Things you must know before having your own Destiny Credit card

We all know that we need a good credit score to have our own credit cards. Destiny credit card is such that you can apply for it even if you have an average credit score. You can apply for this credit card very quickly, so without wasting any more time, let us know the process of application.

Page Contents

Steps for Destiny Credit Card Application

Here are a few easy steps to apply for a Destiny MasterCard:

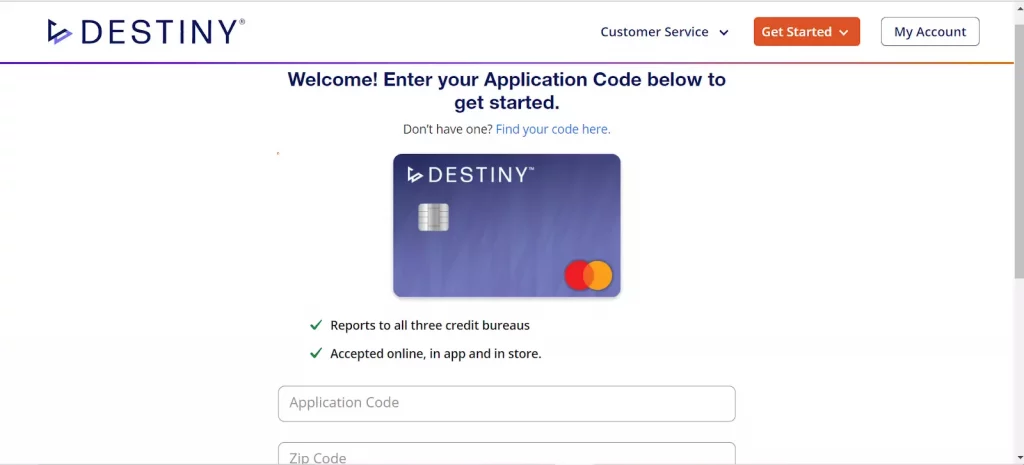

Step 1: Copy & paste the given link https://www.destinycard.com/invite and open the official site of destiny MasterCard. You can even search for it by using your browser.

Step 2: Enter your Application code and zip code, and you are done with the application process.

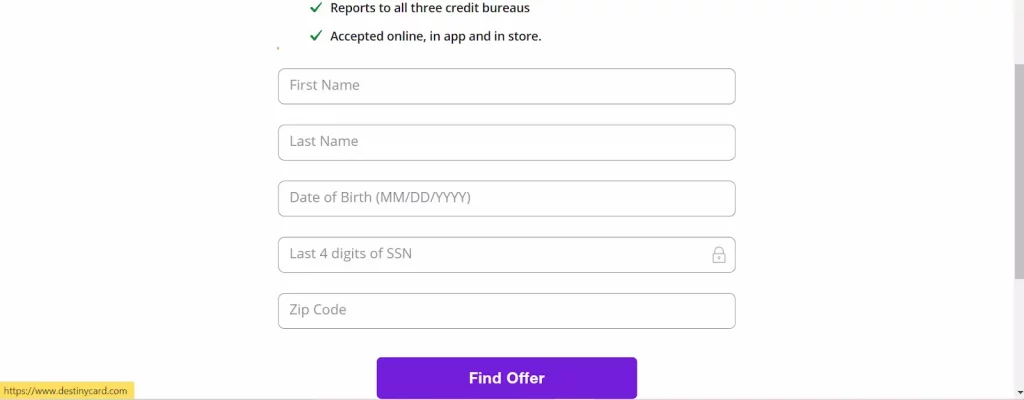

Step 3: If you do not know your application code, then click on “find your code here”. Fill in the details that are asked, and you will get your code. Now come back to the home page, and enter the application code and zip code.

What are the application requirements?

Here is the list of things that you should have to get a Destiny card

- Have your physical address of the US

- You must have an SSN

- You must have not been rejected due to delinquency.

If you have these things along with your personal details, you can easily apply for a Destiny credit card.

Who is Eligible?

Unlike any other credit card, anyone who is trying to better their credit card score can easily apply for this credit card. All you need is a US address and must be above 18 years of age.

Annual fees, Interest rate & Credit Limit

There is no credit score requirement for Destiny’s credit card, even if you have a bad credit score, you still apply for this credit card. However, you have a very low credit limit for using this card.

You have to pay annual fees for Destiny’s credit card, Annual fees are between $59 to $99. The interest rate is a minimum of $50, for the first year of use you do not have to pay an interest rate but from the second month onwards it gets increasing by 5% and a minimum of $50.

Also read: How to do Boscovs Credit Card Login & Pay Bill Payment?

Benefits of using destiny credit card

There are lots of benefits of using a Destiny card, but here are some key highlights of using the credit card:

- You can get a Destiny credit card with a low credit score

- You have no risk of losing money, as the card is highly secure.

- You can use this card almost anywhere

- It is a very handy card if you want to improve your credit score.

Pros & Cons

Pros:

- You can apply for the card even with a low credit score

- Highly secured card

- You can report to all three credit bureaus

- No extra charges for security.

Cons:

- Has annual fees

- It has a low credit limit

- There are no offers and bonuses

- Comparatively, it has a higher interest rate

FAQs

How to check destiny’s credit card application status?

You can check the status of the Destiny credit card on its official website.

Who owns destiny’s credit card?

First Electronic Bank issues or owns the Destiny card.

Does destiny credit card give increases?

No, you cannot increase your credit limit with a Destiny card.

Where can I use my destiny credit card?

You can use your Destiny card anywhere, it is associated with the MasterCard, so wherever you can use your MasterCard you can use your Destiny card in those places as well.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![First Savings Credit Card Application [Simple & Quick Guide] First Savings credit card](https://kingapplication.com/wp-content/uploads/2022/05/First-Savings-credit-card-1-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)