Walmart offers a credit card that functions more like a reward card with rewards that primarily include cash backs.

There are several benefits that come with the Walmart credit card.

- You get security alerts

- There is the Capital One mobile app for you

- You will also have zero fraud liability on your credit card purchases

- Locking your credit card is easy.

You can also get pre-approved for your credit card and the process of preapproval and application is described below.

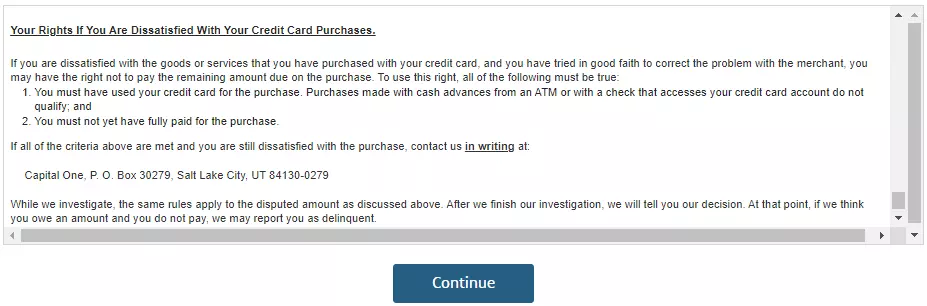

Check this list of important credit card-related points from here.

| Notable Credit Card Features | Walmart Rewards Mastercard | Walmart store credit card |

| Annual Fees | $0 | $0 |

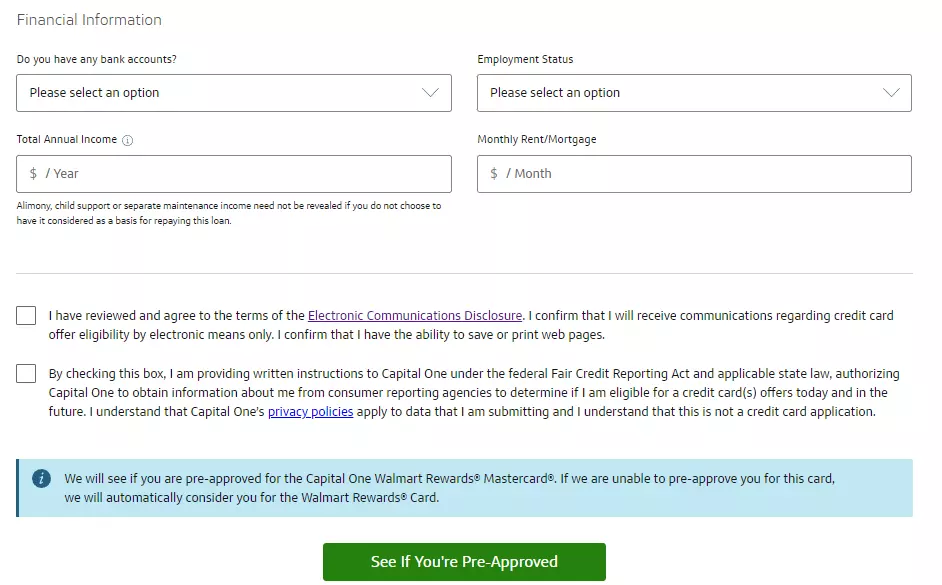

| Purchase APR | 17.99% – 26.99% variable APR | 26.99% (variable) |

| Balance Transfer APR | 3% of each transferred amount & no transfer fee for this APR rate:17.99% – 26.99% | 3% of each transferred amount & 0 for the balance transferred at the transfer APR rate |

| Minimum credit limit | Based on the worth of your credit | Depends on your creditworthiness |

| Foreign transaction fee | None | No |

Page Contents

Walmart credit card Pre-approval process

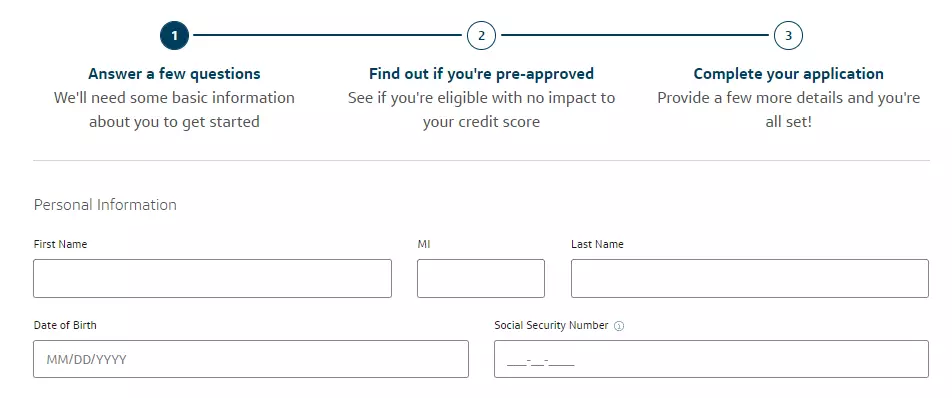

The Walmart pre-approval process is available online and can be reached using their official website.

