Among all taxes that people pay, the tax for child dependents can sometimes seem like an unpleasant one. Over a period, many fought over it until the Connecticut government came to a conclusion that they would provide leverage for the child taxes.

The levy came as a surprise when the government decided to announce a $250 per child rebate for families where children less than 18-year-old are dependents within a family.

The Child Tax rebate is one of the most recent lawful developments in Connecticut where people can file for it. The law was passed with the signatures of Governor Ned Lamont. In any given family, a rebate could be available for up to three dependent children. Each child can receive up to $300 for up to 6 years and $250 of rebate for children above 6 years and a total of $750 will be given to the family having three dependent children. The income level of a family will be taken into consideration when families start filing for the Child Tax.

As part of the fiscal year 2025 budget adjustment, the Child Tax rebate came into being. To assess the total number of people, public forecasting was run, wherein more than 30,000 households were found to be eligible for the benefit from this law. If you want to start the application process, you must visit the Child Tax Rebate website from 1st June 2022 to 31st July 2022.

Page Contents

How to Apply for Child Tax Rebate application?

Click on this link to start the application process https://egov.ct.gov/drschildrebateform/

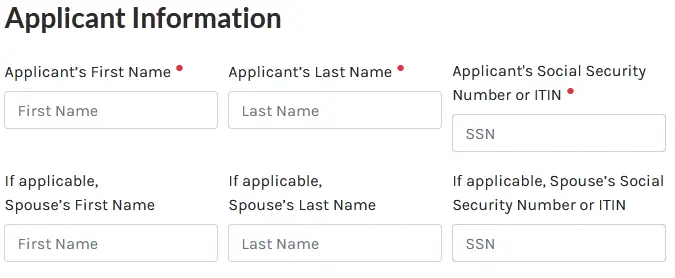

- Scroll down to the applicant information section and start filling it out online. Add your name, social security number, spouse’s name, and spouse’s social security number, if and when applicable.

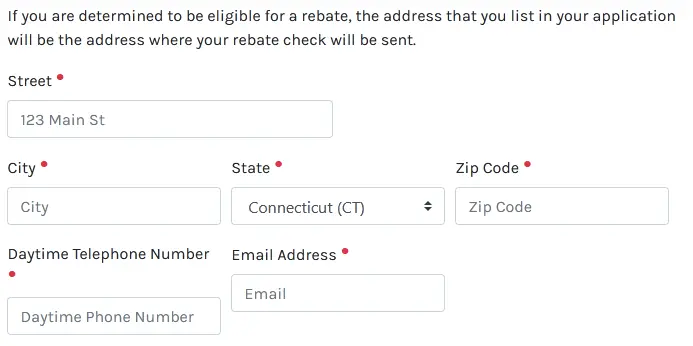

- Next, add your address with your street, city, state, and ZIP Code details. Include your daytime telephone number and email address also to complete your contact information segment.

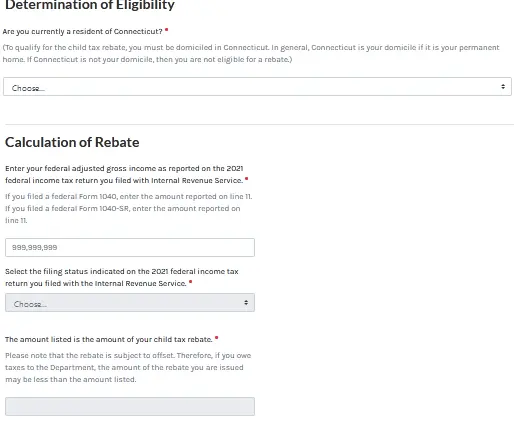

- Add information towards determining if you are a Connecticut citizen,

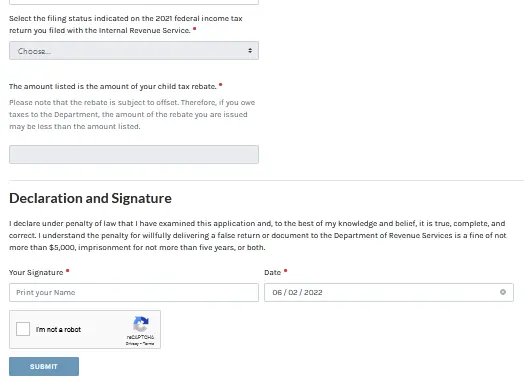

- Complete the application by placing your signatures and also going through the rest of the form.

Also read: Are Parent Plus Loans Federal or Private?

What are the Application Requirements?

The application requirements for the CT Child Tax rebate offer needs the following;

- Your Federal adjusted gross income from your 2021 Federal income tax return details.

- Include your filing status from your 2021 Federal income tax return.

- Add the complete names of each of your children whom you declared as dependents on your 2021 Federal Income Tax Return.

- You will need to add your SSN as well as your spouse’s SSN if and when applicable.

Who is Eligible?

You are eligible for the CT Child Tax rebate if you qualify for the following.

- You must reside in Connecticut for enjoying the CT Child Tax rebate.

- At least a single child must be claimed as your dependent in the 2021 Tax returns.

- Your income threshold should be at par with the one that is specified.

Also read: TASFA Application 2023 Process – Know Requirements & Eligibility

| Status of the applicant | Threshold of income prescribed |

| Single or married individuals filing separately | $100, 000 or less |

| Household Head | A minimum of $160, 000 or lesser than that amount |

| Married individuals filing jointly | $200, 000 or less |

CT child tax rebate 2022 Benefits

Apart from the monetary benefit, one will benefit in the below ways.

- Extended gas tax holiday

- A 40 million dollar reduction in the employers’ State UI Taxes.

- 10 million dollars are being sanctioned for commercial electric vehicle vouchers.

- 100 million dollars go for childcare new investments

- 5 million dollars from the bill goes to helping the homeless

- Bus service will be free until 1st December this year.

FAQs (Frequently Asked Questions)

Will the child tax credit affects my 2023 tax return?

No, it will not impact the Child Tax credit for 2023 tax returns.

How do I receive my child tax credit?

You can receive half of the tax amount through your monthly payments in 2021 and the rest in 2022 after you file your tax returns.

Conclusion

If you are falling under the categories mentioned as per the current guidelines, you can read this entire article to find out more about it. Child tax rebate is a provision that will save your money at the end of the day. If you want to apply, follow this article link to fill in your application details.

![IRS Stimulus Check Application For Non Filers [Complete Guide] IRS Stimulus check application 2021](https://kingapplication.com/wp-content/uploads/2021/03/IRS-Stimulus-check-application-2021-300x171.jpg)