If you are a US federal job holder or work for the state, local or tribal government, and if you are with a non-profit organization, you can apply for the Public Service Loan Forgiveness program. With the PSLF program, you can get forgiven the loan’s balance. But to qualify, you must have made 120 monthly payments in the process. All this has to be done while you are working full-time for an employer who qualifies for the scheme.

Page Contents

What is Public Service Loan forgiveness?

Loans are an integral part of a student’s life and when one takes a loan they need to repay it. However, if someone has already made 10 years of repayments, you can get pardoned of your debts or loans that you took.

This provision is made to help people who are in jobs that are low-paying. Usually, the COVID-19 pandemic has led to some alterations like;

- All student loans have undergone forbearance and no payments are due through 31st August 2022.

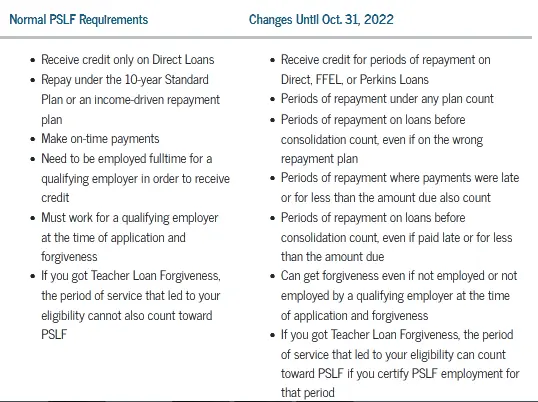

- There is a restricted limitation in waivers through October 2022 for those who have a PSLF for themselves.

The waivers mean that now you could get pardoned for a broader loan range.

Who is Eligible for PSLF Waiver Application?

- Those who work for one or two employers for a period of 30 hours can apply.

- If you are in a standard repayment plan, they qualify for the payment. Those who make payments through the income-driven plan do not fall under PSLF but with the new reforms during the Trump administration made in March 2018, they might still qualify.

- Those who have made 120 payments must make it with the following clauses fulfilled;

- Make payments towards the complete amount due.

- Payments must be made within a fortnight from the due date.

- Those loans are taken in 2007 or after that period.

- You need to do the repayments when you are working for a qualified employer and on a repayment plan.

You must also submit a Public Service Loan Forgiveness application while working full-time for your employee.

PSLF waiver application Online Process

The application process is a lengthy one spread into five distinct steps.

- Understand your current loan situation by finding out how or where you stand.

You could use the Department of Education’s Federal Student Aid website or instead, PSLF Help Tool to count the number of installments you paid and the amount you are still due.

- Before you move ahead with your loans, consolidate them. You will need to fill out the Federal Direct Consolidation Loan Application and Promissory Note to complete the consolidation process.

- Next, fill out the employment certification form online and every year before October, you need to fill out this form. Send it to FedLoan, the wing that currently looks after the overseas PSLF.

- After you are done with the last three steps, complete your paperwork and submit it.

Most people do not know about it and that’s why do not go for it. But if more and more people go for it, there are chances they too can get the benefits.

| Conditions to fulfill | What you should do |

| If you have direct loans but did not fill a PSLF form earlier | Fill out the form and submit by 31st October 2022 |

| When you have a direct loan and you already filled out a PSLF form with all previous qualifying employment | Keep submitting a PSLF each year. |

| For FEEL programs, Perkins loans, and other federal loans. | Fill Direct Consolidation Loan application by 31st October 2022. |

| Those who have multiple periods of employment that qualify | For each of the qualified employers, fill out a PSLF form |

Also Read: How to get Utility Assistance?

What are the Application Requirements?

- You must have already paid 10 years of dues or roughly 120 payments of your loans must be already paid out.

- To get the benefits of the PSLF waiver, you must be working in a low-paying occupation or job.

- Working full time is also essential.

- You will need to complete an employment certification form to ensure your employer qualifies.

- It is mandatory that your employer qualifies for the PSLF waiver. To be so, an employer must fall under one of these categories;

- 501(c)(3) nonprofit organizations

- Federal, state, or any other sort of government organization.

- The ones that work with Peace Corps and AmeriCorps.

- Those who work with a religious organization.

- The non-profit organizations that do not fulfill the 501(c) (3) status but qualify for public service as their primary goal.

FAQs

How long does it take to be approved for PSLF?

PSLF takes almost 3-4 months to get approved mostly.

How to check PSLF Waiver Application Status?

To check the PSLF waiver application status, you will get an email or letter. It will prompt you to the actions you need to take from your end. Read your email or letter and log into your FedLoan borrower’s portal to check your status.

Conclusion

Here is what you must know about the PSLF and to understand more, find out the details from this article.

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)

![Budgeting Loan Application Online [Complete Details] Budgeting loan application](https://kingapplication.com/wp-content/uploads/2022/05/Budgeting-loan-application-300x185.webp)

![African Bank Loan Application & Status [Complete Details] African bank loan](https://kingapplication.com/wp-content/uploads/2022/04/African-bank-loan--300x185.webp)