Page Contents

What does it mean, IRS has accepted your non-filers enter payment info return?

If you were a non-filer once, receiving the notification that states your non-filer status is accepted would mean IRS has accepted your tax return details. The non-filers website contracted by the IRS takes down the blank 1040 tax return form and files it on your behalf.

If your annual income is way below the normal income standards, you would be eligible for the stimulus check rolled in by the government to cover the COVID-19 period for every legal US citizen.

What does it mean when the IRS accepts your return for a stimulus check?

Ideally, the acceptance of the returns for the stimulus checks means that the IRS has reviewed your returns and after initial inspection, the team has agreed to accept your returns.

They verify some normal details like your personal information and also find out a little about your dependents to find out if someone else on your dependent list has got any kind of claims.

It would mean that you have qualified for the stimulus check that the government is rolling out this year. It’s been two times now that the stimulus has been rolled out for the citizens, one came up in 2020 and one has come up this year.

Also Check:- IRS Stimulus Check Application For Non-Filers

How long does it take the IRS to process a non-filer return?

It takes 5 to 10 days for the IRS to process a non-filer return. If successfully validated, non-filers can expect a paper IRS Verification of the non-filing letter at the address provided in the telephone request.

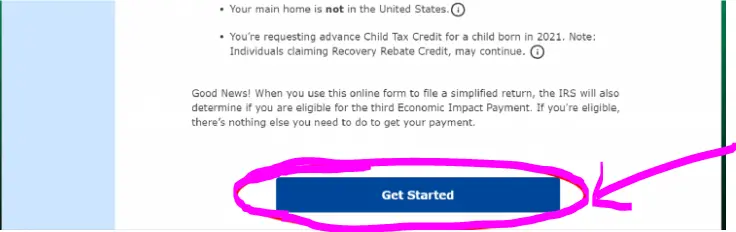

For the people who don’t exactly file a tax return, there is a simple process to file it.

- Go to IRS.gov

- Check for the non-filers, Enter Payment Info Here.

- Register an account with them or if you already have an account, enter the details.

- Include the basic information, which includes the name, address, dependents, and social security number.

- IRS will validate the provided information to confirm if you’re eligible for it.

- They would in return calculate and send the Economic Impact Payment.

- The payment is non-taxable.

- If you have updated your bank account information or your financial information, IRS will allow quick deposition of the payment either into the savings or checking account.

Also Read: How to get through to IRS Customer Service?

How do non-filers get their stimulus check?

Non-filers can get their stimulus checks if they are US citizens if they have a social security number, has an adjusted gross income under permissible limits and it cannot be that the non-filer is another taxpayer’s dependent.

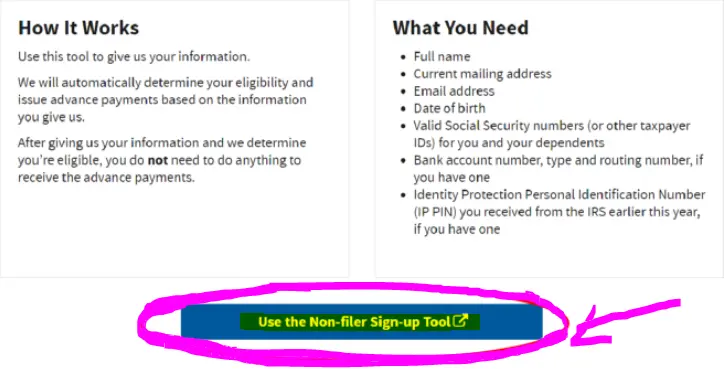

Users need to provide certain information including

- complete name,

- current mailing address and a

- valid email address

- Full birth date

- A valid SSN

- Bank account number, routing, and type.

- IP PIN received from the previous IRS.

- Driver’s license and state-issued identification.

When non-filers enter payment information, they will take the applicant from the IRS site to the Free File Fillable Forms.

Follow the below steps to give in the information.

- Create an account with the email ID and phone number.

- Create a User ID and password.

- You will next have to fill in your filing status.

- Enter detailed personal information.

- Further, have a valid SSN and incorporate it into the form.

- Complete the entire bank information.

- You will also need to incorporate the driver’s license.

You would receive an email confirmation from the Customer Service of the Free File Fillable Forms. Applicants will either receive a confirmation stating all the incorporated information is correct or if there needs to be a correction.

FAQs

If my non-filers were accepted will I get a stimulus check?

Yes, if IRS has accepted your return stimulus, the applicant will get a stimulus check.

Conclusion

There are numerous different stimulus earnings that are hitting the market from time to time even to date. If you want to enjoy all of what the government sends you, read through this article to understand more about the process.

![How to Add TSA Precheck to Delta app [After Checking in]? How to add TSA precheck delta app](https://kingapplication.com/wp-content/uploads/2023/01/TSA-precheck-delta-app-300x185.webp)