Page Contents

What is old mutual loan application?

Old mutual loan offers tailor-made loan solutions for your monetary requirements. Our troubles don’t exactly come when we have enough to meet them.

Loans are provided by many institutions currently, but there are some that help you take a loan as per your needs when the situations don’t go as planned.

It is for such instances that the old mutual loans are designed.

Steps for Old Mutual Loan Online Application

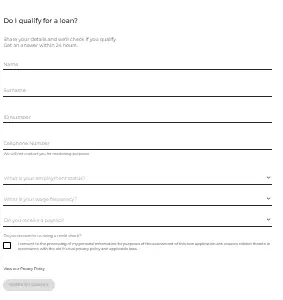

Applications will open when you qualify for the loan. Fill in the form from the official website after clicking the apply online tab.

- You will be taken to a page where you must fill in your complete name, ID number, mobile number.

- You must check the checkbox to consent to the credit check.

- Finally, click on the link to check if you qualify.

- If you qualify, the officials will call you themselves.

What are the application requirements?

Different application requirements include the ones given below.

- A valid ID is required for the application process.

- Bank statement for 3 months

- Recent payslips from up to last 3 months.

- You must at least be a minimum of 18 years.

Who is Eligible?

Eligibility depends on the following conditions.

- The credit score and credit history must be considered. Your credit score must range from 300 to 850 and also depends on payment history, outstanding debt amounts if any, and credit history length.

- The debt-to-income ratio must be considered for granting the loans.

- DL, state-issued ID, and passport are legally accepted original documents.

How to check Old Mutual Loan status?

Either call them, mail them or visit different branches to know the loan application status. You can use the app or visit the internet banking option.

Internet banking loan status can be checked using the following steps.

- Visit the loan application tab under the loan section tab.

- Press the check status tab provided towards the end of the application tab.

Also read: Finchoice Loan Application Online – Know Status & Requirements

How much loan do I qualify for at old mutual?

With Old mutual loans, one can borrow up to R250000 for general emergencies and opportunities. But first, you must find out your credit scores, and after taking a loan you can return the loan with a span of 3 to 72 months.

Conclusion

Here’s a bit about the old mutual loan process. If you wish to go ahead with the loan process, check the details from this site.

![African Bank Loan Application & Status [Complete Details] African bank loan](https://kingapplication.com/wp-content/uploads/2022/04/African-bank-loan--300x185.webp)

![8 Easy Steps - Grad Plus Loan Application [Complete Details] Grad Plus loan](https://kingapplication.com/wp-content/uploads/2022/04/Grad-Plus-loan-300x185.webp)

hi i want to check how much loan i qualify