Loans are a great way to reduce financial burdens. Finchoice is a great choice that can be used for loans but this is what you must know about it even before you apply.

Page Contents

What is Finchoice loan?

No one can apply for a loan with Finchoice without possessing a bank account since this is the only way money will be transferred to your account. Finchoice is a loan option available to South Africans who can easily go for loans through this platform.

Steps for Finchoice Loan Application Online

Visit the Finchoice Loan application site here. If you are a new customer, you can take a loan of up to R40,000.

Existing customers can take a loan even if they own a loan.

For first-time users, here is the process by which you can file the application.

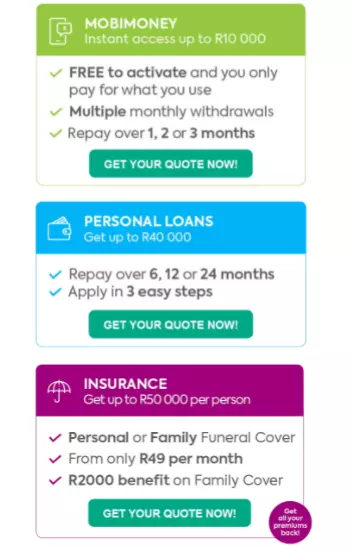

- You will be given three choices- Mobi Money, Personal Loans, and Insurance.

- Once you know what you want, you can start the application. For personal loans, click on the option that helps you to get a quote. Repayment facility is provided over a 6, 12, and 24-month span.

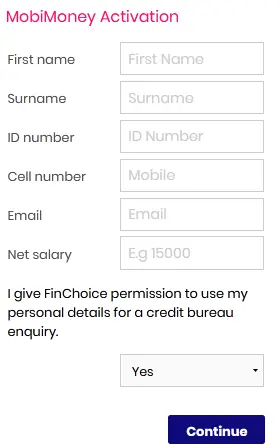

Once you click on the green tab, you get to the next screen.

- Fill in your ID number and mobile number in the space provided.

- Add your employment status, company/employer’s name, and also net income per month.

- Once done, click on the Next tab and then fill in the rest of the form and submit it for helping in the processing of the loan.

Application Requirements

To go for loans, here are the few requirements, you must fulfill.

- Having a bank account is a must.

- Being a South African citizen is mandatory.

- The person must be 18 and above.

- They must have a permanent job

- You must have a phone number registered under your name.

- A government-issued ID card is necessary to apply.

- Specify the monthly income you have and income proofs have to be shown when claiming the loan.

Also read: 8 Easy Steps – Grad Plus Loan Application [Complete Details]

- How to Check Finchoice Loan Application Status?

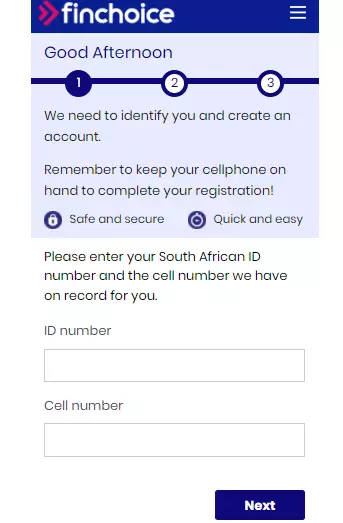

Once you start the loan application process, you must activate your account.

- Create an account by entering your mobile number and ID number.

2) Click on the Next tab to reach the next screen where you must choose a password.

3) Once your account is created, you can log in and then check the application status from the status tab.

How long does Finchoice take to approve?

Finchoice matches your credit history and checks your credit scores. In uneventful circumstances, Finchoice will sanction the loan within 24 hours. But to get the loan in a day, you must submit all necessary documents within 03:00 pm of the same day.

Also read: Easy Pay green card Loans online Application Guide

Conclusion

To conclude, we can say that in dire need Finchoice is a suitable option for considering loans. If you need them, you must read the terms and conditions carefully as well as this blog before beginning the application process.

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)

![African Bank Loan Application & Status [Complete Details] African bank loan](https://kingapplication.com/wp-content/uploads/2022/04/African-bank-loan--300x185.webp)

![Budgeting Loan Application Online [Complete Details] Budgeting loan application](https://kingapplication.com/wp-content/uploads/2022/05/Budgeting-loan-application-300x185.webp)