022, legacy formats using the new application will no longer have an underwriting by Fannie or Freddie Mae.

What are the application requirements?

The application requirements, in this case, will be related to information that you need to provide to the lender following the policies put in place by the Federal government. You will need to inform them more about the following documents and essential information.

- Property and financial information like details about you have that can compensate the loan amount if and when needed.

- Rental details

- Employment-related information like monthly and annual income

- Household’s income details

- SSN

- Any specific government-issued photo identification card

Also read: Are Parent Plus Loans Eligible for PSLF?

Who is eligible?

Eligibility requirements for the borrower involve fulfilling the following conditions.

- The age of the borrower has to be above 18-years.

- The person must be a resident of a particular state where they are submitting their application.

- They need to have a valid checking or saving account number

- Complete residential address, phone number, and a valid email address are a must.

How to fill out uniform residential loan application?

Apart from the nine normal segments, you will also have to fill out a few newly added segments like your rental amount per month, and a few other tidbits. The borrower and the co-borrower if any can fill the form before getting the mortgage and after getting it.

Benefits

The benefits of the form include making a vivid introductory opportunity for the borrower available.

Apart from that, the form allows transparency and inclusion of modern-day employment criteria segregation like the gig economy culture. Also, benefits will further include easy compliance with the demographic data as per the 2018 HMDA inclusion.

Also read: SAL Loan Application Online Process Complete Details

FAQs (Frequently Asked Questions)

How many sections in 1003 uniform residential loan application?

A total of 9 crucial sections one must fill up and another 10th section where you must add all related information.

What is the purpose of the uniform residential loan application?

The purpose of the loan application is to bring clarity to the lenders about their borrowers. Based on this information, lenders sell their closed loans to either the Federal National Mortgage Association (Fannie Mae) or the Federal Home Loan Mortgage Corporation (Freddie Mac).

Who has developed the uniform residential loan application?

It is a document that is generally developed for the welfare of lenders and borrowers. It is a document that follows and lays down the Federal laws regarding a mortgage for the lender as well as the borrower.

Conclusion

If you are interested in borrowing a mortgage, and you have heard about Form 1003, you must read more about the form here. Once you develop an understanding of the form and its use, you can go ahead and fill it.