Update: There were only three stimulus payments- April 2020, Jan 2021 and March 2021. Currently there are no stimulus payments and thus the old process of registering Turbo tax for non filers is to be followed as given below.

Turbo Tax helps millions of people get their stimulus payments. As per the IRS, almost 80% of US citizens are eligible to claim stimulus payments.

Users can simply answer a few questions with the Turbo Tax Stimulus Registration Product and can easily file a return with the IRS through Turbo Tax.

Page Contents

Why is TurboTax asking about stimulus checks?

TurboTax is asking about stimulus checks to see if you have received your stimulus checks or not and if received then how much you have received in order to see if you’re eligible for the Recovery Rebate Credit or not.

Do you need to apply for TurboTax Stimulus check?

The Turbo Stimulus Registration Product is available completely free of cost for users. The product offers its users stimulus payments through either direct deposits or checks and can be easily accessed via the TurboTax Stimulus Center.

People who have an adjusted gross income of $75000 individually or $150,000 as a couple are completely eligible for a full stimulus amount.

The stimulus amount would come up to $1200 for an individual and $2400 for a taxpayer paying taxes jointly. Each of these families can also expect $500 for every child under the age of 17.

By the second half of April, people can receive their stimulus checks.

To do TurboTax stimulus registration for nonfilers, follow this simple guide

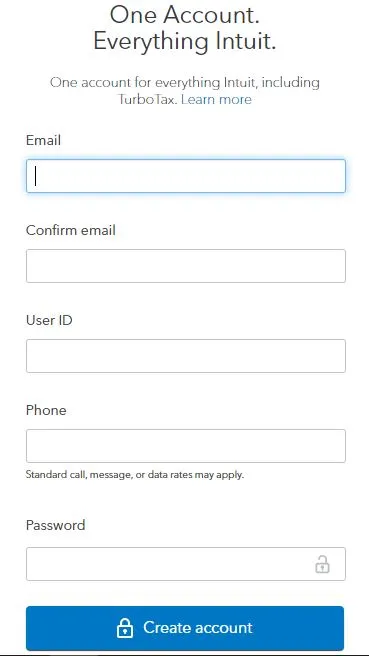

Step 1– Visit the TurboTax page to start the registration process.

Step 2– Next add your working email ID, confirm email, user ID, phone number & password.

Step 3– After entering all the details, click on “Create Account” button.

Step 4– Don’t forget the user id and password that you have created because this will be used to log in.

Step 5: Now fill up the form completely and then submit it. Your form will have different segments related to your personal details, education and job plus income related details.

Also Check:- CARES act emergency grant application

How to use TurboTax to get a stimulus check?

To get a stimulus check, use the TurboTax direct registration process.

Fill in the following questions;

- Did you file the 2020 taxes?

- Your filing status

- Adjusted gross income

- If somebody claimed you as a dependent on the tax returns

- For how many dependents did you claim your return?

- Do you have an SSN?

Further, users have to fill in some other questions to use Turbo Tax.

- Birth date

- Marital status

- Fill in your non-taxable information

- Further Turbo Tax would help you file your IRS

- It would also calculate the total amount you earn annually.

- Finally, IRS stimulus checks would only be slightly away from you.

- Add your name (initial and last name), birth date, social security number, email address, and phone number.

- Include your occupation, state where you live, also if you are a dependent in someone else’s tax return.

- If you are legally blind, you need to also specify that point clearly.

- In the next pages, fill your marital status and also your dependent status apart from your financial information.

TurboTax stimulus direct deposit check

Users have to file their IRS through Turbo Tax and in it, you have to update your account details. Once the bank account details are updated then you can get a direct deposit check. Follow the below steps to find out more;

- Log in to your Turbo account.

- After TurboTax login, file the IRS through them.

- Go to the TurboTax portal for direct deposit information.

- In the Bank Account section, update your bank information.

- Enter all the other details as required.

Those who do not have a direct deposit account can receive the amount through check. Thus if you’re wondering ‘how to get stimulus check from TurboTax’ then you need not worry since all those users who will have a current direct deposit account, would receive a payment as a check or a debit card payment.

There was no stimulus check Turbo tax delay and it was primarily due to the IRS delaying the payments that some of the checks have got delayed.

FAQs (Frequently Asked Questions)

How long does it take TurboTax to direct deposit stimulus check?

It takes almost 21 days to get the Turbo Tax refund after the IRS has accepted.

Can I use TurboTax to get my stimulus check?

Yes, you can use TurboTax apply for stimulus check method to get your money.

How long does it take to get a tax refund from TurboTax direct deposit?

It is refunded within 21 days from the date it is accepted by the IRS.

Conclusion

TurboTax allows many to go for the stimulus payments. If you too want to get your stimulus or you have some improper amount credited to your account or missed stimulus payments, do consider reading this post.

![Truworths Account Application Online or Via SMS [2024-Updated] truworths account online application requirements](https://kingapplication.com/wp-content/uploads/2021/09/truworths-account-online-application-requirements-300x185.webp)