Offered by New Day Limited, Fluid credit card offers a good balance transfer credit card. A trademark of another company called TM Connect Limited Fluid works as a registered credit broker for the New Day in the United Kingdom. Once you take the credit card, you will also be able to create and access an online account.

The minimal requirement for the credit card is UK citizenship with a minimum age of the customer being 18. The credit card is open to new as well as old customers. You must not have a CCJ against your name and should not have been declared bankrupt in the past 18 months. You also should be connected to a source of income either through employment with others or through self-employment.

If you are eligible and have taken up the credit card, create an online account for yourself in the process. To operate the online account, you must know the login process and must, therefore, read the article given below.

| Essential Features | Fluid card |

| Late Payment Fee | £12 |

| Returned Payment Fee | Nil |

| Interest & Purchase APR | 34.94% (variable) |

| Cardholder Fee | NA |

| Cash Withdrawal Fee | 3% |

| Grace Period | 51 days |

| Balance Transfer APR | 4% in first 9 months followed by 5% in the following months |

| Foreign transaction fee | 2.95% (everywhere in the world) |

Page Contents

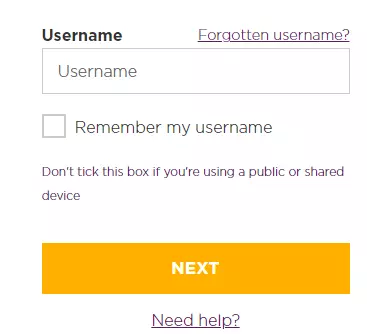

How to do Fluid credit card login

Step 1- The Fluid credit card login is possible by connecting to their website through the given link.

Step 2- Add your username in the first step and then press the next tab to enter your password.

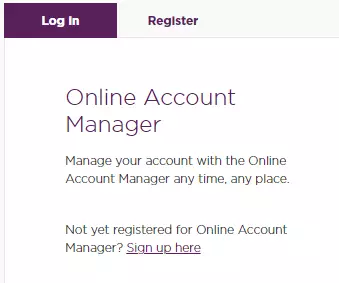

Step 3- If you are not registered with the Fluid credit card online account, you can press the Sign Up Here option, a link to start the process. You can also reach the registration page by pressing the Register tab beside the Login tab.

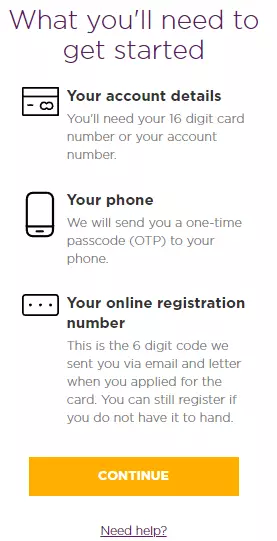

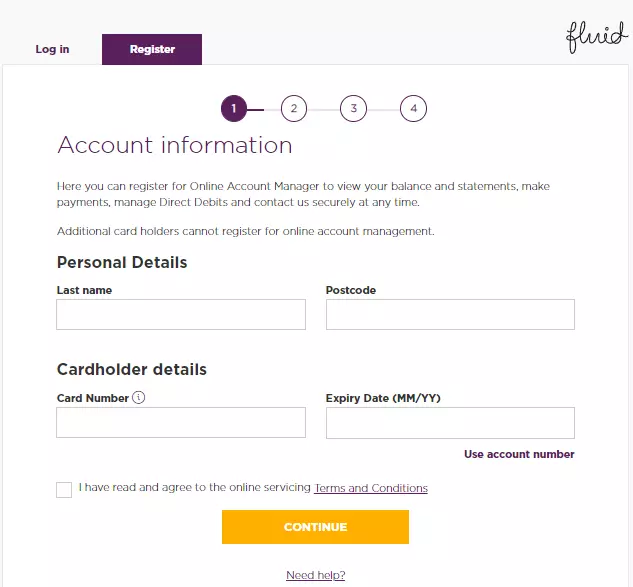

Step 4- When you press this link, you will move to the page where you will be informed about what you need.

Step 5- Fill in the form that opens up for you and add your name, postcode, expiry date, and also your credit card number.

Step 6- Press on the Continue tab to complete the registration process and once done, confirm by pressing the Register tab.

Step 7- After pressing on the registration tab, you will receive a confirmation mail. Click on the mail to confirm and activate your account.

How to pay Fluid credit card bill payment?

To pay the credit card bill, you can go to your online account and complete the credit card billing process.

- Visit the Payment tab and then press the Pay Bill tab.

- Once you press it, you will move to the segment where you need to add your credit card/current account/debit card details.

- Add your billing details and then press on the Pay Bill segment to complete the payment.

It hardly takes a few minutes and your billing is complete.

Payment Mailing Address & Phone Number

The payment mailing address for the Fluid credit card is Customer Services, PO Box 136

Sheffield, S98 1HB.

If you want to pay them the credit card bill using your phone, dial 0333 414 1090. Call them on the number and provide your credit card details when asked. Also, have your payment mode handy so that you can add when requested.

How to cancel Fluid credit card?

To cancel the Fluid credit card, you must call 0333 414 1090 to ensure account closure.

If you have any balance shift it before closing the account. The account closing procedure will usually take 2 days.

Card Benefits

Credit card benefits of the Fluid credit card include the following;

- The balance transfer offer is pretty comfortable to bear with a 4% interest rate in the first 9 months followed by 5% in the following months.

- The credit card also comes with a mobile app and allows you easier access than even your online account.

- You can protect yourself from fraud and thus, fraudulent purchases cannot be possible with this credit card.

Customer Service Number

The customer service numbers are 0333 414 1090 and 0333 414 1098. If you want to resolve your queries and doubts, you can call them at the given numbers to complete the process.

Conclusion

A Fluid credit card is beneficial for those who love its balance transfer features. If you want to take their credit card, know more about their login, payment, and credit card benefits from this article.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)