The SBA Targeted EIDL advance application scheme helps small business owners who have suffered losses during the COVID-19 disaster. The Economic Injury Disaster Loan is meant to provide financial assistance to all the small business owners of the United States whose business was hit by the pandemic. The maximum loan amount that can be claimed by an individual business is $500,000.

EIDL loans are for a fixed term with 3.75% interest for businesses. For nonprofits the fixed term is covered at 2.75%. It is for 30 years span and does not incur any pre-payment fees or even does not levy penalties on it. You will not be forgiven the loan but might be forgiven the advance payment.

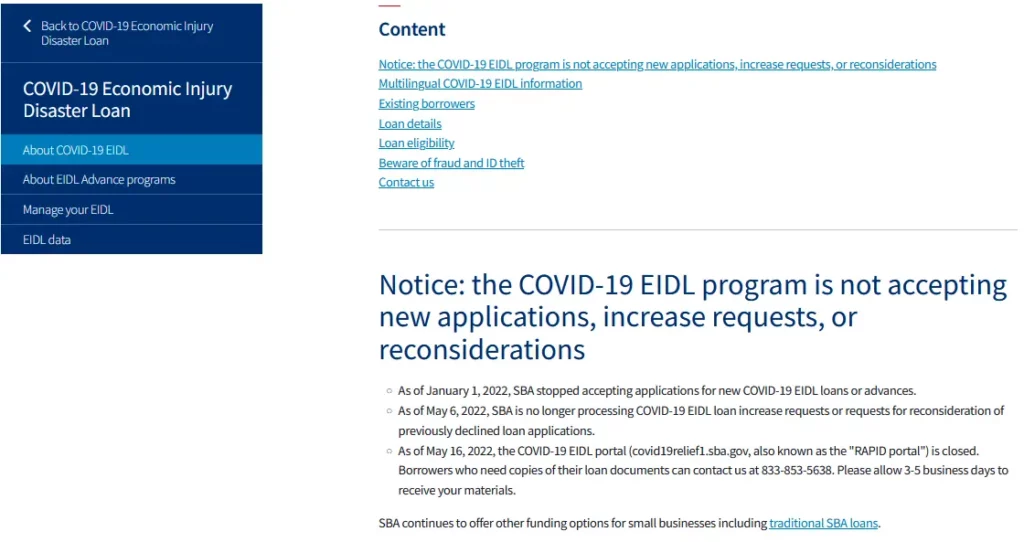

The timelines are to be considered here if you wish to find out more about SBA-targeted EIDL.

| Essential Dates | Events that happened on these dates with regard to EIDL |

| 1st January 2022 | SBA did not accept any application post here |

| 6th May 2022 | From here on, they no longer accept loan increase requests and loan applications previously declined |

| 16th May 2022 | The COVID-19 portal or the RAPID portal closed. Borrowers requiring loan documents can contact 833-853-5638. |

Page Contents

SBA advance Application Requirements

For the targeted EIDL advance application to work, you must know the requirements well.

- Your business and your earnings must fall in the low income group.

- It should be able to show that it suffered 50% or more of economic losses.

- The organization has 10 or lesser number of employees.

- There should be no delinquency observed for more than 60 days for principal owners of the business.

- The applicant must not be engaged in any sort of sexual activity.

- The applicant does not have more than one-third of the income coming from gambling activities.

- The requestor is not into the lobbying business.

- The person is not a government entity and neither a Congress member.

How to apply for SBA Application?

The SBA targeted EIDL application is open to small businesses, non-profit organizations, smaller agricultural co-operatives, and farming sectors.

- You have to fill up your business type soon after you have logged into the site.

- There are numerous checkboxes that you would need to check or leave blank accordingly.

- Click on the next tab to fill out the application form.

- In the next step enter all your business-related information wisely.

- In the next tab fill in all the information about the business owners.

- Fill in additional information, if any and then summarize the application requirements before submitting the application.

How long does EIDL advance take?

The application approval ideally takes 18 to 21 days with two to five more days for moving the loan to your account. EIDL advances however should take ideally three days from application.

How to get the EIDL grant?

To receive the EIDL grant, you have to look into their requirements, and then you’ll have to apply for it online or through submission of a hard copy of the form and other stuffs. Finally, wait for your EIDL advance application’s acceptance before the loan is sanctioned in your name and favor.

How to get approved for EIDL?

To get approved, you must fulfill all their do’s and donts as listed in their website. The list of eligibility requirements must get fulfilled to get your loan approved by EIDL.

How to check EIDL status?

You can either call 1-800-659-2965 or you can write to customer care [email protected] (mentioning your username and other details about the loan application).

Even if you’re invited to fill in the advance grant application, it does not guarantee you would receive the grant.

If you have submitted an online SBA advance application, you can check the status by following the below steps.

- Go to the SBA website.

- Now click on the funding programs from the upper right corner of the website.

- Next, click on the EIDL option by scrolling downwards.

- There itself you can easily check your loan status.

SBA targeted EIDL advance declined solution

If your advance grant application is declined once, you have a span of six months to ask them to reconsider your application once again and you can do it either by sending an email or a mail request.

Also read: EIDL Loan Forgiveness Application – Who is Eligible?

FAQs (Frequently Asked Questions)

Are the SBA EIDL loans still available?

SBA loans are not available anymore as the last date of the SBA loans was 1st January 2022.

What is the credit score requirement for the EIDL loans?

EIDL score requirements are as follows:

For those who take $500,00 or less need to have 570 as credit score.

Those who need more than $500,000 they will need a credit score of 625.

What can you take from the EIDL loans?

EIDL loans can be taken and utilized for the following:

- For paying loans including non-Federal loans

- Repairing your business front is also possible with money.

- Investing in the salaries of your employees is essential

- Spending on purchasing inventory for you is required.

- Rent, mortgage, and utility amounts are also payable

- Spend it to increase your marketing efforts

- Also, obtain assistance for business funding

What are the debts incorporated as per recent changes?

Federal loans and commercial debts can be paid off additionally as per the recent changes made in the EIDL return policies.

Can EIDL loans be forgiven?

EIDL loans can’t be forgiven easily as per current updates. Whoever received or will receive the loans as in 2020, 2021 and 2022 can defer the loans by 30 months.

Conclusion

Those who want the SBA advance application/ EIDL loans they will have to wait until they have received them. Loan applications are still being reviewed and granted for those who have already submitted them. The EIDL advance loans are forgivable up to $10000, but they wouldn’t show you any forgiveness on your original loan amounts. Read the essential details here if you are trying to find out more about the loans and if you are waiting for your loans.

![Assurance Wireless Application Online form [Easy Steps] Assurance Wireless Application Online form [Easy Steps]](https://kingapplication.com/wp-content/uploads/2022/09/assurance-wireless-apply.webp)

![UCLA application deadline: spring 2024- [Complete Details] UCLA application](https://kingapplication.com/wp-content/uploads/2022/12/UCLA-application-300x157.webp)