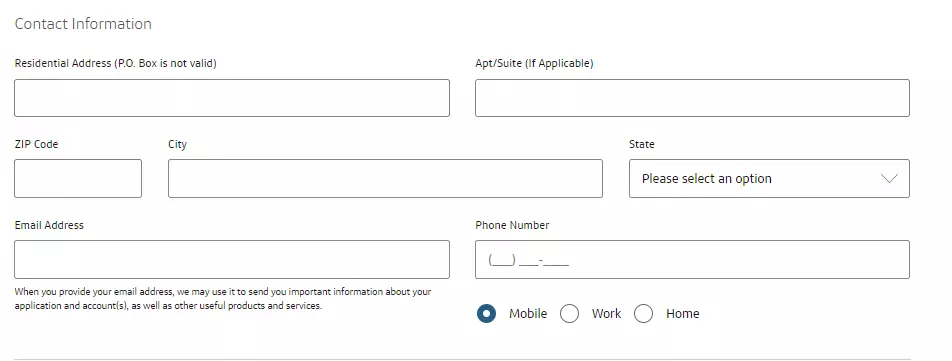

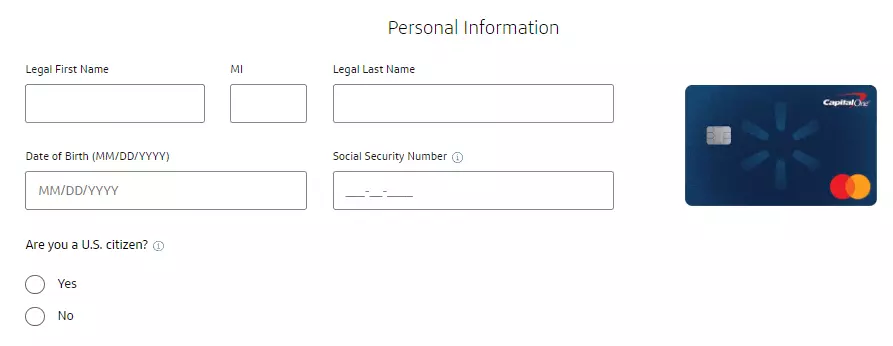

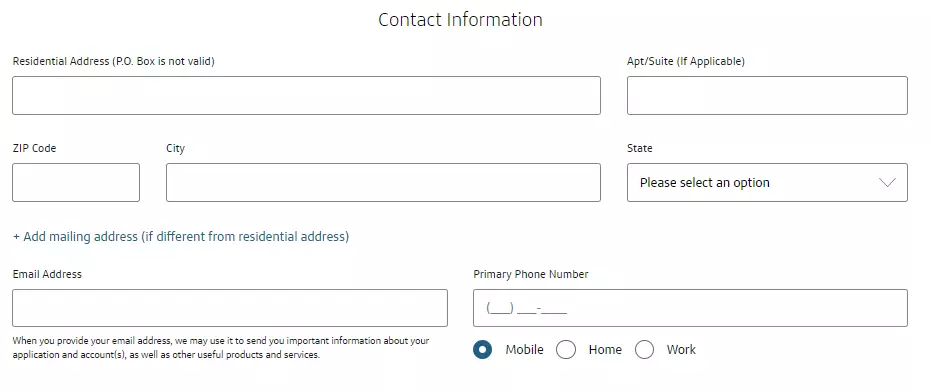

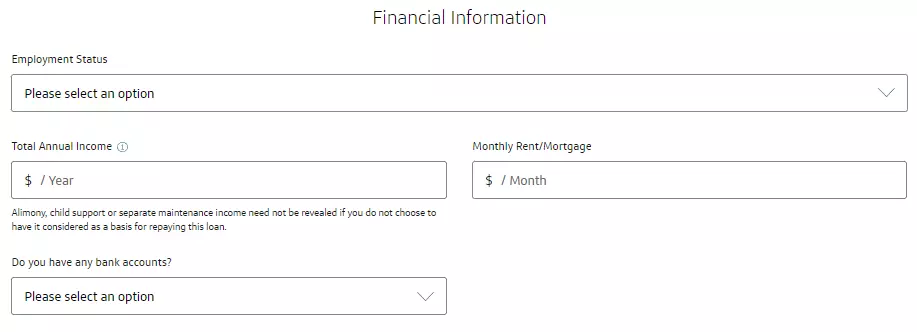

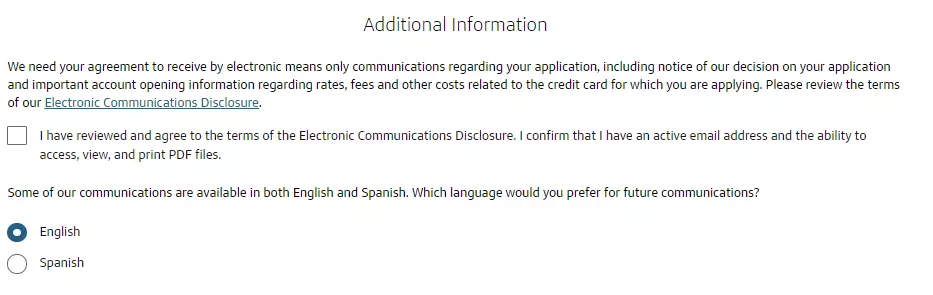

Answer your personal, contact, and financial information and check on the appropriate checkboxes to confirm their terms.

Once done, click on the pre-approval checkbox.

If you are pre-approved, the pre-approval email will be sent to you. It will contain a reservation number and also an access code that you will have to include in your application. However, even if you are pre-approved, it does not necessarily mean that you will get the credit card for sure. It simply means that you can go ahead and send in your application to them.

How to apply for Walmart credit card with bad credit?

Walmart needs a 640+ credit score for those who want to send in their application form. They will also look at your income when you apply for their credit card apart from your credit score.

However, before you apply for a walmart credit card application, these are the things that you can do to get a credit card.

- Pay your credit card bills on time.

- Use a secured credit card to improve your credit scores.

- Use as less as 30% of the credit is made available to you.

- Pay your debts on time to reduce them

- Monitor your credit scores regularly and once it is above 640+, go ahead and apply for it.

To apply, once pre-approved, you must follow the below process.

Step 1: First, visit their official website www.walmart.com/cp/walmart-credit-card/632402. After you visit locate the “Apply now” button given there. Tap the continue to my application tab, you will be taken to the main application page from the page where the Mastercard fees are depicted.

Step 2: Fill in the personal information which includes your first and last name, birth date, and social security number, and also verify if you are a US citizen.

Step 3: In the next section, put up your contact information you must include your complete residential address with your email address and phone number.

Step 4: Incorporate your financial information in the next segment which will include your current employment status, total annual income, monthly rent amount, and also if you have a bank account.

Step 5: Read and check the additional information segment and then check the appropriate boxes.

Step 6: Press the continue tab to review your application details and submit them.

Walmart credit card application requirements

The credit card application requires one to satisfy the following;

- The applicant needs to have a 640+ credit score.

