Big Lots credit card is issued by Comenity Capital Bank and comes under the category of a store credit card. You can use this card anywhere and save your money. Many people have already bought their card and if you want to apply for your Big Lots card then read the article. Also, make sure you are well aware of their pros and cons before applying.

So now, without any further ado, let us get into the application process.

Page Contents

Steps for Big Lots Credit Card Application

Having your own credit card is not a difficult process these days. You can apply for your credit card on your phone or desktop. All you have to do is visit their official website and fill out the application form. Let us see how it is done in a stepwise manner.

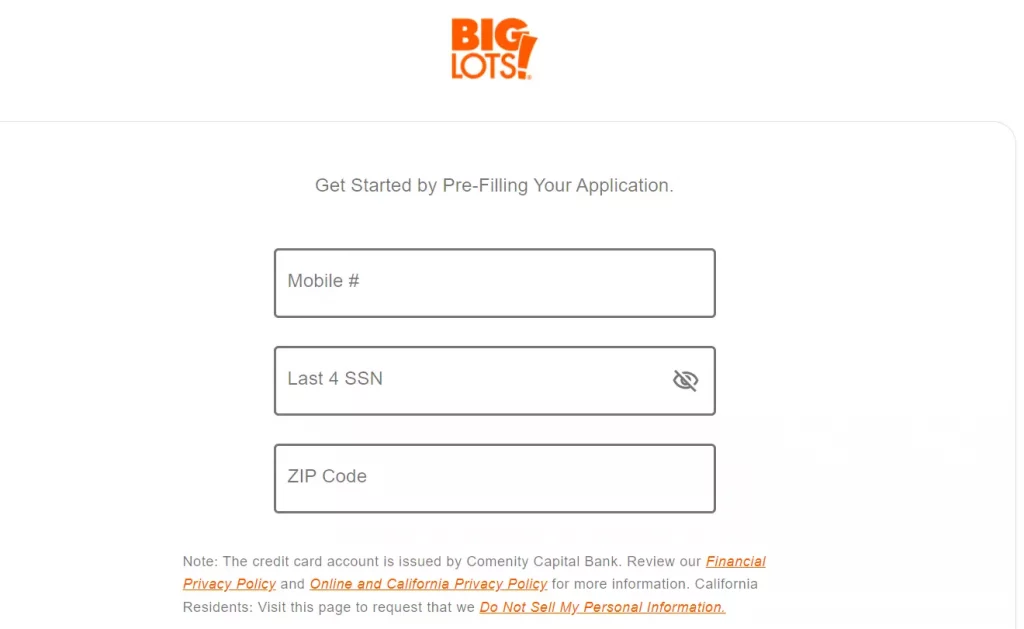

Step 1: Open the browser on your phone or desktop, and search for the Big Lots application. You can also click here https://acquire1.comenity.net/?clientName=biglots, and you will be redirected to the application page.

Step 2: Click on the apply now button and fill in the information.

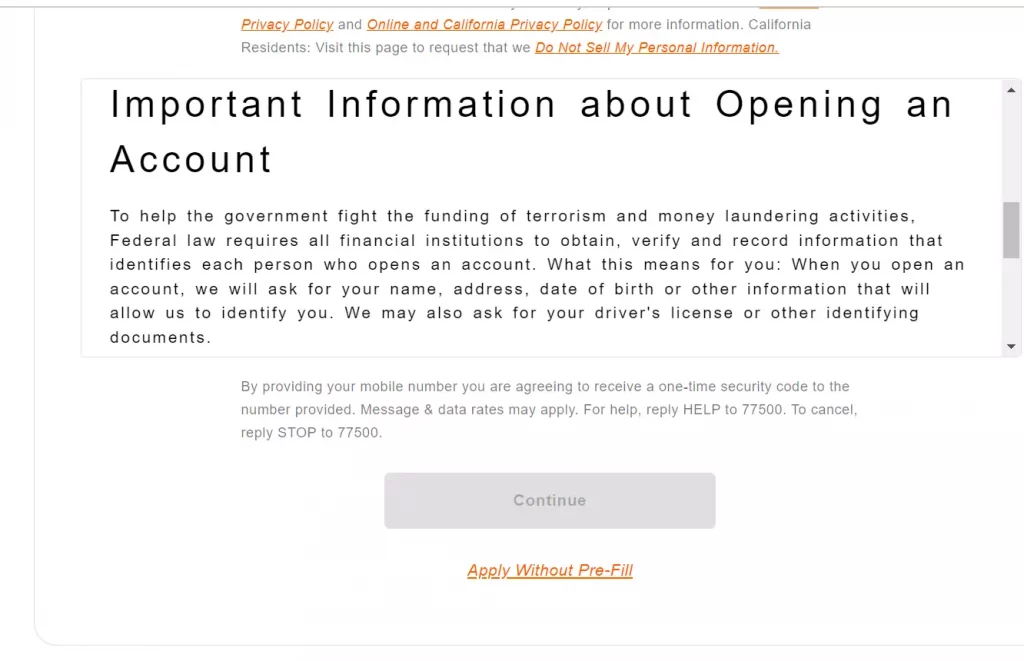

Step 3: Once you are done filling in your information, click continue. (Read all the points that are mentioned in the form carefully)

Now you can click on the apply now button, and you can see you are done with the application process.

Also Check:- How to do Big Lots Credit card login & Pay Bill Payment Online?

What are the application Requirements?

All that is needed to apply for a Big Lots credit card is your basic yet detailed information. The whole purpose behind the application process is to know the person and create an individual identity or account of that person. So the information that is needed to apply for a credit card revolves just around such factors. Here is the list of things that you should have.

- Personal information: Name, Email ID, and contact number.

- Financial information: Your Income details and SSN, SIN.

- Residential details: City, state, and zip code. (make sure you do not submit your PO BOX mailing address).

- Government ID: You need Government ID proof, and it must have your photo on it.

Who is Eligible?

Anyone who has a credit score above 640 is considered eligible to apply for Big lots card. You will also need to fill in the right details about yourself in the form. The requirements for filling the application are already mentioned above. Apart from these, you must make sure that you are above 18 years of age, and you are earning, or we can say a financially stable person.

Annual Fees & Credit Limit

Big Lots cards are one of the most economical cards that you can find in today’s market. You do not have to pay any annual fees, no APR on a new purchase, and no penalty APR charges. Also, you get a decent credit limit and if you are having a high credit score you can definitely increase your credit limits. Overall, this credit card is very economical and rewarding for its users.

PROS & CONS

Here are some of the major advantages of using Big lots card over other credit cards

Pros.

- 0% APR on new purchases for up to 2 years.

- 0% annual fees.

- No Variable APR is applicable.

- Exclusive offers.

- Reports to multiple bureaus.

Cons

- High APR of almost 30%

- No welcome bonus

- No Reward points and cash backs

FAQs

What bank do big lots of credit cards use?

Big Lots credit card is issued by Comenity Capital bank.

Can I use my big lots credit card anywhere?

Yes, it is involved in a huge network of credit cards. So you can use this car almost everywhere.

Do big lots of credit cards report to credit bureaus?

Yes, this credit card reports to multiple credit bureaus.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)