The Oportun credit card is a globally accredited credit card that is just not innovative but also quite flexible in approach. Those who do not have a credit history can apply for this credit card and build a credit score with it. The reason is that Oportun reports to all the three credit bureaus like TransUnion, Experian, and Equifax.

The credit card is, however, not available in some of the US states like Maryland, Iowa, Washington D.C, Wisconsin, West Virginia, and Colorado until this day.

The credit card does not require a bank account or a social security number and that is what sets you apart from the rest of the available credit cards.

Page Contents

How to do Oportun credit card Login?

The Oportun credit card is one of the best and creating an account with them is the first step towards a long and happy relationship.

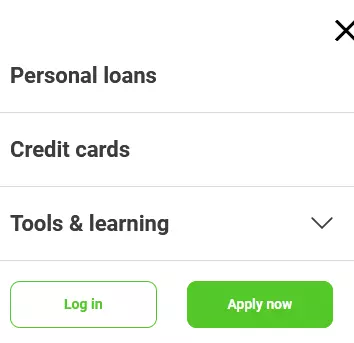

Step 1: Visit the website i.e https://oportun.com/credit-cards/ and click on the login tab.

Step 2: In the next step, you must choose a credit card from the option list that includes personal loan applications, personal loan customers, and credit cards.

Step 3: Add your username and password and complete the sign-in process.

Step 4: You can also do registration with the site if you do not already have an account.

Step 5: Add all the essential details like name, address, SSN, and birth date to complete the registration process. Click on the Register tab once you are done filling it up.

How to pay Oportun Credit card Bill Payment?

Paying the Oportun credit card bill requires fulfilling the following steps;

- Login to your account and then visit the Payment tab.

- Once you are in the Payment tab, you need to add your billing details like your billing amount.

- It mostly does not accept debit cards but instead, current account details or credit cards.

- After filling in your credit card or your current account details, you can click on the Pay tab to complete the Payment process.

Interest Rate & Late Fees

Several people are bothered about late fees and interest rates and since it is a globally accredited credit card, the fee structure is slightly different.

The cash advance APR is 24.90 to 29.90%.

There is a maximum late fee that you must pay and that is $35.

Interest rates vary as per the set APR and the daily interest rates.

How to cancel the Oportun credit card?

To cancel the credit card application process, you need to call 833-OPORTUN (833-676-7886).

If you already have an Oportun credit card, you need to call (855) 613-0070.

Also read: How to do Sears Credit Card Login & Make Bill Payment Online?

Customer Service Number

The customer Service Number is (855) 613-0070. You can also text their bot (650)-425-3419.

FAQs

Can you pay Oportun online?

Yes, you can pay your Oportun card bill online.

Does Oportun help your credit?

Yes, it does help increase your credit scores as regular payment of your credit bills can make your credit scores go higher if you are based in the United States.

What is the Oportun credit card mailing address?

If you want to mail your payment, then you must use the following mailing address;

PO Box 4085

Menlo Park, CA 94026

Conclusion

Here’s a bit about the way you can login to your Oportun credit card. Additionally, you can know more about the payment details and also know a bit more about the other intact processes with the Oportun.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![First Savings Credit Card Application [Simple & Quick Guide] First Savings credit card](https://kingapplication.com/wp-content/uploads/2022/05/First-Savings-credit-card-1-300x185.webp)