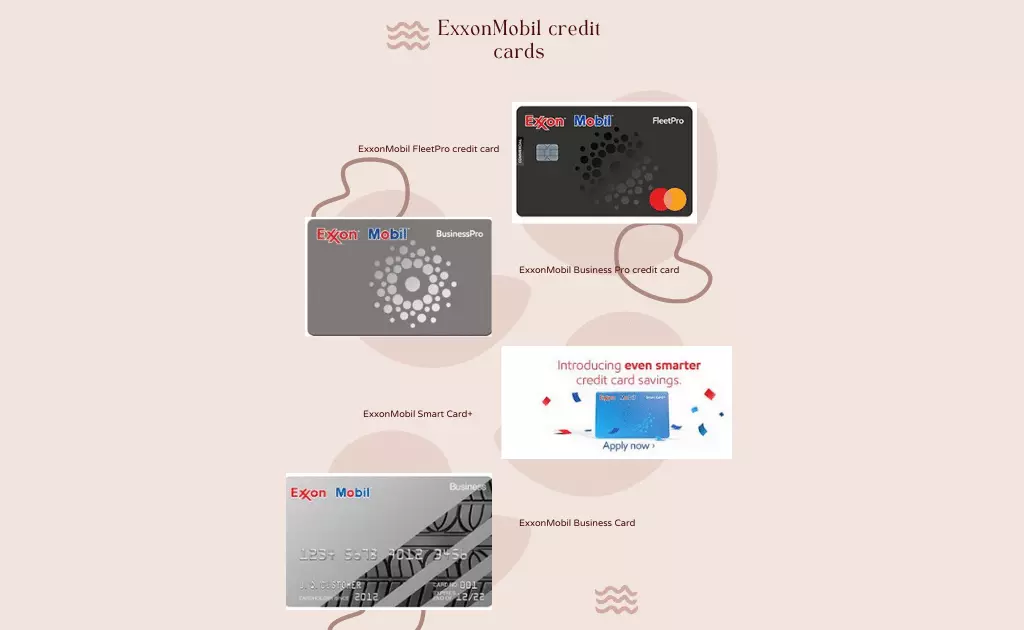

The ExxonMobil credit card application is no longer available for the general credit card that has been now made into four different types and you can apply for them separately. If you buy gas from them or purchase vehicle fluid, and use this credit card, you will get lots of discounts and offers on it.

These credit cards from ExxonMobil make your life easier and your pockets fuller. There are additional perks like zero fraud liability on the credit card and with it; you can get almost a 12 cents discount per gallon of fuel. These benefits are received not just in Exxon Mobil stations but also in 700+ commercial truck stations all across the country.

Currently, they have four credit cards- FleetPro, BusinessPro, Smartcard+, and Business card.

| Annual Fees | Nil |

| Credit Limit | Depending on your creditworthiness |

| Purchase APR | 26.49 % |

| Balance Transfer APR | 19.99% – 23.99% |

| Minimum required credit score | 580+ |

| Security Deposit | N/A |

| Average Regular APR | 17.74% – 24.74% (variable) |

Page Contents

Steps for ExxonMobil credit card application

To apply for the ExxonMobil credit card, you must keep this procedure in mind.

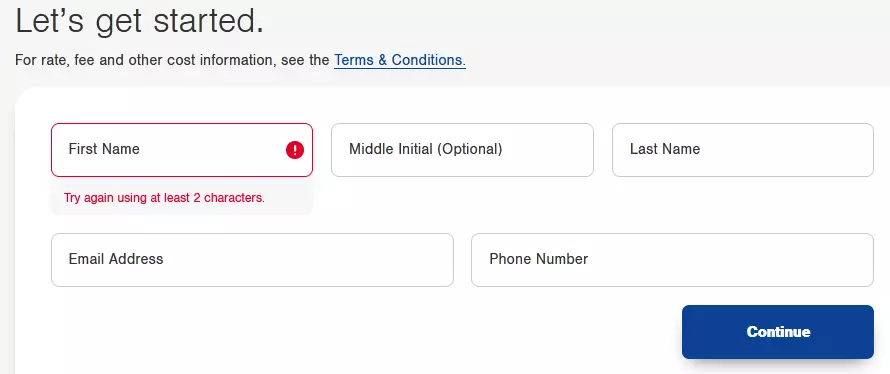

Step 1: From the link provided here i.e. https://www.exxon.com/en/smart-card-plus, you can add your first, middle, and last name, including your email address and phone number.

