If you frequently fly with Southwest Airlines, then you can apply for the Southwest rapid rewards credit cards offered by JP Morgan Chase & Co. With this, you can enjoy a wide range of rewards, exclusive benefits, and services.

There are four types of Southwest cards; and they are, Plus, Priority, Premier, and Business Credit Card. This is one of the best co-branded credit cards. Consumers can benefit immensely as they can avail hotels, dining, car rentals, and even retail shopping with the cards. To get all these benefits one needs to apply for a card but if you have already applied for it then you should check the Southwest credit card application status.

| Card Type – Southwest Rapid Rewards | Annual Fee |

| Plus Card | $69 |

| Premier Card | $99 |

| Priority Card | $149 |

| Premier Business Card | $99 |

| Performance Business Card | $199 |

Page Contents

How to check the Southwest credit card application status?

There are two ways to check the Southwest credit card application status. One is through the online process and the other one is through the phone. We will discuss them one by one below.

Via phone line:

You can call the application status line at 800-432-3117 and business applicants can reach out at 800-453-9719.

Online:

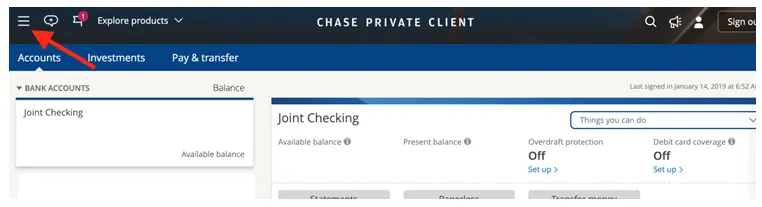

- You can visit the chase site and log into your Chase account.

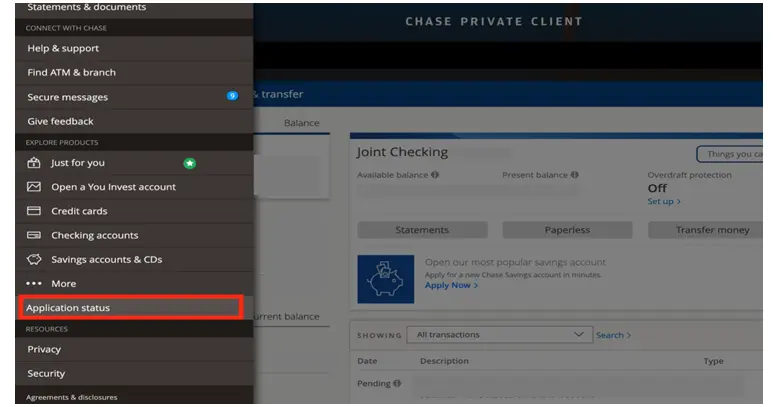

- Click on the menu icon (three lines at the top left corner).

- This will open a left pane on the screen.

- You need to scroll to the bottom of the list and click on “Application Status” to learn more about it.

Also Read: How to get the latest Aspire Credit card?

How to Apply for it?

Here’s how one can apply for them: If you have already applied for it then check your southwest credit card status by following the guide given above.

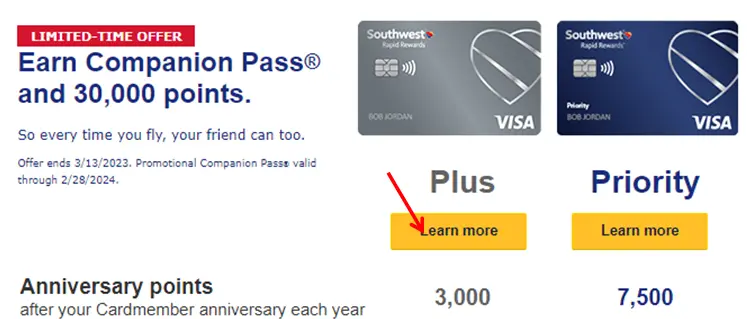

- One can visit the official website and click on their favorite card.

- Then, click on the “Learn More” option.

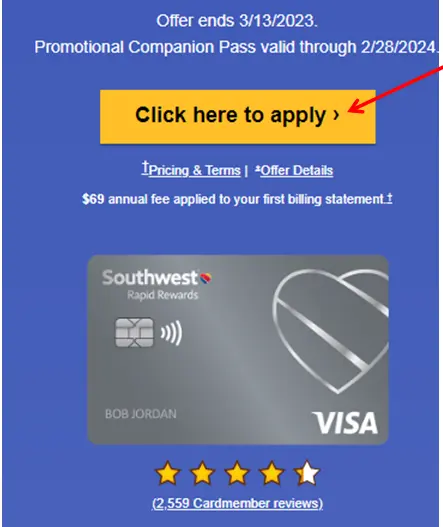

- Once they are redirected to the new page, they can click on the “Click here to apply” button.

- Once they are redirected to the new page, they can click on the “Click here to apply” button.

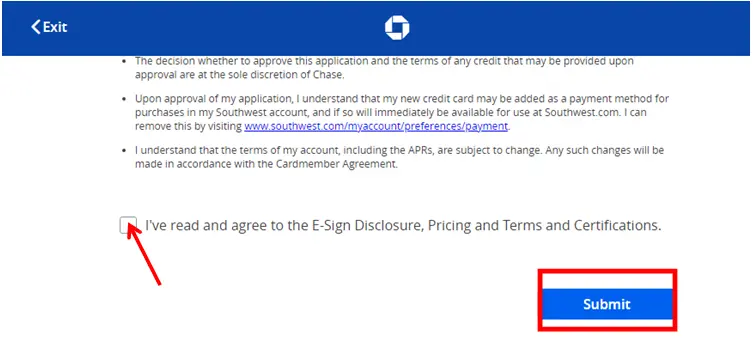

- Lastly, click on the “Submit” button.

Which Southwest credit card are you eligible for?

The eligibility for Southwest personal credit card (Plus, Premier, or Priority Card) is as follows:

- Applicant must not already possess a Southwest personal category credit card.

- Or the applicant has received a new card member bonus in the personal cards category.

For a business card; the applicant mustn’t already be in possession of a Southwest business card or has received a new card member bonus.

Also Read: What is the Easiest Credit card to Get Approved for?

Who can have a Southwest credit card?

Anyone who flies with Southwest Airlines frequently can apply for a Southwest card. The general restrictions imposed by Chase are:

- Chase has a 5/24 Rule which prevents from being approved for a card if an applicant has applied for more than five-card accounts in 24 months.

- Chase typically doesn’t approve more than two credit cards in a month.

FAQs (Frequently Asked Questions)

What should be your credit score if you wish to have a Southwest credit card?

In general, there are no prominent rules in regard. However, it is recommended to have a credit score between good to excellent or above 740 to apply for the Southwest credit card.

Which bank has got Southwest credit card?

JP Morgan & Chase offers all types of Southwest credit cards.

Conclusion

Chase’s Southwest cards are excellent for frequent flying customers of Southwest airlines. They can pick a suitable card as per their requirements and eligibility. They can also utilize the card in other purposes such as dining, shopping, and even renting cars.

![Truworths Account Application Online or Via SMS [2024-Updated] truworths account online application requirements](https://kingapplication.com/wp-content/uploads/2021/09/truworths-account-online-application-requirements-300x185.webp)