Using the Wawa credit card, you can pay at the petrol pumps to earn 50 cents for every gallon for the first month from the time of account opening. Thereafter, you can keep earning 5 cents per gallon for the rest of the time.

With their credit card, you can manage your payments and account necessities online. While keeping track of purchases also becomes easier with the Wawa card, you can also opt for flexible payment terms.

It offers a secure solution and no responsibility for unauthorized charges when using a credit card.

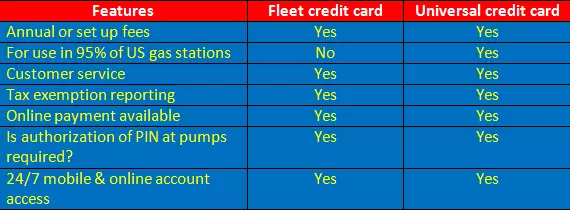

There are two credit cards offered by Wawa-

- the Wawa Fleet card and

- the Universal card.

| Annual Fees | $0 |

| Credit Limit | Based on your creditworthiness |

| Purchase APR | 26.49% |

| Balance Transfer APR | N/A |

| Minimum Required Credit Score | 670 or higher |

| Security Deposit | None |

Page Contents

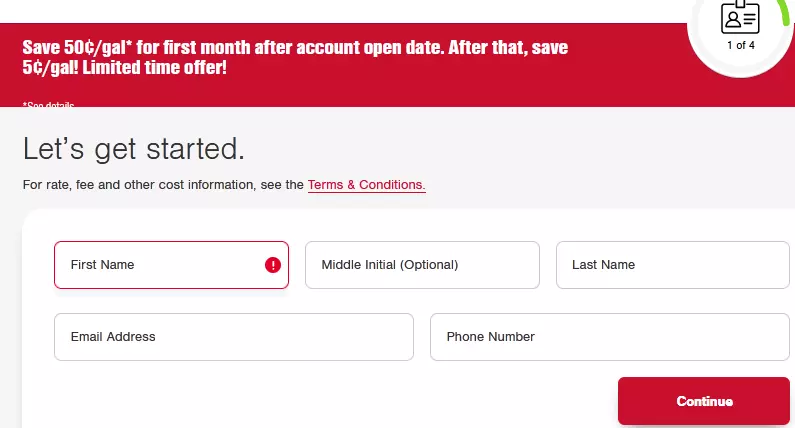

How to apply for Wawa credit card application?

To apply for the Wawa credit card, you have to follow the typical application process.

Step 1: To apply for a credit card, you should visit their official website i.e www.wawa.com/wawacreditcard

Step 2: Press the Apply Now tab to start the application process.

Step 3: Add your name, email address, and phone number in the first section.

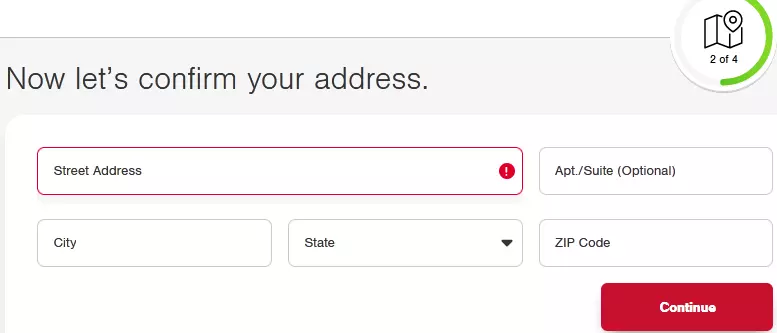

Step 4: Add your residential address completely. The system will not accept a PO Box address.

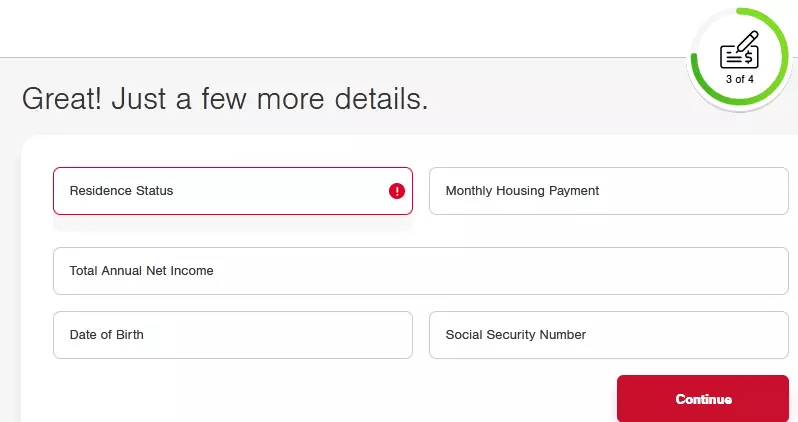

Step 5: The residence status, monthly payment, total annual net income, birth date, and social security number must be mentioned in this segment.

Step 6: As the last step check all the details carefully before applying.

Wawa credit card application requirements

Different application requirements for the credit card include fulfilling the following criteria.

- You must have a social security number.

- Their credit record needs to be clean.

- An applicant must be 18 year’s old or above

- An applicant must have a photo identity card with them for fulfilling the application requirement.

Who is eligible?

To be eligible for a credit card, here are a few things you need to do.

- You must not have been a debt defaulter ever within your state.

- You must have an annual income and you need to put it down in the application. Based on your income limit and source, your credit limit will be decided.

Also read: Neiman Marcus Credit Card Application Online [2023]

Card Pros & Cons

Different credit card pros and cons include the following:

Pros:

- As a welcome offer, you can save up to 50 cents per gallon in the first month of account opening. These offers function under special schemes that are announced once in a while.

- You can earn on your gas purchases at a rate of roughly 2% for your gas.

- There is no annual fee for owning the Wawa card.

Cons:

- The credit card works only for gas purchases and for nothing else.

- It has a high APR of 26.49% is variable and quite higher than the average 16%.

- It is a shop-only credit card and cannot be used anywhere else except in Wawa.

FAQs

Can you use Wawa credit card anywhere?

No, since the credit card is just a shop-only credit card, it can be used only in Wawa outlets.

What bank issues Wawa credit card?

Citi Bank issues the Wawa credit card to all applicants.

Conclusion

Do you want to go for the Wawa credit card? Do you think you need to save 2% on your gas? If so, read this blog article to understand more about the Wawa application process. Additionally, go through the beneficial features of the credit card below.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Wawa credit card login and Pay Bill Payment [2024] Wawa credit card online](https://kingapplication.com/wp-content/uploads/2022/03/Wawa-credit-card-online-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)

![QT Credit Card Account login & Pay Bill Payment [2024] online credit card login](https://kingapplication.com/wp-content/uploads/2022/02/Untitled-design2-10-300x185.webp)