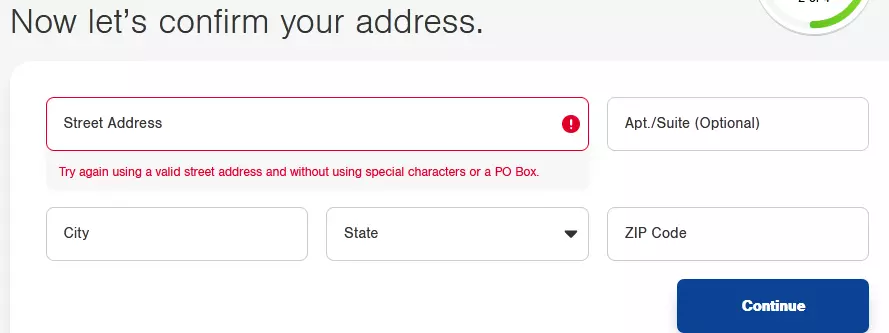

Step 2: In the next segment after pressing the Continue tab, you can add the complete residential address for yourself.

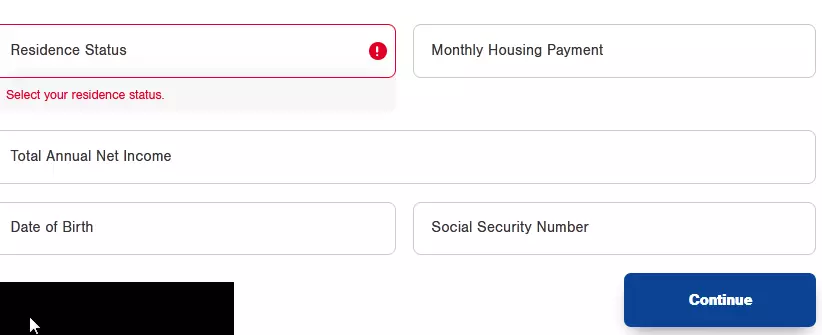

Step 3: You must add your net income, birth date, social security number, and monthly housing payment.

Step 4: Next, you must review the credit card details and then agree to their terms and conditions before pressing the Submit tab.

What are the application requirements?

The application requirements for the various ExxonMobil credit cards include fulfilling the following criteria.

- You will need a credit card score of 580+ to get credit cards from them.

- The ExxonMobil application would require a proper US address which is not just a PO Box address.

- They must have a social security number.

- You need to have an annual salary that can help get you a credit card.

Who is eligible?

People who are eligible for this credit card must fulfill the following;

- You should not be a defaulter with the Federal government in terms of taxes.

- Credit cardholders must reveal their house rent.

- One needs to be a major as per their statewide laws and regulations.

Also read: How to login to GM credit Card Account & Pay Bill Payment

ExxonMobil credit card Benefits

There are several benefits of using the ExxonMobil credit card and these include;

- You can get 30 cents off on every gallon of fuel during the first two months after you open your account.

- For in-store purchases and car washes, you will get 5% off on the $1200 non-fuel purchase in a year.

- You can save 12 cents for every gallon of supreme or premium fuel quality and 10 cents for other fuel grades.

- Accessing your funds is possible in Cirrus ATMs, 200,000 of them exist around and a cash advance fee applies.

- Payment terms are entirely flexible, you can either pay the complete amount or pay the minimum amount on your billing date.

FAQs

Who issues Exxon credit cards?

Citibank N.A. issues the Exxon smart credit card and the Business Pro and Fleet Pro are issued by the Wex Bank.

Is ExxonMobil credit card good?

ExxonMobil credit cards are many and they are good for those who regularly fuel their tanks with ExxonMobil. There are different types of credit cards that can suit different pockets easily.

Conclusion

There are different types of ExxonMobil cards and each of these credit cards has its benefits, pros, and cons. If you have any of these credit cards or you wish to take one, you can try one of them after reading more about them here.

![How Often can you Apply for a Credit Card [Latest Guide] apply for a credit card](https://kingapplication.com/wp-content/uploads/2022/04/apply-for-a-credit-card-300x185.webp)

![Walmart Credit card application [Pre-Approval Process] Walmart CC apply](https://kingapplication.com/wp-content/uploads/2022/03/Walmart-CC-apply-300x185.webp)