Scheels credit card is a stores card that works as a reward card and provides people with lots of discounts, offers, and rewards in various other forms. For buying sports goods, Scheels offers you one of the best credit cards in store. You can use the card to shop for different sports items and each purchase will benefit you when you do it through the credit card given to you by Scheels.

Besides, it is a VISA card offering all the VISA benefits to the user and brings in the best offers. Use it wherever you go and wherever they accept a VISA card.

Page Contents

How to apply for Scheels Credit Card Online?

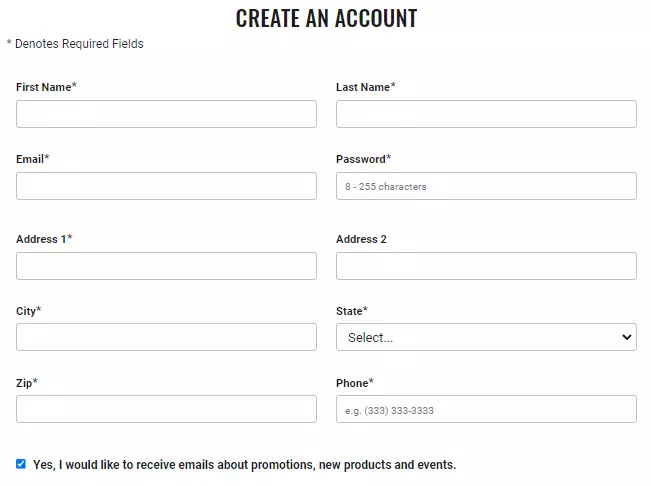

The first process to acquire a Scheels Credit card is to register with them online if you still do not have a log-in ID.

Step 1- Fill in your name, address, email, and telephone details within the form.

Step 2- Add your details like birth date, gender, and birthday.

Step 3- Click on the sign me up tab to complete the registration process.

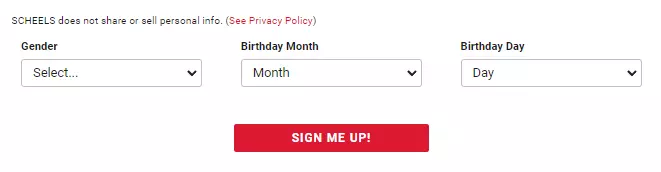

Step 4- After signing up, start the application process.

Step 5- Add your details in the application form including your income details, and your complete address.

Step 6- Add all the relevant documents including your SSN/ITIN, income proofs, and your net annual income.

Your credit score will be verified before granting you a credit card from them.

What are application Requirements

Few requirements include several important documents and a few other normal requirements.

- One must be a major (at or above 18 years) to hold a credit card.

- You must have a valid SSN/ITIN to apply for the Scheel Visa credit card.

- A credit score of 700 is required to get the Scheel Visa credit card.

- A valid US physical address is required to complete the registration process.

- A valid physical address is required for the same.

Annual fees

There is no annual fee for owning the Scheels credit card.

Credit Limit

The credit limits are adjusted according to your creditworthiness and vary from one to another individual. You can also request them a security deposit of $550 in $50 increments upto $5000. If the card is approved you can have it at a $35 annual fee.

Also read: BrylaneHome Credit Card Login and Pay Bill [Payment]

Scheel Visa Credit Card Benefits

Several Visa credit card benefits include;

- For every one dollar spent at Scheels, you can get 3 points. For spending in other places, you can get one point for one dollar.

- After you buy for the first time with a Scheels credit card, you will get 1500 bonus points in your account.

- You can take cash advances with your Scheels credit card in emergencies even though you must pay a high fee for it.

- They have a 0% APR on introductory purchases.

- The card also acts as a balance transfer reward card which means you can transfer several credit cards balances into this one card and then make payouts from here.

Contact Details

The contact details for (701) 356-8264.

FAQs

What bank Issues Scheels Visa Credit Card?

First National Bank of Omaha (FNBO) issues the Scheels Visa credit card.

Can you use Scheels credit card anywhere?

Wherever a VISA card is accepted, you can use the Scheels card.

Conclusion

Here’s all about the Scheels credit card, if you are planning to take read the details from here.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)