Chevron credit card application is an American multinational energy corporation that issues credit cards for its customers. If you are their regular customer, you too can apply for their credit card. Their credit cards come with no annual fee, zero fraud liabilities, and also online and mobile account management.

There are four types of credit cards.

- All Techron Advantage cardholders

- New Techron Advantage cardholders

- Techron Advantage Visa cardholders

- Gas card

Each of these credit cards promises a lot of different rewards. With All Techron Advantage cardholders, you can earn up to 8 cents per gallon. They have three types of credit cards- Regular, Plus, and Supreme variations.

- With regular variety, you can earn 3 cents,

- Plus gives you 6 cents,

- You can have 8 cents for Supreme variations

If you are planning to acquire one of their credit cards, you must know these essential features.

| Notable Credit Card Features | Chevron Gas & Advantage Visa credit card | Chevron Gas & Advantage credit card |

| Annual Fees | $0 | $0 |

| Purchase APR | 26.99% | 27.24% |

| Balance Transfer APR | Not allowed | 0% for first 15 months & then 14.99%-24.99% (variable) |

| Minimum credit limit | $500 | $500 |

| Foreign Transaction Fee | 3% | 3% |

Page Contents

Steps for Chevron credit card application

Step 1- To apply for the credit card, visit the website i.e www.chevrontexacocards.com/Chevron

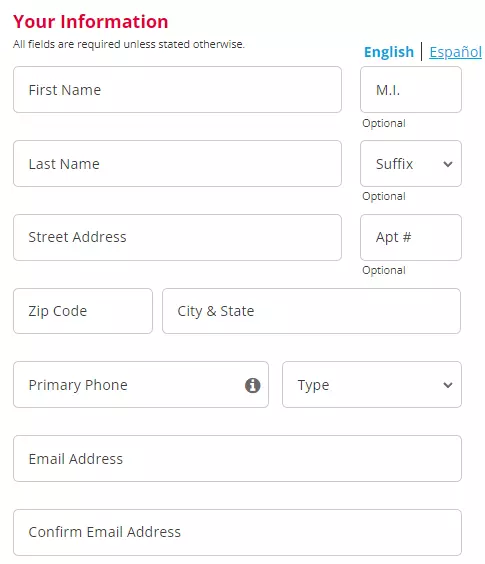

Step 2- Start by filling in the application form and begin by adding your first name, last name, and complete address including your street details. Also, add your email address and telephone number to start with.

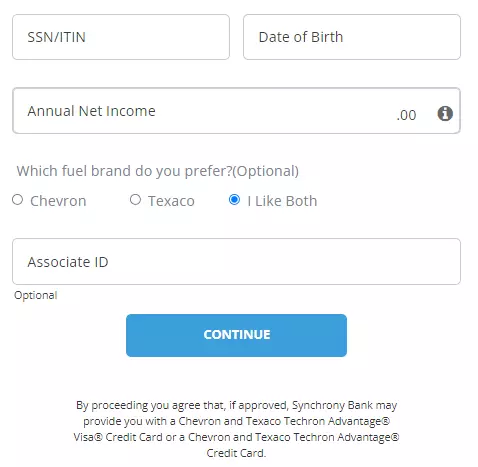

Step 3- In the next segment, add your SSN (social security number), birth date, and annual net income. Additionally, incorporate the fuel brand you prefer between Chevron and Texaco. Mark the ‘both button’ if you prefer both.

Step 4- If you have your Associate ID, add that as well.

Step 5- Press the continue tab to move to the next segment of the application.

Step 6- Fill in your options, terms, also results, and then press the Submit tab to complete the application process.

Chevron Credit card application requirements

The application will have a few requirements that must be fulfilled.

- A credit score of 620 is a must.

- You must have a permanent address in the United States that you must add to the application.

- An SSN (social security number) must also be added to the Chevron credit card application.

- Your annual net income must be included in the application form.

Who is eligible?

Eligibility criteria for the Chevron credit card will include the following;

- You must be 18 years and above.

- The applicant needs to be a permanent resident of the United States

- Your registered email addresses and phone numbers must be valid.

- You should not be any sort of a defaulter when it comes to returning debts.

Card Benefits

| New Techron Advantage | All Techron Advantage | Techron Advantage Visa |

| 37 cents for every gallon | +8 cents per gallon | +10 cents for every gallon |

| 6-month promotional financing | 6-month promotional financing | 6-month promotional financing |

| 3 cents per gallon on regular, 6 cents for regular & 8 cents for Supreme options | Save $100 to get 2 cents profit. For each $100 extra, you keep getting 2 cents profit and for $500 you get 10 cents off. |

Annual fees & Credit limit

Annual fees on Chevron credit cards are $0 and the minimum credit limit is $500. The upper credit limit will depend on your creditworthiness.

The creditworthiness will further depend on the following three factors:

- The annual income of the individual

- Your debts in the market

- The credit scores you earned

Also read: Walmart Credit card application [Pre-Approval Process]

FAQs

Who issues Chevron credit card?

Synchrony Bank issues the Chevron card.

Can you use Chevron credit card anywhere?

Yes, the card can be used anywhere a Visa credit card is accepted.

Is Chevron credit card good?

Yes, it is a good credit card but is beneficial for those who buy gas from Chevron and Techron.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Penfed Credit Card Application [Card Pros & Cons] Penfed credit card](https://kingapplication.com/wp-content/uploads/2022/04/Penfed-credit-card--300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)

![Legacy Credit Card Login and Pay Bill Payment [increase limit] Legacy credit card login](https://kingapplication.com/wp-content/uploads/2022/03/Legacy-credit-card-login-1-300x185.webp)