COVID-19 is still running the show in terms of economic damages and destruction. Those businesses that were not so strong in the face of the aftermath of COVID suffered irreparably. To support them the government found out that they will need solid measures in place.

Under the Employee retention credit, there was financial help being granted to companies. But then the Infrastructure Investment and Jobs Act became law the ERC program halted. However, companies can still retroactively claim ERC assistance.

Page Contents

What is ERC?

ERC is a refundable payroll tax credit that was rolled out from 13th March 2020 to 31st December 2020. It is a segment of the CARES act and it is present in the plan to encourage the employees employed by a company during COVID-19.

The employers who enrolled for the ERC could claim 50% of their wages and those who qualified for it in 2021 could claim 70% of the ERC wages.

Deadline Information for Employee Retention Credit (ERC) Submissions:

- ERC submissions for the first to the fourth quarter of 2020 should be lodged by the 15th of April, 2024.

- ERC submissions for the first to the fourth quarter of 2021 are due by the 15th of April, 2025.

Who is Eligible for employee retention credit Application?

Eligibility for the ERC application depends on the following;

- Your application to ERC and its approval heavily depends on the time frame for which you apply for it.

- You must have run a business or tax-exempt organization which shut down completely or partially due to COVID-19.

- The sales decline is another essential criteria you need to show whereby your sale declined by 50%. For the 2021 qualification, you must have an 80% decline in your purchases.

- Wages can be claimed only for employees and not for someone close to you or related to you.

- There are no size limits for qualified wages and there are only big and small companies where you get different results.

What are Application Requirements?

For filling out the ERC form, you will need the following documents and forms.

- Forms 941 represents the Employer’s Quarterly Federal Tax Returns

- Form 7200 is a form that needs to be filled for advanced payment of employer’s credits that arises due to COVID-19.

- Reporting Agent Authorization Form 8655.

- PPP applications and forgiveness

- Any other COVID-related grants that you might have received during this period.

- Financials for all the four quarters of 2019, 2020 and 2021.

- Shutdown or suspension orders from the Federal government

- Power of Attorney for your company

- General responsibility release form

- Client service agreement and fee arrangement forms

Employee retention credit application

ERC is a completely refundable tax credit for employers and it qualifies for 50% wages and 70% wages for 2021.

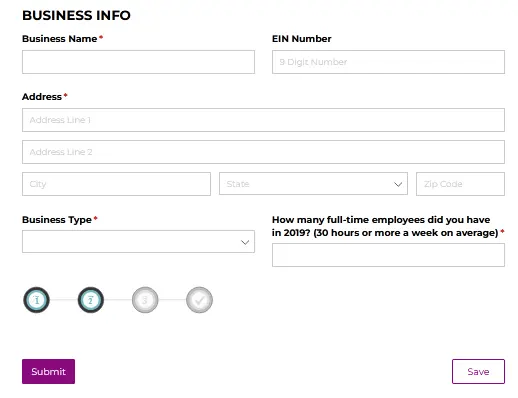

- Complete the client information by adding the names, email, phone, and also how you heard about them.

- Include the business information that includes your business name and address, EIN, business type and the number of full time employees.

- Add your income related details and then submit the ERC application form.

Employee retention credit Benefits

The ERC benefits include the following;

- $5000 per employee per annum as ERC benefits for those receiving a $10,000 salary.

- For 2021, it is $7000 for every employee per quarter and that will be $21000 per three quarters.

FAQs (Frequently Asked Questions)

Does employee retention credit have to be paid back?

The Employee Retention credit need not be paid back as it is not refundable and definitely not a loan. It is rather classified as a quality tax credit instead.

Does employee retention credit only apply to full time employees?

Yes, the ERC is only applicable to full-time employees and does not include part-time workers.

Has employee retention credit been extended?

It was expended till 31st December 2021 in March and this was done as part of the American Rescue Plan Act.

When does employee retention credit expire?

The employee retention credit can still be claimed retroactively through an amended tax return. These employers who feel there is a pandemic effect on the payroll have till 2024 to do it.

Conclusion

The ERC or the Employee Retention credit is a way in which you can save your employees over a period. The tax credit benefits are non-refundable and the amount paid to them is not charged back. Even retroactive claims are being entertained until 2024 for those who seem to have been hit by the COID-19 pandemic.

![UCLA application deadline: spring 2024- [Complete Details] UCLA application](https://kingapplication.com/wp-content/uploads/2022/12/UCLA-application-300x157.webp)