- Your monthly income should be a minimum of $425 more than the monthly housing payment one does towards their house.

- You must carry a valid SSN or a government-approved ID with a photo like your tax ID card.

Who is eligible?

Eligibility for the Walmart credit card includes;

- You need to be at least 18 years old to apply for it.

- A physical US address is a must when applying for a credit card.

How to check Walmart credit card application status?

Walmart store credit card: You can obtain information online or by calling 1-877-969-3668 about the card.

Walmart MasterCard: The applicant needs to check the MasterCard application online by logging into their Walmart account.

Also read: Kohls credit card Login & Pay Bill Payment [increase credit limit]

Card Benefits

The benefits are the same for both the credit cards from Walmart except that the store credit card can be used only in stores and the Mastercard can be used wherever it’s accepted.

| Walmart MasterCard |

| 5% introductory offer on purchases made in Walmart stores |

| Zero annual fees |

| 2% cashback in Walmart stores and restaurants |

| 5% cashback for online Walmart purchases |

| At Murphy and Walmart fuel stations, you get 2% cashback |

| No foreign transaction fee |

| Rewards can be redeemed for cash back, statement credits, and current purchases, along with that with travel and also on gift cards |

FAQ (Frequently Asked Questions)

Can a Walmart credit card be used anywhere?

The store credit card can be used only in their stores, however, the Walmart Mastercard can be accepted anywhere and everywhere.

Is Walmart credit card interest-free for 12 months?

Yes, the card accrues no interest during the first six or twelve-month period.

Can you have 2 Walmart credit cards?

Yes, you can take two credit cards from them. It means you can take their store card as well as their MasterCard but you cannot take two of the same card type.

Does Walmart credit card give instant approval?

Typically, you will get approval for their credit card instantly and if not at least on the same day.

What are Approval odds?

If you fulfill all the eligibility criteria and requirements, the chances of your approval odds are high.

Conclusion

To conclude, we can say that Walmart credit cards are a convenient way to shop at Walmart. This article is all about the application process, pre-approval, and requirements for shopping from Walmart. Additionally, we also touch upon a lot of important points through this article that must be known when applying for a credit card.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)