If you own a home in British Columbia, you might also be eligible for a homeowner grant. The homeowner grant allows people to reduce the property tax amount considerably for the residence you use for personal use.

The homeowner grant is of three kinds-

- Individual homeowner grant

- Multiple homeowner grant

- Grants with higher amounts for a certain class of people

- Individual grant for homeowners is to be claimed by those who apply for an individual homeowner grant. For a single occupant, a personal regular homeowner grant application is enough.

- If you have multiple homeowners, you must qualify for a homeowner grant and pass on the benefits to others.

- Higher grants are allotted to certain segments of the population:

- An aged individual who is in the senior category.

- A veteran member of the country

- Living in a home with a disabled spouse or relative

- If you are a disabled individual

- A deceased owner’s relative or spouse

The grant amount differs from one county to another:

- For properties around the Capital, Metro Vancouver, and the Fraser Valley Regional District the grant amount is $570.

- In all other districts, the grant amount is $770.

The property owners need to pay $350 towards property maintenance taxes for roads and police protection services. If you qualify for the grant, the amount reduces substantially.

Going forth municipality residents can no longer apply for the homeowners’ grant. Instead, one needs to raise an application online or via phone.

Page Contents

How to Apply for BC Homeowner Grant Application?

The swiftest application source is their online mode however if you are not computer literate, you can still apply by visiting the service BC locations.

Service BC locations and terminals are unavailable in Burnaby, Surrey, and Vancouver.

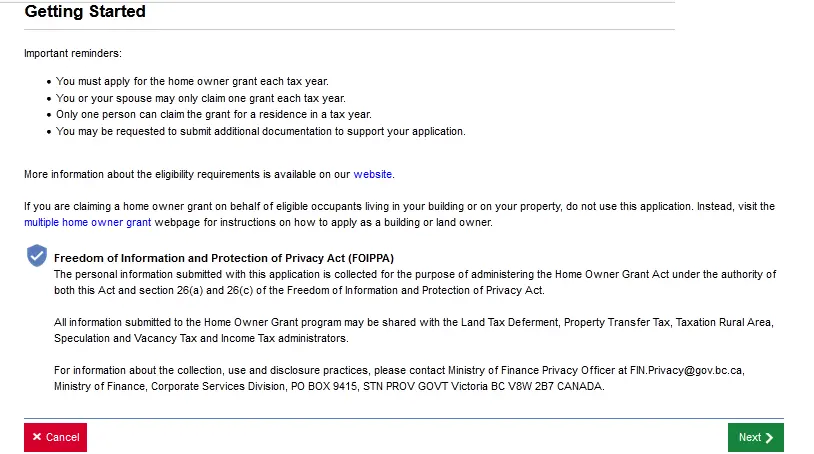

Step 1- Apply using the link given here.

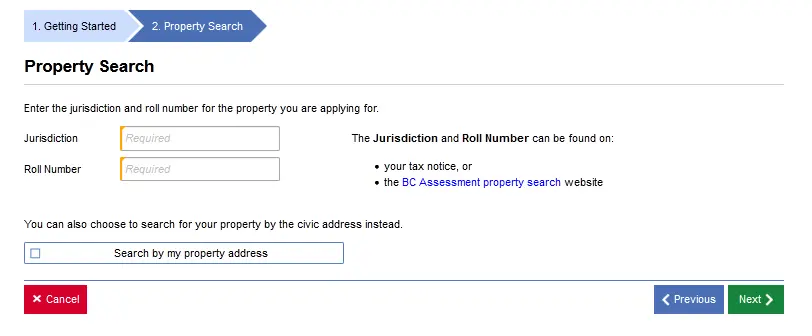

Step 2- Fill in the following to start your application form. Add your roll number and jurisdiction number to start your application.

Step 3- Follow the application prompts and enter all your essential details. Include all the essential information and append documents as per the requirement as also the BC assessment notice you received the following January of the year.

Step 4- Your personal information is encrypted to protect it and to keep it secure.

Step 5- Click on the Submit tab to complete the BC Homeowner grant application process.

Step 6- To apply via phone, use the 1-888-355-2700 number and choose option 3. Select the regular grant or special grant services.

What are the Application Requirements?

Different application requirements include the following;

- Include your property tax notice

- BC Assessment notices for January

- Search BC Assessment notice

- SSN (social security number)

Who is Eligible bc homeowner grant application?

- To be eligible, you must be able to show your property ownership documents to ensure you can claim the homeownership funds.

- If the person falls under any of the special categories including their seniority, veteran, or disabled status, they can apply for a higher grant.

- You must be a permanent resident of British Columbia to apply for the grant.

- Your home address is on eligible land and building. To be declared an eligible building, they should either be;

- A building under the housing co-operative

- Corporation building

- Housing society building

- If your apartment is provincially designated

- Eligible lands will incorporate the following kinds of lands and properties.

- Co-operative lands

- Leased parcel multiple dwelling properties

- Individuals can be eligible under these lands and buildings including the following;

- If the building is under a housing co-operative or corporation, then the owner should either own the entire house or a share and other securities. They must have the right to occupy the unit they share or have equal value in the share.

- At least 25% of the assessed property should be owned by the owner if it is a housing society building.

- If you are a lessee for a 99-year lease, you can be the property owner for a provincially designated apartment building.

Also Read: How to Apply for Jobber Grant?

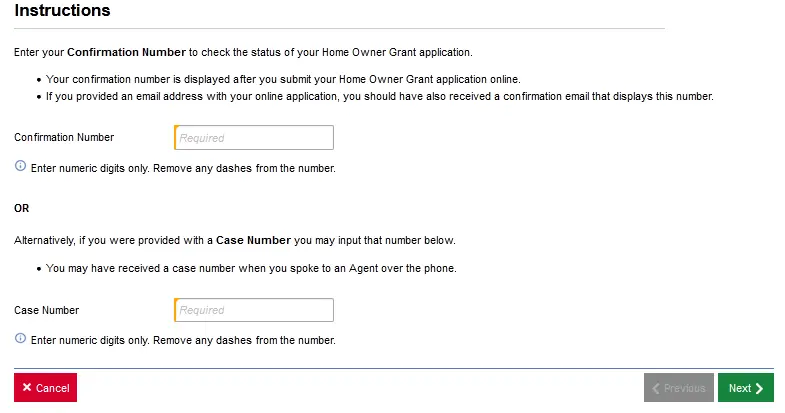

How to check BC Homeowner Grant Application Status?

Use the below link to check your application status. Add your case number and confirmation number in the given spaces to view your application status. Click on the Next tab to check the application status.

Grant Benefits

The grant benefit reduces the amount of property tax you pay for your principal residence.

If you apply to a First Nation for your taxes, you can directly receive the grant and if you are in a rural area and apply for taxes to a municipality or province, you can go for the grant.

Also read: Fearless Fund Grant Application: Are You Eligible?

Conclusion

Here is all about the homeowner grant, if you have not yet applied, you are missing on much-needed help. In British Columbia, the rules and regulations for the homeowners’ grant are widely prevalent. Read this article to gather all the information you need for it.

![CPP Disability Application Medical form [2024] How to Apply for CPP Disability Application?](https://kingapplication.com/wp-content/uploads/2023/04/CPP-Disability-Application-300x185.png)