Brandsmart is a brand that brings the lowest prices for its products to local store markets. The sales department of Brandsmart focuses on making products available at their lowest prices. Their low prices come with a 30-day guarantee for their low price ranges and if any consumer can find a store with lower prices, Brandsmart will refund their prices.

The Brandsmart credit card is a facility available to all its consumers. If you are regularly shopping from Brandsmart, you should have a credit card with you for better available options. But you must apply for a card to secure one for yourself in due time.

| Annual Fees | $0 |

| Credit Limit | $300 & above |

| Purchase APR | 29.99% |

| Balance Transfer APR | Low rates |

| Minimum Required Credit Score | 640 or higher |

| Security Deposit | None |

Page Contents

Steps for Brandsmart credit card application

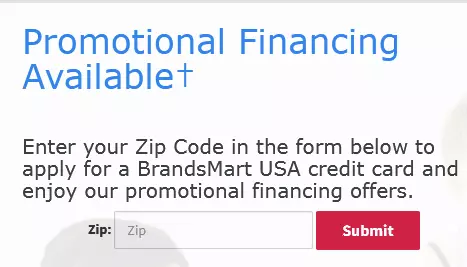

Off late, the online application process for the Brandsmart credit card is not available directly on the website. Instead, you need to first enter your ZIP code on their website i.e www.brandsmartusa.com/financing-100 to pull out the online application.

Step 1: Move to the page where you can put your postal code to move to your online application.

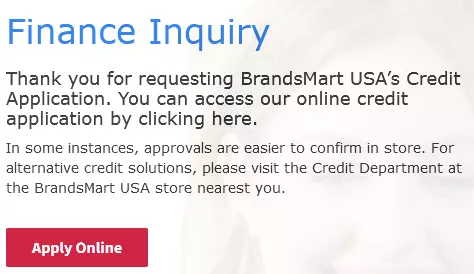

Step 2: Next, you will be taken to the online application where you must press on the Apply Online tab to complete the process.

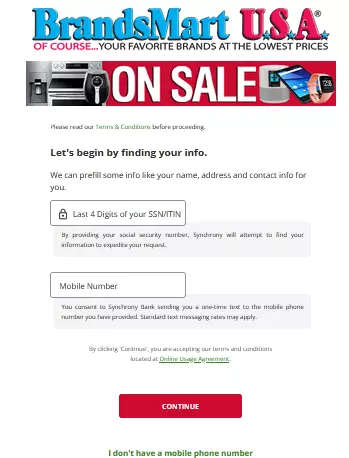

Step 3: It takes you to Synchrony Bank’s online application page where you first enter the SSN and also your mobile number.

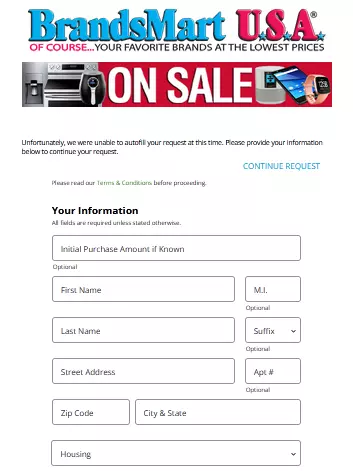

Step 4: Add your personal information including your name, the first purchase amount, street, and other address details.

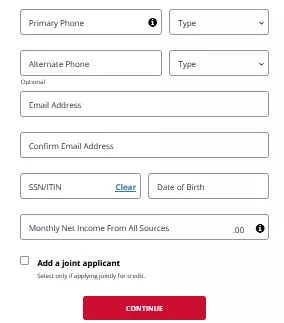

Step 5: Include your primary and alternate phone number, email address, SSN/ITIN, and also birth date, and monthly net income from different sources.

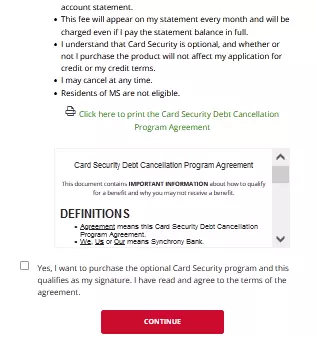

Step 6: Agree to their terms and conditions by checking the square box at the end of the segment before clicking on the Continue tab.

Step 7: Review the application and complete the process by pressing the Submit tab.

Brandsmart Credit Card Requirements

You cannot just apply for any credit card and must fulfill some requirements before applying.

- Citizens must be 18 years and above and they should ideally be a major in their state or territory.

- You must be legally residing in the United States or a citizen currently living in the States.

- As an applicant, you must have a Brandsmart online account.

- Your credit check must go well and you must qualify when run by Synchrony on your account.

Who is eligible?

Eligibility of the Brandsmart credit cardholders includes satisfying the following conditions.

- You must declare your annual income to Brandsmart.

- As an applicant, you must be able to put down a permanent address on your online application form instead of a PO Box address.

- If you have debts, you should reveal them in the application form as well.

- One must have a valid social security number

Also read: Brandsmart credit card Login and Pay

Pros & Cons

There are several advantages that the Brandsmart credit card brings to you.

- With them, you have a 6-month option of getting financial freedom.

- There is no annual fee on the use of the credit card.

- If you pay within the 6-month duration, you do not have to make any more extra payments.

- As a credit cardholder, you can get several exclusive offers for yourself.

- Managing your online credit account becomes easier and you can easily add a second authorized user to your account.

- Earning 1% on purchases can be made at Brandford USA.

- There is no initial interest financing on the initial purchase during the first month of your account with them.

There are several disadvantages of using the Brandsmart credit card that include the following;

- Pointwise conversions often don’t yield satisfactory amounts.

- You get very little in terms of bonus points compared to other credit cards.

FAQs

Where can you use Brandsmart credit card?

The card can be used in-store or online and cannot be used anywhere else.

Is Brandsmart credit card hard to get?

No, it’s not very hard to get and the credit card can be used easily.

Conclusion

The Brandsmart credit card is one of the best ways to shop from the store. If you have a credit card, know more about it from this article. If you don’t have a credit card, you can apply for the credit card here.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)